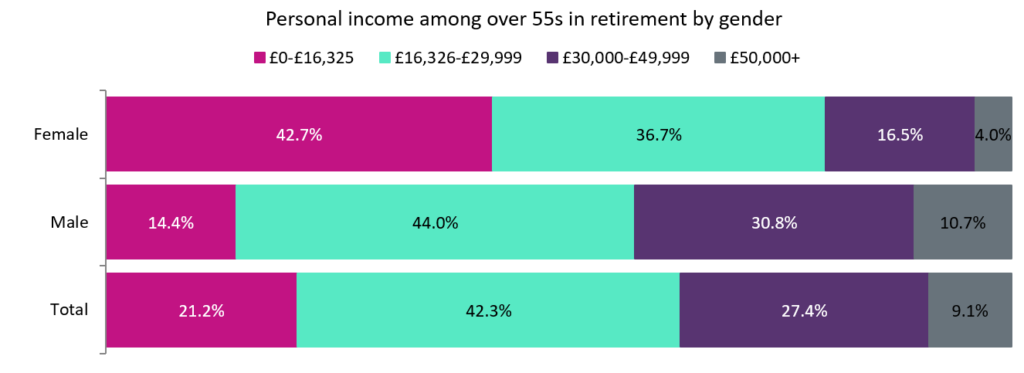

Earnings of retired women are considerably lower than those of men, owing to smaller pension pots and lower state pension pay. Improved awareness of this shortfall should help narrow the gender gap further.

GlobalData’s 2020 UK Life & Pensions Survey highlights that 42.7% of retired women aged 55 and over have an annual income of up to £16,325, compared to 14.4% of men. On the other side of the spectrum, 4.0% of women receive an income above £50,000, which is less than half the proportion of men with this income (10.7%).

The disparity in retirement income has long existed. It stems from a combination of differences in average pay (i.e. the gender pay gap) as well as the impact of career breaks to bring up children. As a result, workplace and personal pension pots of women saving for retirement are considerably smaller than those of men, while their state pension pay is also lower on average. According to the UK’s Department for Work and Pensions, as of February 2020 a retired male receives £160.09 per week on average, compared to a retired female’s £152.90 per week.

Since February 2018, all UK employers are legally required to offer a workplace pension. Meanwhile, the introduction of auto-enrollment – requiring employers to automatically enrol employees aged 22 and over but below the state pension age when they earn above a certain threshold – will improve individual pension savings. While it will encourage many to save for retirement from an earlier age, individuals do have the right to opt out. Auto-enrollment may increase the size of pension pots of women (as well as men), but on its own it will not address the gender gap in retirement income.

While this gap has narrowed over the years, improved customer engagement with pensions should help boost awareness. Pension providers and employers have a role to play: they should have frequent contact and/or meaningful conversations with individuals saving for retirement. This will help ensure individuals have a better understanding about the impact contributions have towards their final pension pot size and pay. Indeed, lower contributions – as is generally the case for women, owing to typically lower wages and career breaks – can lead to sizable shortfalls over time.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData