An insurer’s record on sustainability is important to SMEs. But when it comes to choosing policies, it is still the least important factor to businesses according to GlobalData findings. Rising inflation – at a time when many businesses are still recovering from the COVID-19 pandemic – could push the importance of sustainability further down, with financial factors becoming even more essential for small businesses.

GlobalData’s 2022 UK SME Insurance Survey found that SMEs claim sustainability is important to them. We asked respondents to rank its importance between one and five (with one being not at all important and five being very important) and 65.3% of SMEs ranked it as either four or five. This was slightly down from 67.6% in the 2021 survey

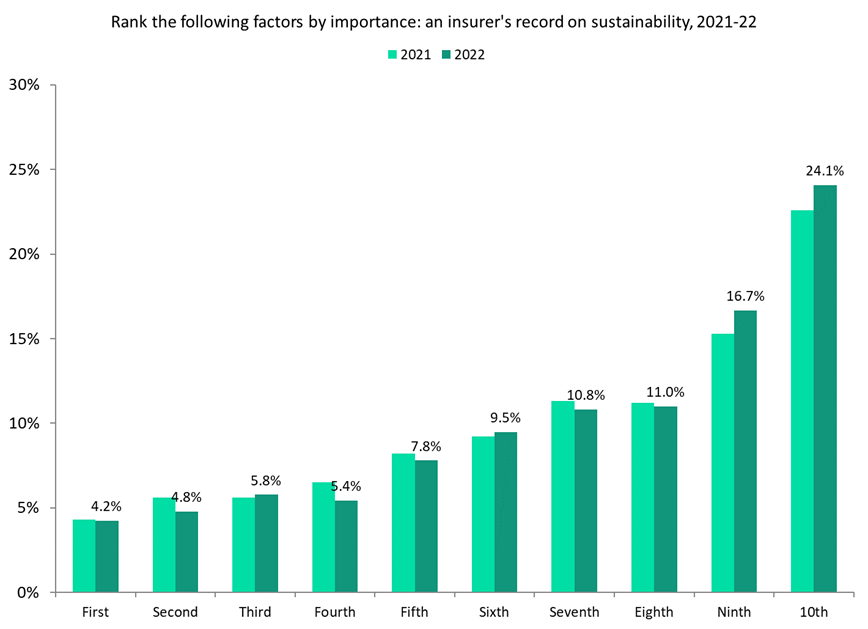

However, in the same surveys, SMEs were asked to rank a range of factors in terms of their importance when choosing an insurer. Sustainability was most often placed last, with the chart below showing where SMEs ranked sustainability out of a list of 10 factors.

There was a 7.4 percentage point difference between SMEs who ranked sustainability 10th compared to ninth, which was the single biggest gap between rankings. Factors placed above sustainability by SMEs included cost of policy (which 25.0% of respondents placed in first), the reputation of the insurer (12.1% first place ranks), and transparency of pricing (11.6% first place ranks).

Sustainability is a growing trend in the industry, with insurance brokers Marsh McLennan and Lockton both walking away from a coal mining operation in Australia in 2022. Yet high inflation and cost-of-living crises around the world – as well as businesses still recovering from COVID-19 – will make factors around price, pay-outs, and trust even more important. This is likely to explain businesses being slightly less concerned about sustainability in 2022 compared to 2021.

Overall, it is clear that sustainability remains a key issue for businesses. Even though this has not yet translated into it being a key factor when choosing policies, it is something of which insurers need to be increasingly aware.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData