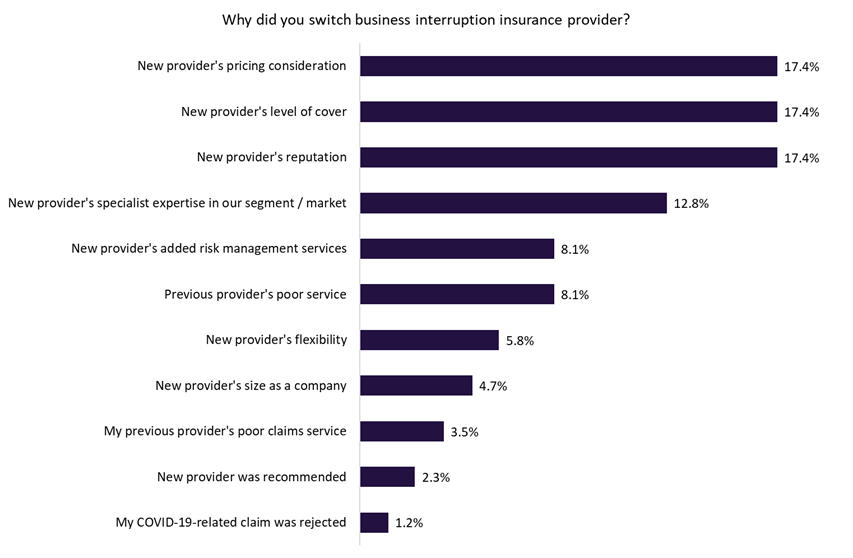

UK SMEs consider insurer pricing consideration, level of cover, and reputation as equally important when choosing a new provider for business interruption (BI) cover. The continuation of court cases involving BI payouts will blight new business opportunities for insurers caught up in the ongoing legal battles.

When SMEs were asked in GlobalData’s 2022 UK SME Insurance Survey why they chose to switch provider for BI cover, the new provider’s pricing consideration, level of cover, and reputation could not be separated as the top reasons for switching. Over half of all switches were down to one of these reasons, highlighting the importance of the three factors to SMEs when selecting a new provider. For reference, the same survey found that reputation was important to just 8.8% of SMEs switching public liability provider and 8.5% of commercial property switchers. Almost a third of SMEs switching in these two lines cited pricing as the main reason for changing insurer (32.1% and 33.1%, respectively).

The precedent for legal contests of BI claims has shifted frequently since the onset of the COVID-19 pandemic. The BI test case, which ruled in favor of policyholders, was seen as a watershed moment for insureds, with many believing they were entitled to considerable payouts. However, the High Court ruling in favor of insurers MS Amlin, Zurich, and Liberty Mutual against pub group Stonegate has muddied the waters regarding BI payouts. It is likely that many policyholders are now reconsidering their provider and looking to purchase a policy from those deemed less likely to take matters to legal proceedings.

Source: GlobalData’s 2022 UK SME Insurance Survey

New BI cases continue to filter their way into the courts, with International Entertainment Holdings’ (owners of the Savoy Theatre among others) pursuit of insurer Allianz over alleged failed BI payouts a more recent example of such action. As these cases continue, it is likely that policyholder trust in their provider, perhaps even in the wider industry, will fall as they look to switch provider or cancel altogether. Indeed, 36.8% of SMEs that canceled their BI cover in 2022 did so because they did not receive the level of cover that they thought they would get.

BI cover is a complex policy, with a crisis such as the pandemic highlighting ambiguity in policy wording that has driven this surge in court cases. Insurers looking to grow business in the BI line must ensure greater clarity in their policy wordings if they want to maintain a reliable reputation and stem the tide of cases filed against them.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData