GlobalData findings reveal that e-scooter insurance penetration rates are low, despite the increased growth of bike and e-scooter sharing and ownership in urban areas. However, the rapidly changing mobility ecosystem will push insurers to rethink their products, including exploring new marketing avenues to serve prospective customers.

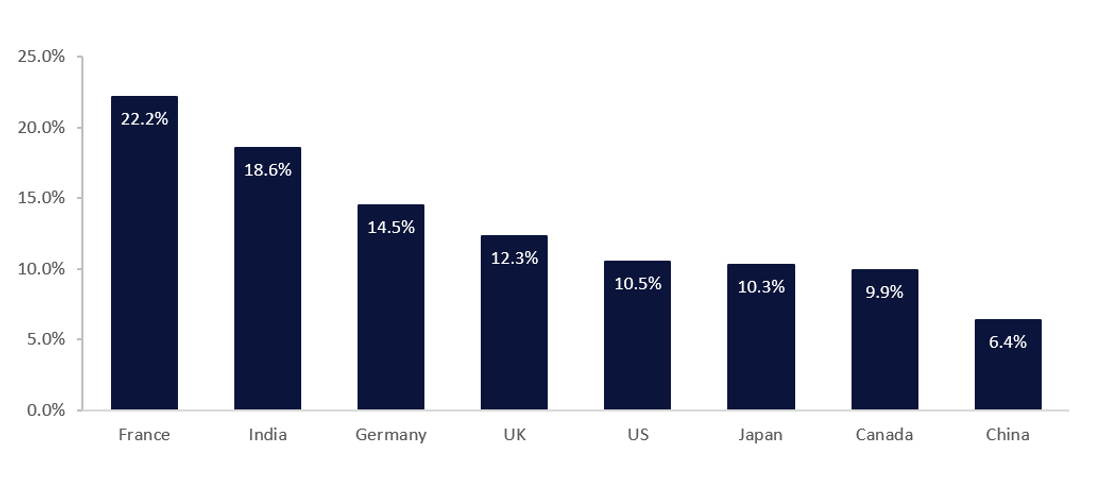

Rentals are commonly associated with micromobility, but privately owned micromobility vehicles can offer insurers fresh avenues for new business. According to GlobalData’s 2023 Financial Services Consumer Survey, e-scooter insurance penetration rates vary significantly by country but remain worryingly low even in countries where there is a legal requirement to hold insurance. France has one of the highest e-scooter insurance penetration rates globally, standing at 22.2%. However, considering that riders are legally required to hold insurance, this rate is disappointing. In Germany, insurance holding is also a must to use e-scooters, but the rate is even lower.

Regulators have not been able to keep up with the rapid growth of the e-scooter market, but legislation surrounding the use of e-scooters will prompt more insurers to develop new products. There are also discrepancies on where individuals can ride e-scooters. In some countries, e-scooters should be used on pavements rather than roads, increasing the risk of a rider injuring a pedestrian—particularly as riders can navigate much faster than pedestrians. In this respect, motor and fleet insurer AND-E has launched a new tagline, “Every Journey Protected,” as it focuses on connected mobility protection. The insurer aims to provide products that ensure every journey—regardless of its shape or purpose—is safe and secure. It offers protection for journeys with e-scooters, e-bikes, and e-cargo bikes, as well as car-sharing and car-pooling services. AND-E aims to provide a strong customer experience through straightforward policies and easy claims processes. As governments globally implement measures to decrease the number of vehicles on roads in order to reduce CO₂ emissions, and the cost of car ownership soars, the mobility ecosystem will continue evolving. At the same time, more consumers will embrace greener and more convenient modes of transport. These trends will create significant growth opportunities for insurers, with emerging legislation also driving growth. Insurers that can cater for the emerging micromobility space early are more likely to capture a larger share of the market.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData