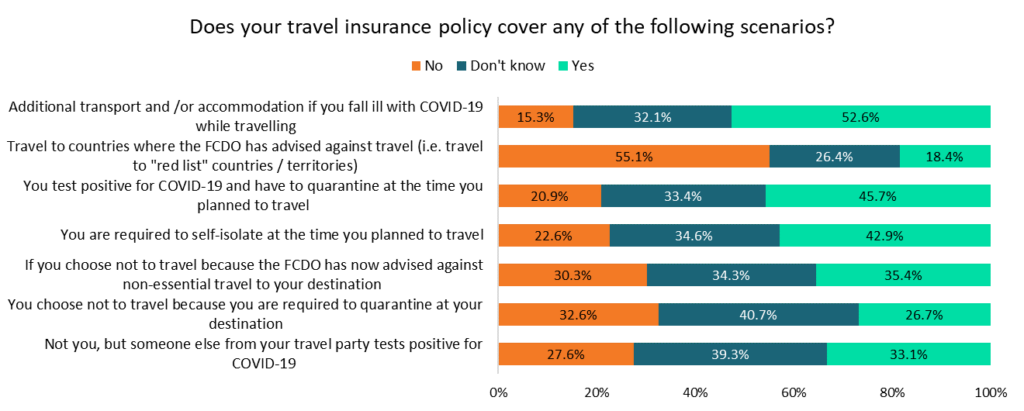

According to GlobalData’s 2021 UK Insurance Consumer Survey, over a quarter of travel insurance policyholders do not know what their insurance covers when it comes to COVID-19-related claims.

The survey asks a series of questions to travel insurance customers on whether their travel insurance policy covers them in certain scenarios involving claims related to COVID-19. In every scenario, at least 26.4% of consumers did not know if they were covered for that eventuality.

Indeed, for five out of the seven scenarios, over one third of consumers were unsure whether they were covered. Insurers should be slightly disconcerted by these figures as gaining the trust of consumers in uncertain times such as these should be key to winning and maintaining future business. If consumers were to make a claim for something that is not covered in their policies (contrary to their understanding), they are likely to become disillusioned with the product or insurer themselves, potentially leading to loss of future business and a reputational hit.

COVID-19 regulations, particularly in relation to travel, have been frequently altered as the UK has tried to react to the spread of different variants across the world. For the time being, there are no countries on the Foreign, Commonwealth, and Development Office’s (FCDO) red list. However, many countries have entry requirements themselves (such as a 14-day quarantine upon arrival, as in Australia) of which consumers must stay abreast if they wish to travel. Given the extra planning required for people to ensure that they meet a country’s entry conditions, it is surprising that so many are unsure of what their travel insurance policy will cover. With last-minute cancellations becoming increasingly commonplace, travel insurance is taking on a more important role to consumers looking for peace of mind before organizing a holiday or business trip. Insurers must make clear and explicit the level of cover that they are providing to their customers.

Further data from our survey indicates that 20% of consumers bought their travel insurance policy through a price comparison website (PCW). This may lead to difficulties for insurers in communicating their policy wordings over to the consumer.

However, this gives PCWs an opportunity to enhance their product offering by not only allowing consumers to compare policies by price, but by allowing for a more tailored search so that consumers can find the most appropriate policy for their needs. Greater clarity on the exact cover a policy provides will lead to greater confidence in both the product and provider, in turn leading to more returning customers moving forwards.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData