Cyber insurance is now seen by industry leaders as the product with the greatest demand potential due to political tensions, according to GlobalData polling. As political tensions spill into cyberspace and attacks become costlier and more disruptive, insurers and organisations alike are shifting their strategic focus to improving cyber resilience and risk transfer.

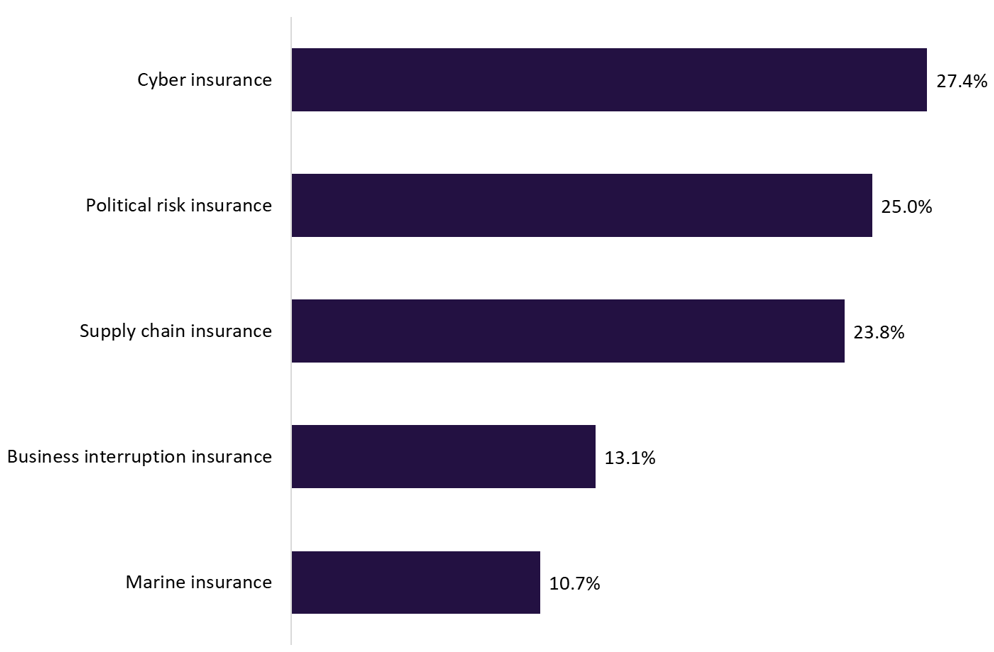

GlobalData’s latest poll run on Verdict Media sites in Q3 2025 found that industry insiders believe cyber insurance will see the highest increase in demand, with 27.4% selecting it as the top product. This perception is driven by rising geopolitical tensions and the growing threat of cyberattacks. Cyber insurance was placed ahead of political risk insurance (25%), supply chain insurance (23.8%), and business interruption insurance (13.1%), which shows that digital security concerns have overtaken traditional political and operational exposures.

What type of insurance product do you think will see the highest demand due to geopolitical tensions? Q3 2025

The ongoing conflict between Russia and Ukraine has extended beyond conventional warfare to include sophisticated cyber operations targeting critical infrastructure and corporate networks.

Concurrently, heightened instability in the Middle East is increasingly manifesting as state-sponsored and hybrid cyberattacks that span beyond traditional war zones. Organisations are now recognising that cyber incidents are not solely the domain of individual hackers or criminal groups but can originate from geopolitical escalation and nation-state actors.

These threats can compromise supply chains, undermine operational resilience, and damage reputations—creating complex exposures that conventional insurance products struggle to address. As a result, cyber insurance is emerging as a core strategic risk transfer tool in a world where digital threats and political tensions are deeply intertwined.

Insurers can play a more active role in mitigating risks by offering clearer coverage, improving threat monitoring, and providing stronger preventative and incident-response support. Solutions such as vulnerability assessments, employee cyber awareness training, and enhanced security partnerships can help organisations reduce the likelihood of an attack in the first place. By collaborating closely with governments and cybersecurity experts, insurers can stay ahead of evolving attack methods linked to geopolitical tensions. This dual focus on prevention and faster recovery will help strengthen operational resilience and ensure organisations are better protected before and after cyber incidents occur.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData