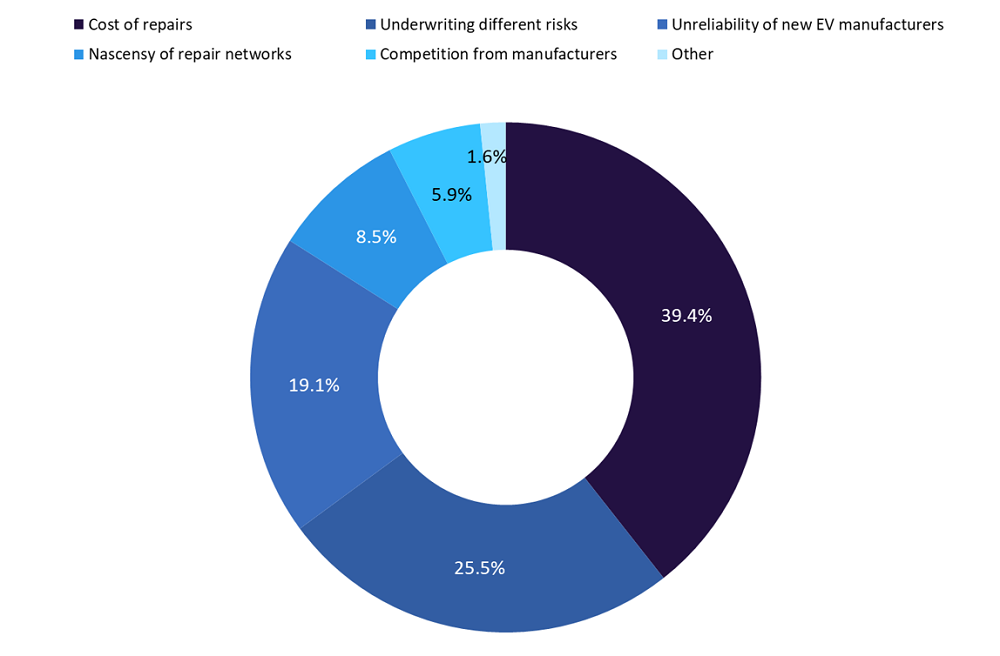

John Lewis has temporarily stopped offering insurance to electric vehicle (EV) drivers due to concerns over the cost of repairs. Meanwhile, GlobalData surveying finds that the cost of repairs is the biggest challenge insurers are facing in the move to EVs.

As per a GlobalData poll run on Verdict Media sites in Q2 2023, 39.4% of insurance industry insiders believe the cost of repairs is the biggest challenge for insurers in the move to EVs. Respondents also cited underwriting different risks (25.5%), the unreliability of new EV manufacturers (19.1%), and the nascency of repair networks (8.5%) as key challenges for insurers in the move to EVs.

What is the biggest challenges for insurers in the move to EVs? 2023

Against this backdrop, John Lewis has announced the cost of repairs as a primary reason why it has paused offering insurance to EV owners. John Lewis has stated that the pause is temporary while risks and costs are analysed by its underwriter, Covea.

Repair costs are a significant challenge for insurers during the transition to EVs. EVs feature complex technology, making repairs more expensive compared to traditional internal combustion engine vehicles. Additionally, the limited availability of specialized repair shops and technicians can increase expenses, leading to the need for insurers to cover transportation costs to qualified repair centres. Additionally, battery replacements—one of the costliest repair jobs for EVs—can be influenced by factors such as supply chain disruptions and technological advancements, making cost estimation challenging.

However, as supply chains for EVs mature, repair costs are likely to decrease. Economies of scale will make manufacturing EV components more cost-effective, leading to cheaper replacement parts. Increased competition will foster innovation and reduce repair expenses. Standardisation will simplify repair procedures, and improved infrastructure will streamline the repair process, reducing logistical challenges and costs for insurers. These developments will ultimately make it more cost-effective for insurers to provide coverage for EV owners as the market evolves.

Overall, insurers can overcome these challenges by adapting their policies and practices. This includes staying up to date on EV technology, collaborating with specialised repair facilities, and developing partnerships with EV manufacturers. Additionally, insurers should consider offering tailored coverage options that account for the unique risks and repair needs of EVs, while continually monitoring and adjusting their policies as the EV market matures. By taking these steps, insurers can better manage repair costs and provide comprehensive coverage for EV owners.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData