Artificial intelligence (AI) is changing the insurance sector by enhancing accuracy and efficiency across the value chain, helping improve the evaluation of insurance needs. Yet small and medium-sized enterprises (SMEs) provide an obstacle to insurers in the adoption of this technology, according to GlobalData’s 2023 UK SME Insurance Survey. Almost a quarter of SMEs responding to our survey reported that they were not very comfortable or not at all comfortable with having AI assess their insurance needs.

Based on the same survey, the following are the top three reasons SMEs oppose using AI to determine insurance needs: 56.1% prefer human expertise and advice, 37.3% do not trust AI, and 36.2% believe AI is not advanced enough to perform the activity. For insurers that want to integrate AI into their operations, overcoming these obstacles is crucial. Additionally, 25.6% of SMEs expressed concern about how AI will use their personal or corporate data, which is in line with general concerns about data security and privacy. Notably, according to AXA, risk associated with AI and data is among the top ten concerns for both UK experts and the general public. Furthermore, 16.9% of respondents stated that they do not understand AI, which makes them opposed to its application to insurance.

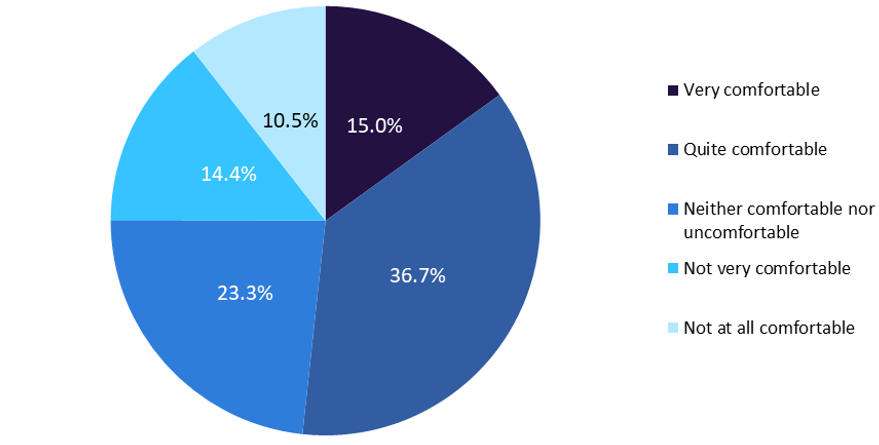

How comfortable are you/would you be for an AI tool to asses your insurance needs and recommend the most suitable coverage options to you?

On the contrary, 51.7% of SMEs say they would feel very or quite comfortable using AI to meet their insurance needs (23.3% were neither comfortable nor uncomfortable). They acknowledged the advantages of AI, with 45.8% willing to use AI for faster processing times and 38.1% for more accurate estimations of levels of cover (and thus premiums). Even though AI is still relatively new to the insurance sector, its integration into certain key areas of the value chain is progressing quickly.

To navigate the deterrents identified by GlobalData’s survey, it is essential to increase AI security and trust. Concerns about cybersecurity are growing as AI develops quickly. Check Point Research has reported that there could be an 8% increase in global cyberattacks due to increased developments in the use of AI for cybercrimes. By making investments in robust cybersecurity measures and data handling practices, insurers can deal with this issue. They should make it clear that they are committed to protecting sensitive data and should provide details on the security protocols and applications of AI. Insurers should attempt to educate consumers on the benefits of AI assessing their insurance needs. This includes emphasising that AI complements human expertise rather than replaces it. Customers’ apprehension can be alleviated, and trust can be fostered by highlighting the speed and accuracy AI brings to the process. Insurance companies can successfully incorporate AI into their operations and provide more accurate and efficient insurance assessments by addressing concerns and showcasing the technology’s advantages.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

Related Company Profiles

AXA SA