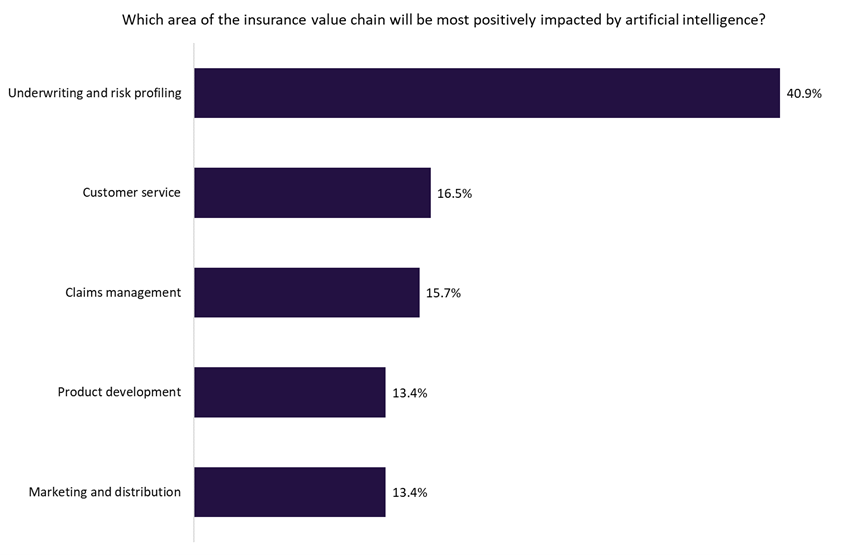

Insurance industry insiders believe that artificial intelligence (AI) can play a vital, positive role in all areas of the insurance value chain. Results from a Life Insurance International poll run by GlobalData suggest that the underwriting and risk profiling parts of the value chain are most ripe for AI to play a positive role.

Over 40% of respondents to the poll stated that they believe underwriting is the area of the value chain set to be most positively affected by AI. As the capabilities of AI-based tools (including machine learning) have evolved in the past five years, the tangible benefits of the technology are becoming increasingly apparent. These benefits often come in the form of enhanced risk management, underwriting efficiency, and profitability. Given the wealth of data points to which an insurer has access, using AI tools to assess a client’s risk profile can deliver faster and more accurate conclusions than traditional underwriting techniques. Greater accuracy leads to fairer and more profitable pricing, while faster underwriting speeds allow underwriters to devote more time to more complex or core activities.

Customer service and claims management – two facets of the value chain that often go hand in hand – are seen as the next most impactful segments. AI’s role in these segments of the value chain includes various different avenues, frequently pioneered by burgeoning insurtechs seeking an innovative edge. These include Lemonade’s automated personal assistant Maya, which adds a personal touch and simplifies the onboarding process for new customers.

Meanwhile, Hedvig utilises natural language processing to allow consumers to make a claim by submitting a voice note to its app. Simple claims are settled immediately while more complex cases can be handled by the claims team. Hedvig’s record claim settlement time is 195 seconds. Other insurtechs such as Shift use AI to detect and analyse fraud in real-time. Shift says its technology can detect both isolated cases of opportunistic fraud as well as sophisticated fraud network schemes.

AI technology often works in tandem with big data and analytics. Insights generated from any activity in which significant data can be generated is ripe for AI disruption. Cross-selling opportunities can be developed for brokers as AI continually analyses a customer’s responses in the signup process, giving the broker key insight into the customer’s intentions before they begin a call. AI can also allow for a more personalised service, especially as telematics and other Internet of Things-enabled devices become widespread across both personal and commercial lines.

AI looks set to have a role to play in all corners of insurance. With insurtechs leading the innovative charge in the industry, many legacy insurers are still looking to catch up. Collaborations and acquisitions will continue to play a key role in the future as the capabilities of AI keep developing.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData