Life insurers should consider payment holidays as the cost-of-living crisis deepens and more households are pushed into financial hardship, with monthly bills already being a leading concern. Life insurers will have to look into ways of helping their customers as families will be forced to cut monthly outgoings, as was the case at the onset of the COVID-19 pandemic.

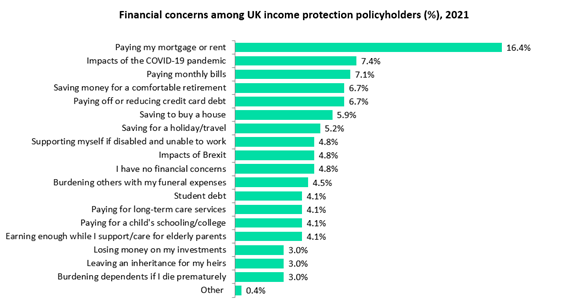

Life insurers have been more proactive than their non-life insurance counterparts at introducing payment breaks. Despite this, only a small number of life insurers have introduced payment breaks as a result of the cost-of-living crisis. Most recently, income protection specialist Holloway Friendly has joined the wave. Findings from GlobalData’s 2021 UK Insurance Consumer Survey show that paying for accommodation—either a mortgage or rent—is the most important financial concern for income protection policyholders, with 16.4% of consumers citing this. Paying monthly bills (7.1%) is also cited as a top concern.

As inflation continues to spiral, so will the cost of food, bills, and fuel. Inevitably, households facing financial hardship will have to reassess their outgoings and cut down costs on unnecessary expenses. Maintaining customer numbers is likely to be more of a challenge for life insurers than non-life insurers given that life products are often complex products misunderstood by customers and often perceived as unnecessary. Non-life insurers will also be hit, but some lines will fare better. For instance, motor insurance is a legal requirement for any driver intending to drive or park on roads.

In order to reduce premiums, policyholders have two options: to reduce cover or cancel the policy altogether. Thus, enabling policyholders to take a short payment break until they hopefully regain control of their finances can help insurers to reduce the number of policy cancellations.

At the onset of the pandemic, many life insurers introduced payment holidays, again for fears over cancellations. At the time, banks, too, made it easier for customers to take a mortgage repayment holiday. The current economic climate partly shares some similarities with the economic uncertainty brought about by COVID-19.

Holloway Friendly offers a payment holiday break of up to six months for income protection customers who have been with the company for at least three months. Meanwhile, LV= has maintained its payment break option that it introduced during the pandemic—this is valid for up to three months. Similarly, AIG has continued to offer its flexibility of payments introduced during the pandemic. Unlike other insurers, instead of offering a payment holiday, AIG allows customers to reduce their premiums for six months, but at a lower level of cover, before returning to the original policy plan. It is likely that other providers will follow the steps of these insurers, introducing mid-term policy breaks to assist vulnerable customers.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData