An insurer’s record in sustainability remains the least important factor to SMEs when choosing an insurer, and that does not show much change year to year. The past 12 months have seen numerous severe weather events that have been disruptive to many businesses. However, the impact of the cost-of-living crisis appears to have increased the focus on the price of policy and trust in the insurer.

GlobalData’s 2023 UK SME Insurance Survey found that the majority of SMEs say that sustainability in general is important to them. We asked respondents to rank its importance between one and five (with five being very important), and 64.9% ranked it either four or five (effectively important or very important). This is actually slightly down from the two previous years in which we asked this question—65.3% in 2022 and 67.6% in 2021—but remains a significant proportion.

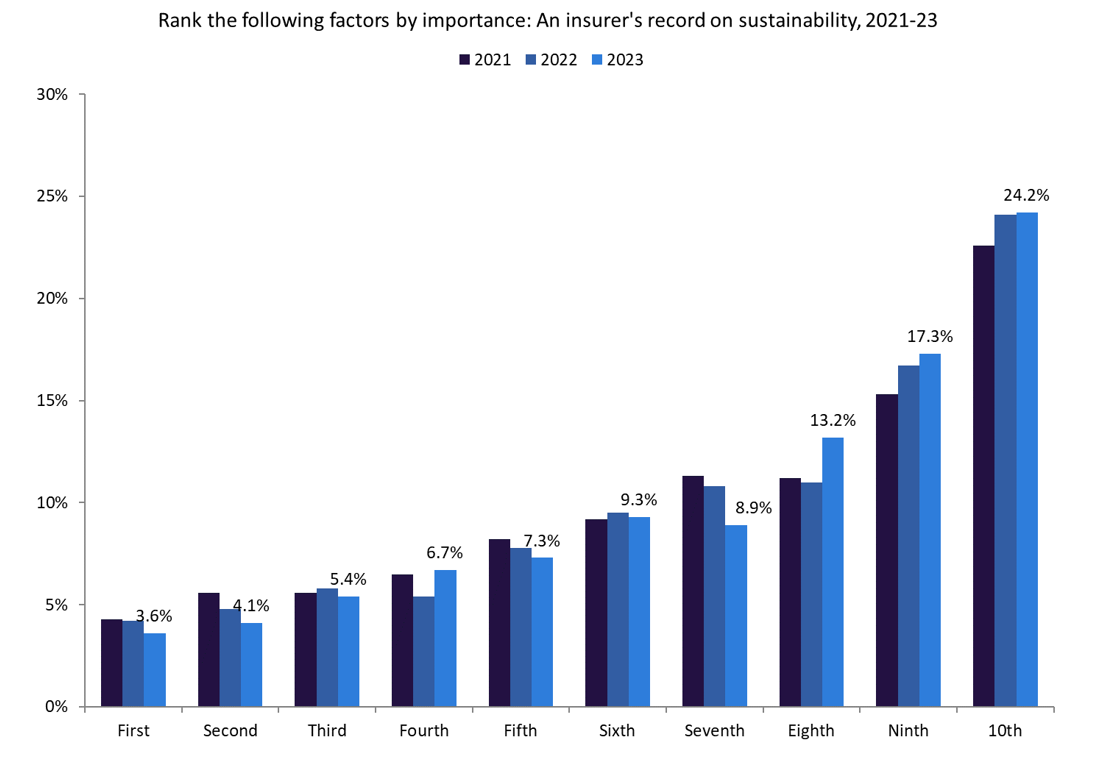

SMEs were also asked to rank a range of factors in terms of their importance when choosing an insurer. Sustainably came last (tenth place) both for the mean score of all of the ten factors listed and for having the highest percentage of respondents ranking it as least important. The chart below shows the proportion of SMEs that ranked sustainability in each of the ten positions.

There was a considerable difference in the proportion (6.9 percentage points) of SMEs that ranked sustainability tenth compared to ninth, and this was the single-biggest gap between positions. Other factors ranked above sustainability by SMEs included the cost of a policy, the reputation of the insurer, the relationship with the insurer, the transparency of pricing, and the insurer paying claims in full and promptly. Sustainability is an ever-increasing trend in the industry, but this data shows how risky it would be for an insurer to prioritise its records in this area over offering competitive pricing. This is likely to be accentuated by the current economic difficulties, with businesses focusing on surviving and needing value and reliability from insurers.

Sustainability remains a key long-term trend, and our data does show that SMEs believe insurers should have strong records in this area. But it remains a long way off being a significant factor for customers at the point of purchase.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData