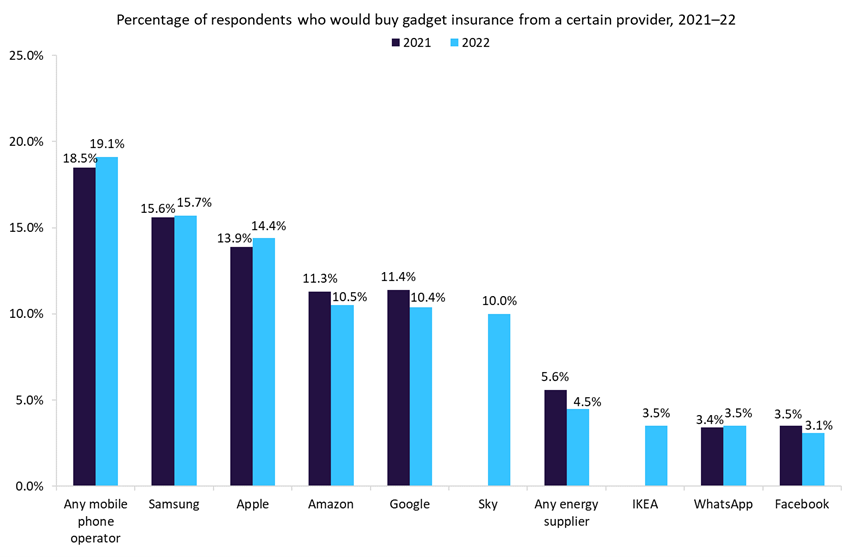

Out of all affinity providers, UK consumers are most open to purchasing gadget insurance from a mobile network operator according to GlobalData’s 2022 UK Insurance Consumer Survey. 19.1% of consumers indicated a willingness to purchase from these providers. EE’s possible plans to expand into more insurance markets in the future could depend on its ability to use partnerships such as its collaboration with Verisure to enhance its product offering to customers.

EE currently offers gadget insurance for smartphones, tablets, and watches in collaboration with Chubb. Insights from GlobalData’s 2022 UK Insurance Consumer Survey indicate that almost one fifth of UK consumers would be interested in purchasing gadget insurance from a mobile phone operator. The embedded (or point-of-sale) aspect to the purchasing journey clearly weighs on consumers’ minds, as they naturally associate gadget providers with gadget insurance (Samsung and Apple rank second and third respectively). Offering this form of insurance is an excellent way for these providers to get into insurance markets before looking to expand into new lines of business in the longer term.

Indeed, EE’s partnership with Verisure to provide home security packages to customers could be an excellent way for the former to enter the home insurance market. More specifically, EE can make use of the smart devices installed as part of security packages to provide a more all-encompassing home insurance product. The focus of these products is ‘prevent and protect,’ compared to the ‘repair and replace’ models of traditional home insurance, thus helping to bring claims and premium costs down. This would be a similar approach to leading US home insurers such as State Farm, which recently announced a $1.2bn deal to purchase 15% of ADT in order to improve its smart home insurance offering.

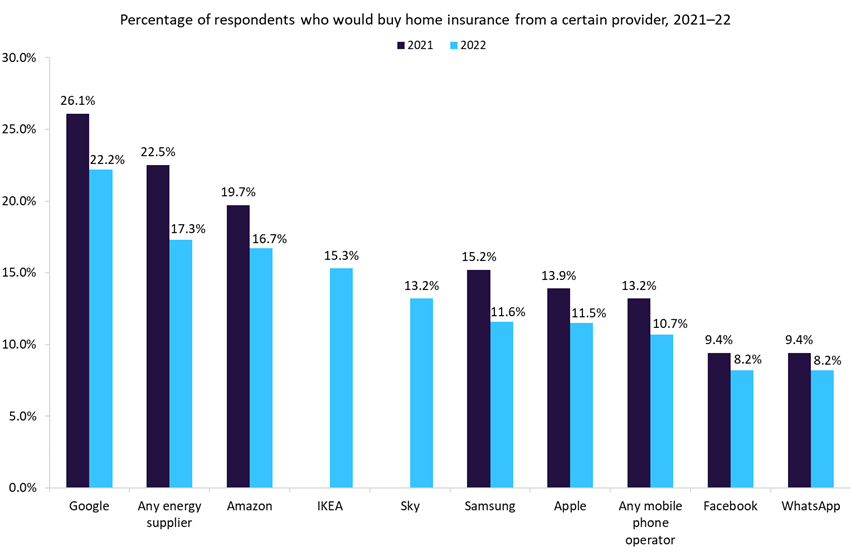

Further insights from GlobalData’s 2022 UK Insurance Consumer Survey indicate that mobile phone operators are not consumers’ first port of call when it comes to affinity home insurance providers. However, if EE can build a reputation as a trustworthy provider through its gadget insurance, more consumers will be likely to turn to it for home insurance – especially if it can make use of modern technologies to provide the product at a cheaper price. This will be driven by younger consumers, who are more open to affinity providers in general (27.5% of under 30s are open to buying home insurance from a mobile phone operator).

The Financial Conduct Authority is beginning the process of investigating how it can regulate the trend of big tech firms entering UK insurance markets. With many affinity providers seeing insurance as an opportunity to grow revenue streams, this could be pivotal to the future of UK insurance markets. EE can be among the affinity leaders by using its tech products, customer data, and point-of-sale model to drive its business in the future.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData