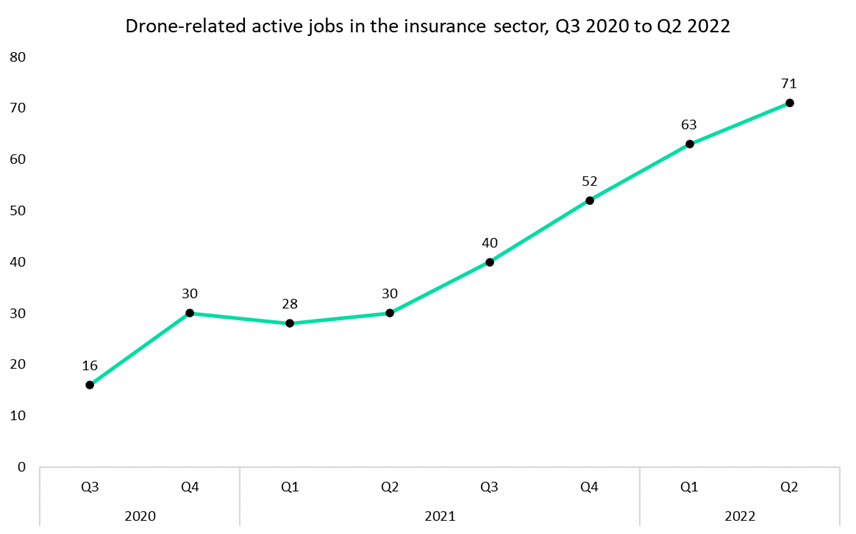

GlobalData’s Job Analytics database suggests that the number of drone-related jobs in the insurance industry has been increasing steadily since the start of 2021. In Q2 2022, the number of drone-related active jobs in the industry grew 136.7% year on year. An increasing number of use cases for drone tech, particularly in property inspections, are showcasing drones’ cost-saving credentials for insurers.

Despite the negative outlook for many economies heading into the end of 2022, drone-related jobs continue to gain more traction. This shows that insurance companies are finding an increasing number of benefits from their use. Leading companies looking to make hires within this theme include Swiss Re, AXA, and Heritage. Steadily increasing claims costs in the property line – driven by spiraling global inflation levels and the persistent threat of damaging natural hazards and weather events – is likely to drive further use of drones in insurance.

A key use case for drone technology in insurance can be found in Zurich North America’s claims adjustment process for its Rural Community Insurance Services line. If a severe weather event damages a farmer’s crops, drones can be used to scan the area in order to locate and assess damages (which can often be sporadic) in large fields in much shorter times. Reduced inspection time as well as requiring fewer in-person inspectors and adjustors drives cost savings and efficiency in the process. Zurich suggests that in some cases, these time savings have been as significant as 66%. Drones can also assess areas that are inaccessible to loss adjustors, such as areas recently damaged by wildfires or floods.

Furthermore, the use of drones has also opened up other windows of opportunity for insurers. UK-based startups Flock and Coverdrone have become leading insurers for commercial drone flights – such uses include inspection (not only in the insurance industry, but also construction and agriculture) and deliveries. Coverdrone also offers cover for recreational drone pilots, while Flock’s insurance policies are based on pay-as-you-fly principles. In May 2022, Coverdrone and the British Insurance Brokers’ Association (BIBA) announced a partnership whereby BIBA members receive full access to Coverdrone’s products, enabling them to service niche customer demands. This scheme provides further evidence that the insurance industry believes drone technology is here to stay.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

Related Company Profiles

AXA SA

Swiss Re Ltd