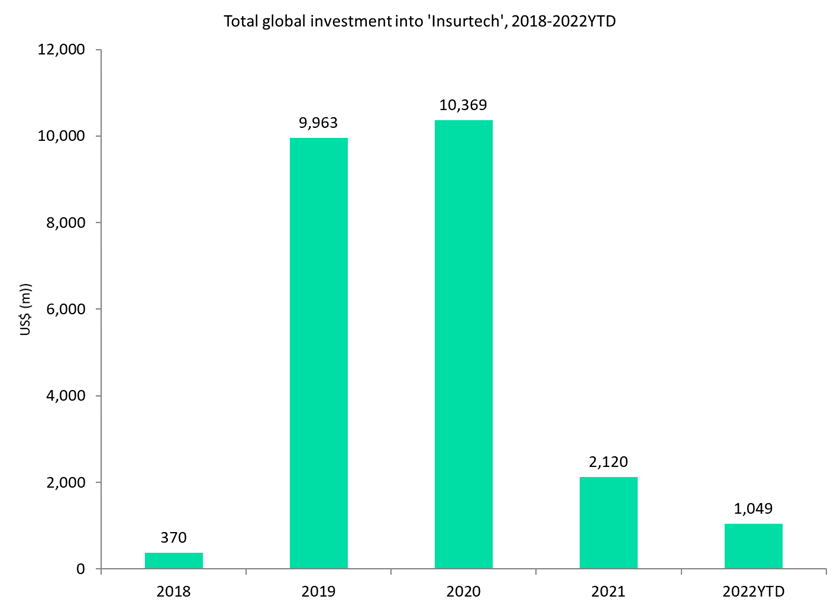

The COVID-19 pandemic and cost-of-living crisis are having an impact on the insurtech industry, as leading providers go bust or cut staff, and GlobalData data shows investment into insurtechs has fallen significantly in 2022.

GlobalData’s Insurance Deals database shows that the value of global investments into insurtech fell by 79.6% in 2021, and lit does not look like it will register growth in 2022. At the end of July 2022 there had been $1.0bn invested into the theme, which represented 49.5% of the total 2021 figure, despite being over halfway through 2022.

This follows a consistent flow of stories of insurtechs struggling so far in 2022. The most recent was of Lemonade cutting MetroMile’s staff by 20% after completing the acquisition of the insurtech in August. This was after Lemonade had said it would not cut staff. Further signs of insurtechs struggling were Honcho, the reverse insurance comparison site going bust in July 2022. This had been one of the most promising UK insurtechs in recent years, it had received £4.1m ($5.0m) in funding and had the innovative idea of making insurers bid for customers, by competing to offer the lowest price. In reality though, the big four comparison sites dominate that market and it is hard to break into. Other high-profile insurtechs also reducing their headcount in 2022, including: Zego cutting 17% of staff in July, and Nova Benefits cutting 30% of its staff in June.

This is likely due to a combination of factors. Investment into the sector had dried up somewhat, as GlobalData data highlighted. The funding rounds are essential to keep insurtechs running in the early stages, before they become profitable, so this was a significant barrier. It is also likely that in tough economic times, such as a pandemic, or now cost-of-living crisis, consumers turn to trusted and established brands, as they trust them more to survive and pay-out claims. It is also true that a lot of insurtechs are in the gadget or possession sector, which is not perceived as an essential purchase for consumers, and is therefore a line that is always likely to be hit as consumer’s disposable income decreases and they therefore look to cut expenditure and bills where possible.

Insurtechs will need to focus on offering value to consumers, as that is what they will be looking for in the immediate future. This can come through relying heavily on AI to cut processing costs, or offering innovative products, such as pay-as-you drive and on-demand policies, which allow consumers to control how much they pay or even providing cover only when it is strictly needed. Once insurtech handles that, investment is sure to follow.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData