According to GlobalData’s 2023 UK Insurance Consumer Survey, DeadHappy is one of the UK’s most recognisable insurtechs but has hit the headlines once again for the wrong reasons. Now, the company’s underwriting partners have clipped their wings, leading the life insurer to rebrand its website logo to ‘DeadUnhappy’ as it is no longer able to sell new policies. Blunt tone and contentious adverts had previously drawn attention to the provider and driven brand recognition.

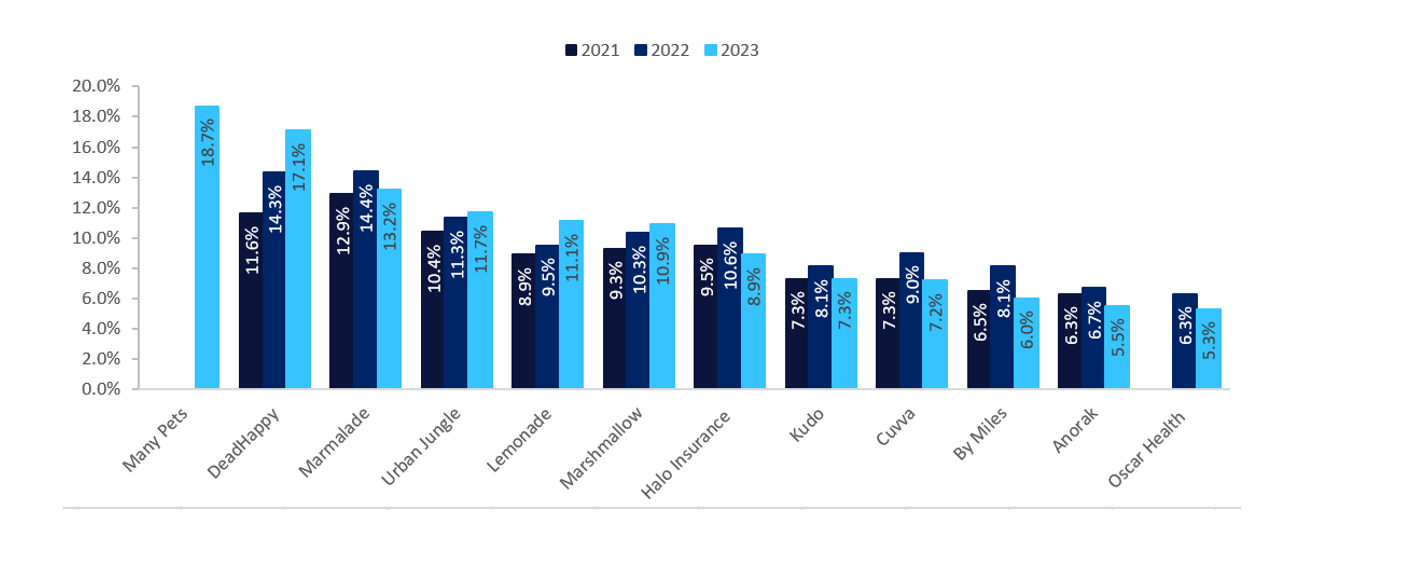

With a skull for a logo, a website covered in graffiti-style writing, and selling “life insurance to die for,” DeadHappy has made a name for itself as one of the most creative yet controversial life insurers. In fact, it is controversy that has led DeadHappy to become one of the most recognised startups in the insurance space, with 17.1% of consumers in 2023 stating that they had heard of the brand, up from 11.6% two years earlier, as per findings from GlobalData’s 2021 and 2023 UK Insurance Consumer Surveys.

Without explaining what happened, DeadHappy has made it clear that it does not agree with its partners’ decision, saying, “We wish it was different, we believe it should be different, but unfortunately not everyone agrees.” Elsewhere, the company alludes to the fact that it is trying to work things out. On the flip side, if the water clears, and we see DeadHappy being able to resume its business as usual, the insurer may witness another uplift to its brand recognition. This is assuming that DeadHappy has not pushed its boundaries to a dead end.

The life insurer’s dark humour has not been to everyone’s liking. Last year, DeadHappy drew criticism over a social media campaign featuring convicted serial killer Harold Shipman. In 2019, the Advertising Standards Authority criticised it for trivializing suicide when it launched an ad campaign with the slogan “Please Die Responsibly”. DeadHappy had defended that the “provocative nature” of its brand was to make people stop and think, bring change to consumer attitudes towards death, and make life insurance discussions less difficult. It is possible that underwriters may be concerned that DeadHappy’s controversial stance may do more harm than good to the protection industry, and this may be the reason the company has been brought to a standstill.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData