COVID-19 and the Insurance Value Chain

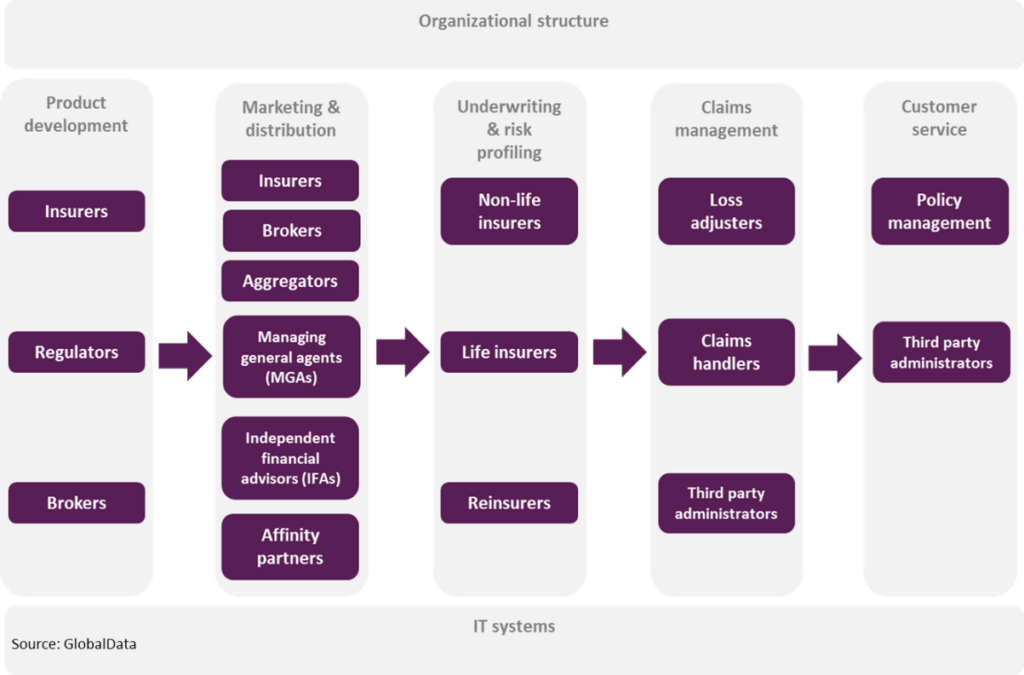

COVID-19 will have significant impacts across the insurance value chain. However, not all of these will be detrimental, with some creating opportunities to further the digitalisation of current processes. The below graphic illustrates the insurance value chain and how different areas will be impacted.

Impacts stemming from the spread of COVID-19 in the short run will be detrimental to the industry across all areas of the value chain. Product development will be halted as liquidity concerns will limit the availability of funds required to develop new policies and move into different markets. The development of new products will also suffer as providers will look to focus on their core markets, where performance is strongest, in order to ensure business continuity.

There is evidence that the marketing and distribution of policies has already been impacted, with some insurers pausing the sale of new policies in markets such as travel insurance as they look to limit their exposure to claims and protect existing policyholders. Within underwriting and risk profiling, there will be a significant need for policy terms to be reviewed to identify possible hidden exposures where exclusions or policy terms are not clearly stated.

Although there will be little that providers can do to rectify this, it will be essential to ensure the business can attempt to prepare for the associated costs. Given the disruption caused to the global economy across all industries, insurers will experience a surge in claims across multiple lines of business. With social distancing measures in place across a large number of countries, the ability of insurers to efficiently manage and process these claims will be considerably stretched.

Yet despite these negative impacts, the benefits will eventually come to the industry in the longer term. The changes in consumer behaviour that have been forced to occur during periods of lockdowns, such as accelerating the shift towards online purchasing, will result in opportunities for the development of new products focused solely on digital channels.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe tracking of citizens has occurred in some countries in an effort to slow the spread, which may result in some consumers becoming increasingly open to the concept of sharing their own personal data, creating opportunities in the health and life insurance space. The wealth of data that will become available following the pandemic will greatly increase underwriting accuracy for such events in the future, allowing for providers across the industry to better mitigate their impact.

Arguably the biggest benefit will come in the claims management and customer service areas in the form of increased digitalisation. The need for social distancing has forced consumers to become comfortable with virtual interaction. As a result, insurers will have the opportunity to move towards an increasingly virtual claims and policy management system.