Pre-paid funeral plans and over-50s policies both compete in the market since they are both designed to help the policyholder’s family or friends with funeral expenditures after he or she passes away. In July 2022, the Financial Conduct Authority (FCA) implemented regulations to improve industry standards of funeral plans, such as ensuring policies are sold and priced fairly and fit customer needs. As a result, customers will be able to compare pre-paid funeral plans with alternative solutions, such as over-50s policies, which provide alternative cover.

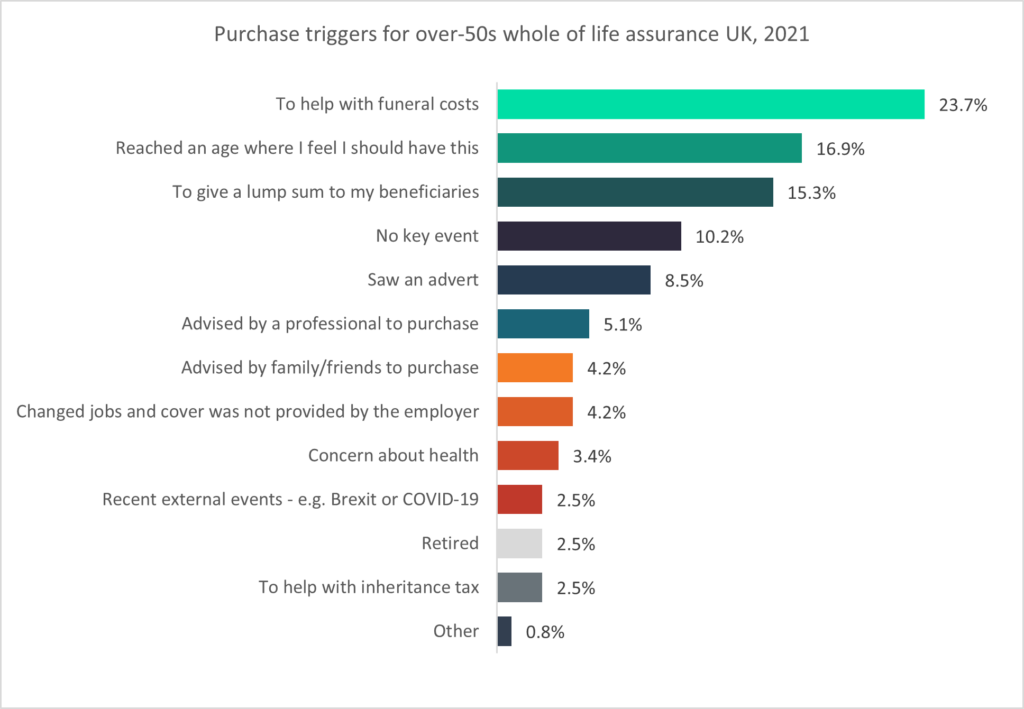

According to GlobalData’s 2021 UK Insurance Consumer Survey, 23.7% of individuals who purchased an over-50s whole of life assurance policy did so to help their beneficiaries cover their funeral costs. Paying for a funeral is the main reason for the purchase of over-50s whole of life assurance, given that they are expensive. Over-50s policies are specifically designed to help with funeral costs, as a lump sum of cash is paid following a death that contributes to the cost of funerals and other expenses, such as unpaid bills. Whereas funeral plans are an alternative that strictly stick to a pre-agreed funeral arrangement, this can include tailored add-ons such as coffin design.

Due to the relevance of the cost of funerals, both are seen as comparable products for individuals looking to protect their families from the costs. The FCA’s regulations on funeral plans will allow for the comparison between the two products, in turn potentially increasing competition.

The FCA introduced regulations on funeral plans in July 2022 as a result of individuals being charged unfairly, paying more than what the cost of the funeral was, and in some instances not receiving the funeral arrangement they had planned. Some providers have until October 2022 to adhere to the new rules. The FCA’s regulations on funeral plans aim to bring higher standards and boost consumer protection by banning cold calling and funeral installments that do not promise the tailored pre-paid arrangement.

Furthermore, it has banned commission payments to intermediaries such as funeral directors, so that the prices of the service are reasonable and represent fair value. This is aligned with the FCA consumer duty, which is set to be implemented in July 2023 and focuses on the client’s best interests throughout the process.

The FCA’s regulations on funeral plans will also ensure customers are able to choose which plan is appropriate for their needs by simplifying comparisons between the two packages, as over-50s policies allow for customers to protect their loved ones from additional costs including unpaid bills, inheritance tax, and funerals, whereas funeral plans specifically help with that of the funeral, focusing on tailoring it to their needs. As a result, the regulations have the potential to shift market dynamics, with some customers who would have bought pre-paid funeral insurance instead opting for an over-50s policy, and vice versa.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData