COVID-19 has forced companies to change the way they work, accelerating digital transformations. Historically, brokers have resisted these changes, but a growing number of them are now adopting new online and digital services to keep abreast with changing client demands.

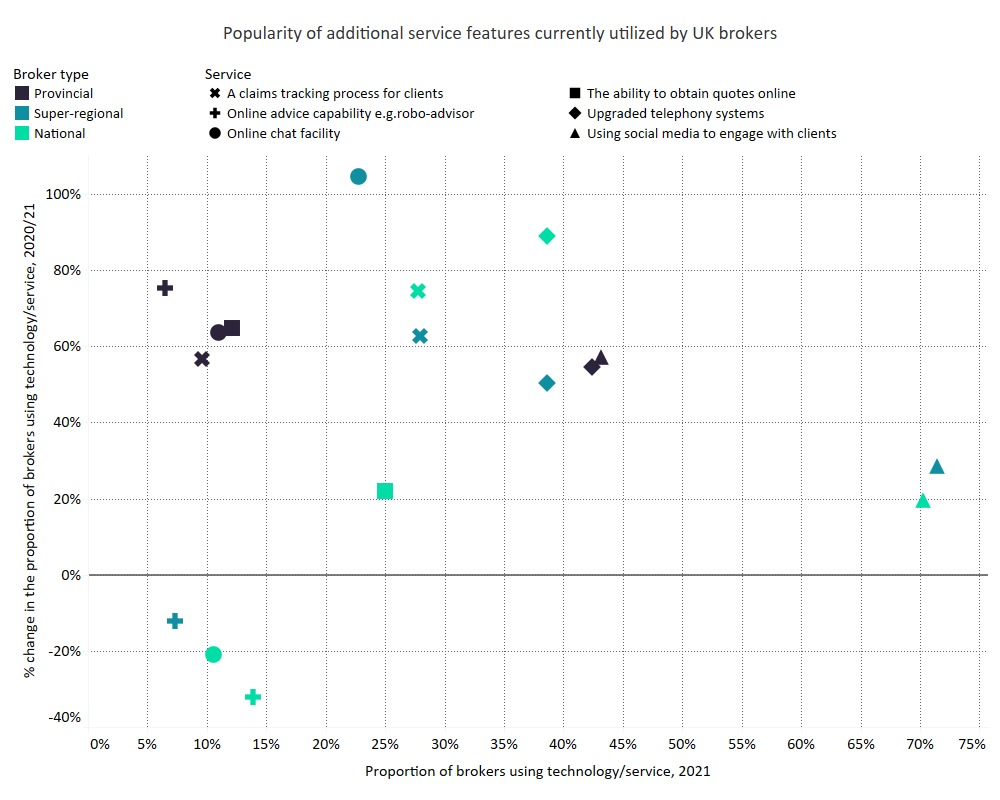

After 2020, UK insurance brokers have become more open to the use of online services, such as online chat functions and claims-tracking portals, for their clients to use. According to GlobalData’s UK Commercial Insurance Broker Surveys, the proportion of brokers that provided a claim-tracking process for their customers decreased from 10.8% at the beginning of 2016 to 9.5% at the beginning of 2020. However, over the past year, the proportion of brokers implementing this technology has increased by 65.3%. Still, while only a minority of brokers (15.7%) are currently using this technology, this represents a marked increase in those willing to use online services.

There were also increases in the proportion of brokers using online quote functions and social media, as well as upgrading their telephony systems with the elimination of face-to-face meetings over the past year.

The above graphic also highlights that these changes are being seen across the board, from smaller provincial brokers to national ones, showing that all brokers see the need to transform their business. The brokers that implemented these services over the past year will be more competitive than their peers, especially among smaller businesses that can purchase their insurance via online channels. Digital brokers are quickly becoming the norm.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData