The environmental, social, and governance (ESG) theme has vastly increased in importance in various industries, especially insurance, and it is significantly influencing how insurers operate. Due to rising activism, shareholder pressures, increased regulatory monitoring, and customer interest in the ESG standards of the companies they buy from, insurance companies have strengthened their ESG commitments in recent years. As a result, several businesses have established programs to follow all of these ESG guidelines, including AXA XL, which just issued its new three-year sustainability strategy.

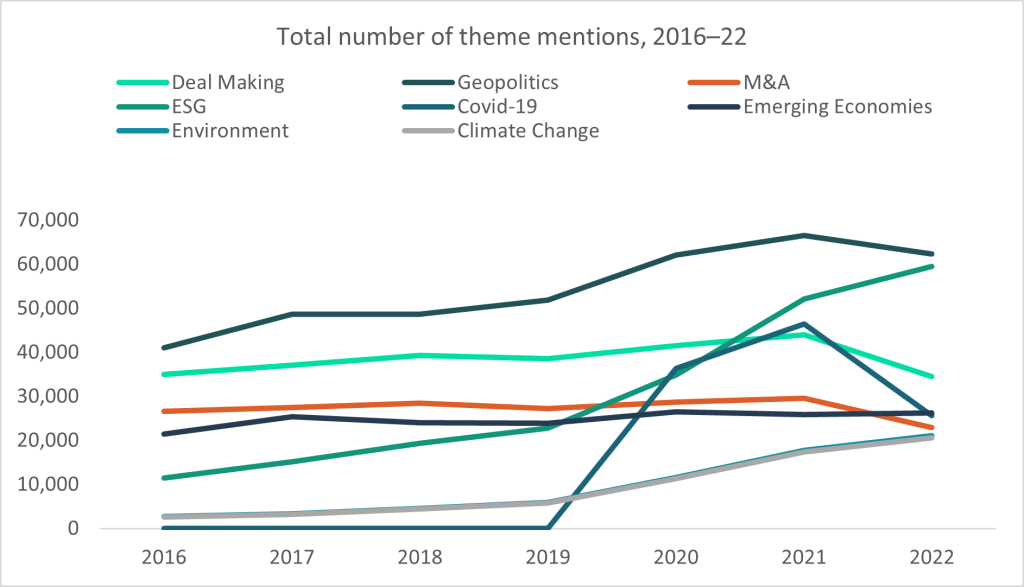

ESG was the second-most mentioned theme within insurance in 2022, according to GlobalData‘s Company Filings Analytics database. The database tracks how many times any insurer around the world mentions a theme, such as ESG, in its publicly released reports. The graph demonstrates how the topic has gained popularity over time and provides valuable insight into the significance of ESG. Businesses may benefit financially from adopting ESG into investment and underwriting strategies because research indicates that organisations with good ESG practices may perform better financially over the long run. Overall, as insurers in the UK negotiate the numerous opportunities and difficulties posed by climate change and sustainable finance, ESG has grown to be a critical factor.

AXA XL has launched its new three-year sustainability strategy, “Roots of resilience.” The plan is based on three key pillars: valuing nature, combating climate change, and incorporating ESG elements into daily company operations. Focusing on sustainability is beneficial for risk management as well as influencing new clients to choose AXA as their provider.

Investors are using ESG considerations more and more to help them decide whether or not to invest in particular companies. They are becoming more aware that ESG concerns can affect corporate value and that mitigating these risks can boost economic value for businesses and their shareholders. According to GlobalData’s Poll/Macro Themes: ESG Survey Q1–Q3 2022, 54.5% of respondents indicated that they do take ESG concerns into account before making an investment in a firm, and 42.7% indicated that they would withdraw from businesses that do not adequately manage ESG issues.

In conclusion, insurance companies should consider increasing their ESG commitments because doing so can have significant financial and reputational advantages. It is a win-win situation for insurers because strong ESG targets also boost brand recognition and income.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData