The cost of repairs and underwriting risks are the biggest challenges insurers are facing in the transition to electric vehicles (EVs), according to a GlobalData survey. As interest in EVs grows, the British Insurance Brokers’ Association (BIBA) has partnered with NOVO Insurance to launch a new EV scheme to help address specific challenges in policy coverage faced by the industry.

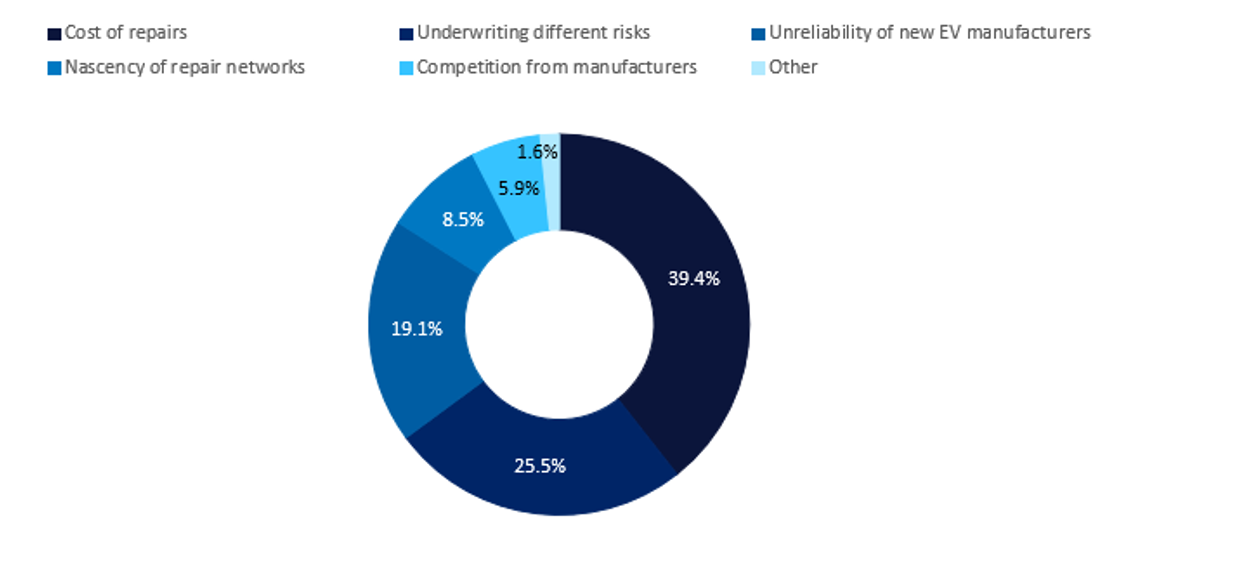

A GlobalData poll conducted on Verdict Media sites in Q2 2023 indicates that 39.4% of insurance industry insiders believe the cost of repairs is the biggest challenge for insurers, followed by underwriting different risks (25.5%). There is no doubt that the insurance industry continues to grapple with the switch to EVs as they rely on advanced technology and lithium-ion batteries, which not only makes repairs—and premiums—very costly but also changes the nature of risks compared to petrol or diesel vehicles.

BIBA’s new scheme is a step in the right direction as it aims to tackle some of the shortcomings in coverage and improve the claims process by providing access to a UK-wide EV repair network. Supply chain issues when sourcing replacement components for EVs contribute to high premiums as they naturally push up the cost of repairs. Having a specialist manufacturer-approved EV repair network should hopefully improve stock and provide a more reliable service to owners. Targets for a net-zero transition are exerting more pressure on motor insurers to offer adequate cover for EVs. However, the complexities of insuring EVs are dissuading underwriters. In October 2023, John Lewis stopped selling insurance to EV drivers following a decision made by its underwriter, Covéa. Meanwhile, 35.9% of car owners plan to switch to a fully electric-powered vehicle in the next five years, as per findings from GlobalData’s 2023 UK Insurance Consumer Survey. This proportion rises to 46% when considering a period of ten years. Yet, as older vehicles break down and become in disuse, more motorists may be persuaded to purchase an EV earlier than they expected given that all new cars and vans sold in the UK must be fully electric by 2035. The industry needs to find ways to make EVs insurable at a reasonable price so that the transition to EVs can continue and motorists do not feel discouraged. As the EV parc grows, manufacturing components at scale will bring prices down. Greater availability of specialized repair shops and technicians will also reduce costs. For the time being, insurers will have to continuously monitor the EV market and adjust their policies accordingly. In this way, they will be able to manage repair costs better and provide comprehensive EV cover.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

Related Company Profiles

John Lewis Partnership Plc

Covanta Holding Corp