Advisors continue to represent an important distribution channel for life insurance products in the protection space. The speed of underwriting in the sale of life products is very important, as the process can often take a few weeks to complete. Innovation in underwriting aims to speed up the decision-making process, in turn reducing customer waiting times. As insurance providers move towards digitally integrating results from medical screenings into their platforms for advisors, the application process will be streamlined. Advisors have access to applicant profiles through these platforms and can achieve a quick decision on the eligibility of the customer, in turn allowing advisors to speed up their journey.

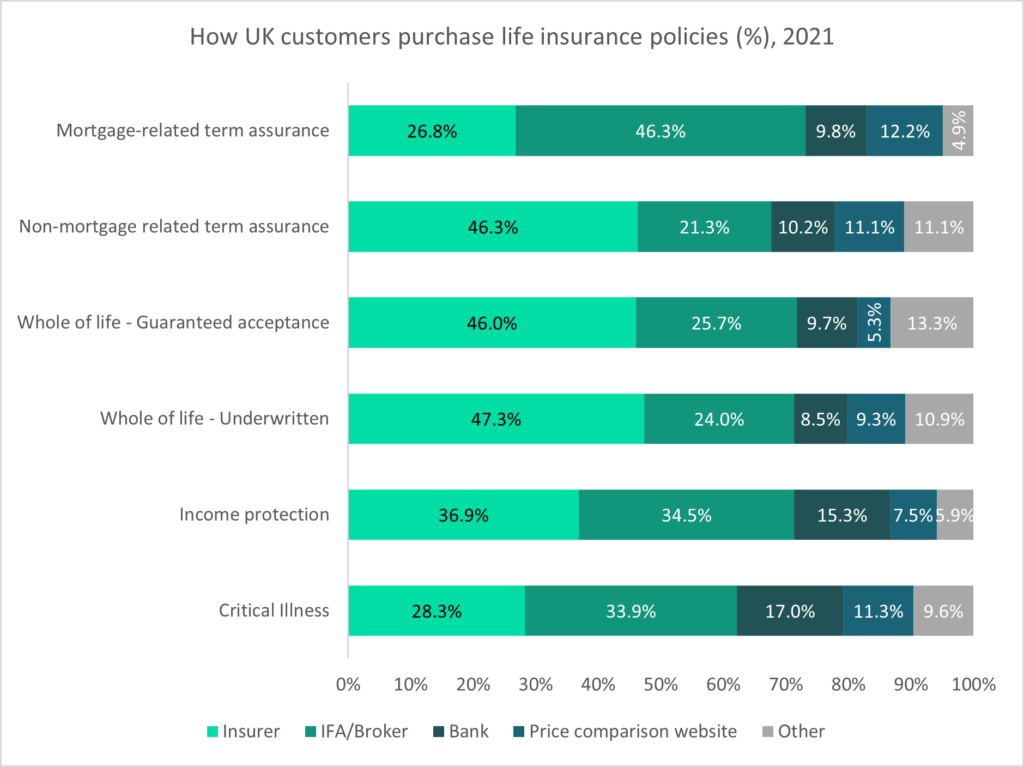

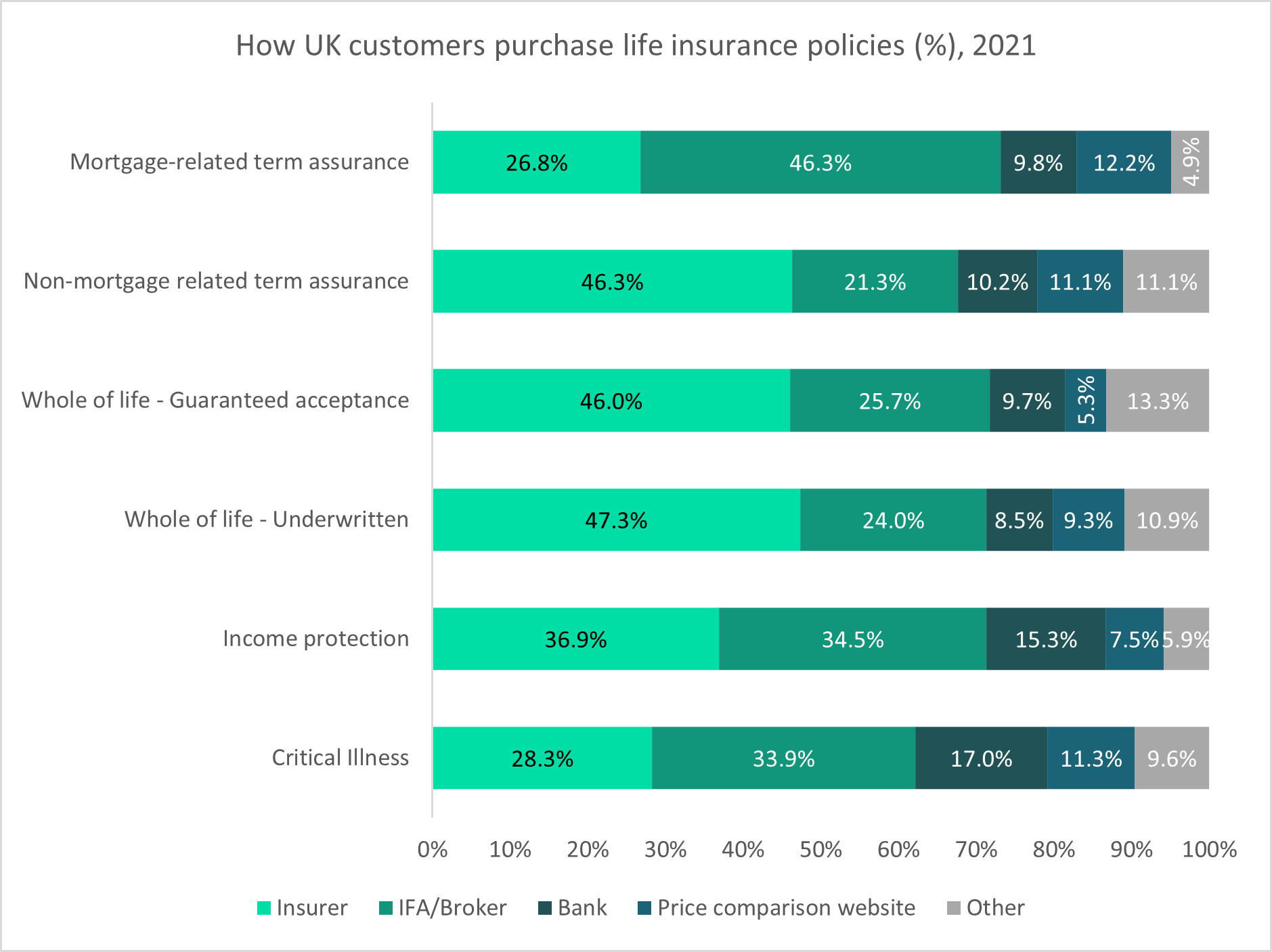

According to GlobalData’s 2021 UK Insurance Consumer Survey, independent financial advisors (IFAs) and brokers play a large role in the distribution of protection products. For instance, 46.3% of mortgage-related term assurance policies are sold through IFAs/brokers, the largest channel for this product. Furthermore, 33.9% of critical illness policies are sold through IFAs/brokers. This expresses the importance of the utilization of IFAs when purchasing policies. Advisors, when provided with medical screening information, may be able to speed up their journey when searching for recommendations.

HSBC Life offers insurance services through the banking channel and selected third parties, including IFAs such as IRESS and iPipeline. Through UnderwriteMe’s platform, HSBC Life introduced a digital underwriting innovation that enables medical screening requests to be sent to and returned back instantly from medical screening provider Square Health. The findings of the screening are sent back to HSBC Life’s digital underwriting rules engine, which is provided by UnderwriteMe, to rapidly determine eligibility. The innovation will hasten underwriting decisions, decreasing both consumer waiting times and advisors’ time spent looking for results.

The solution improves both the advisor journey and customer experience while adhering to the Financial Conduct Authority’s consumer duty guidelines, which will be implemented in 2023. Furthermore, it will spark innovation across the protection space as more insurers look to improve their services to best meet the needs of their consumers.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

Related Company Profiles

IRESS Ltd