The vast majority of UK consumers believe they will continue to work from home for at least two days a week beyond COVID-19, which will have long-term effects on a range of insurance lines. Hybrid working is sure to last after the pandemic.

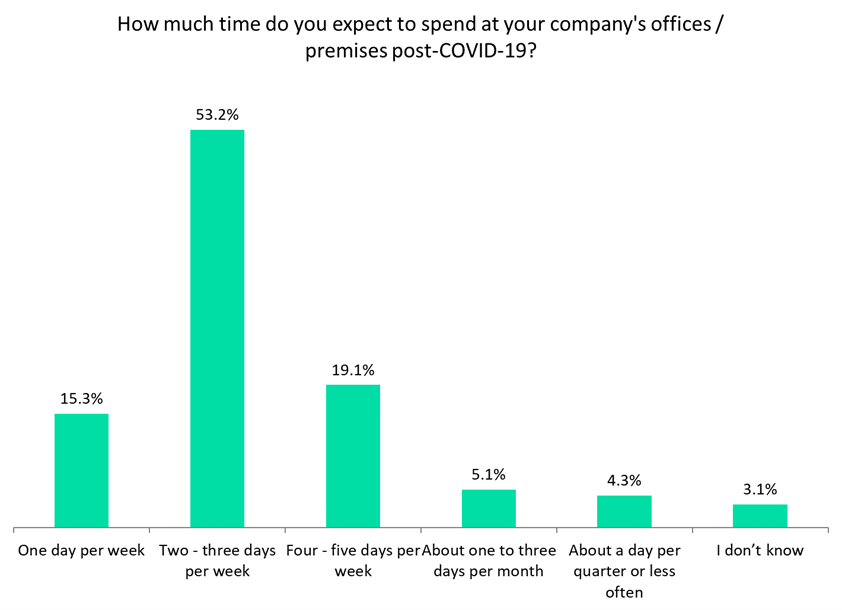

GlobalData’s 2021 UK Insurance Consumer Survey found that only 19.1% of respondents believed they would be in the office for four or five days a week after the pandemic. The survey was conducted in Q3 2021 – over a year into the pandemic – which suggests consumers have a good idea of what their situations will be. This is not necessarily bad news for insurers, but they will need to adapt several policies to fit the new climate.

Source: GlobalData’s 2021 UK Insurance Consumer Survey

One of the leading lines to be disrupted by post pandemic behaviour and hybrid working is personal motor insurance. Commuting is one of the main reasons for people having cars and a key driver of mileage. Employees now working in the office for one or two days a week may want to retain their cars but are likely to feel they should be paying less than when they were driving to and from work every day. Insurers face more of a threat from competitors and start-ups here, as pay-per-mile car insurance is becoming more mainstream and fits perfectly with post-COVID employees.

The most obvious issue for insurers is commercial property. So far, this line has seen premiums increase significantly since the start of the pandemic, though that is solely due to claims inflation. Rising premium prices will only make it harder for insurers to maintain customers, especially while fewer people are in offices. It is perhaps a line insurers will need to be flexible in going forward, offering some companies flexible employee liability rates based on how many people are in the office on a particular day, for example.

Other changing risk profiles include cyber, which will see heightened risk with employees away from the office. Home insurance may also need an extra liability for homeworking.

The challenge for insurers is that the working world has suddenly evolved by decades in the space of one event. This requires them to adapt quickly or risk losing customers across a range of lines. Flexibility is likely to be key, but the cheaper premiums that come with this are unlikely to suit insurers, which often face increased risk in commercial lines in particular.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData