According to GlobalData’s 2024 Emerging Trends Insurance Consumer Survey, insurance penetration remains low across all sectors of the gig economy. The launch of Acorn Group’s new Street Cover brand highlights a critical protection gap in the UK gig economy. The new product offers hire-and-reward coverage for individuals using personal vehicles for food delivery services or courier services.

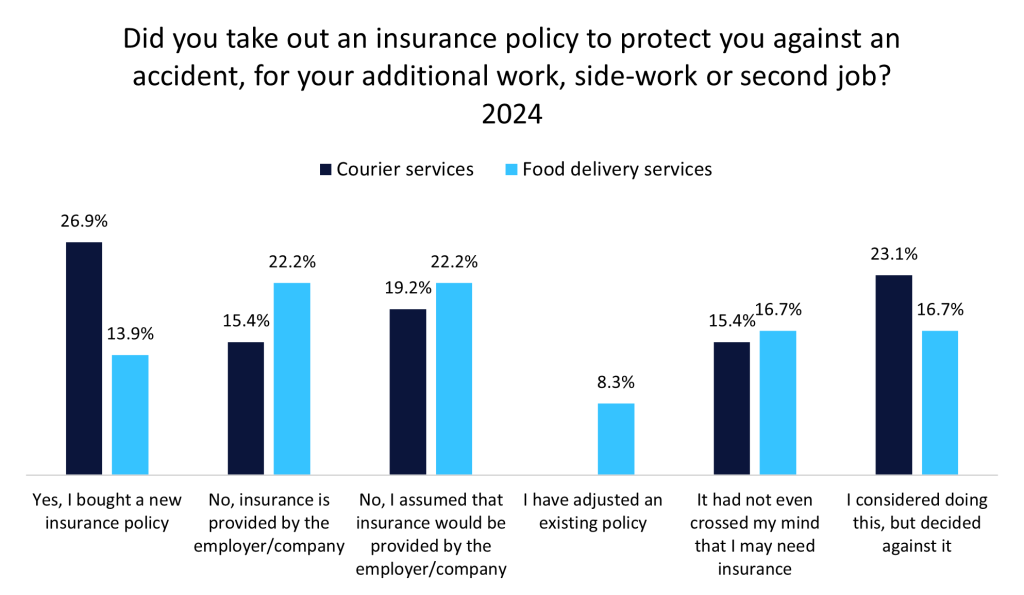

According to GlobalData’s survey, 55.6% of food delivery drivers and 57.7% of courier service drivers lack an insurance policy that covers their work. Among food delivery drivers, 22.2% assumed their employer would provide insurance, 16.7% had not considered it, and another 16.7% thought about travel insurance but ultimately opted against it. Similarly, for courier service drivers, 19.2% believed their employer would offer coverage, 15.4% had not thought about it, and 23.1% considered travel insurance but chose not to pursue it. This significant portion of the workforce remains underinsured, exposing them to substantial financial risks in the event of accidents or incidents.

This gap in coverage is becoming increasingly visible, particularly as food delivery and courier work have surged since the pandemic. Two main drivers behind this global expansion have been the rising cost of living and economic instability, which have resulted in individuals seeking jobs in the gig economy. The flexible nature of gig work can lead to a lack of awareness about the importance of insurance.

With the launch of Street Cover, Acorn Group aims to close the underinsurance gap within the industry by improving product awareness, educating drivers, and making coverage affordable and simple to purchase. However, the effectiveness of this initiative will depend on how well Acorn Group can address potential challenges. Ensuring that the product is genuinely affordable for gig workers, who operate on tight margins, will be crucial. Additionally, the company must develop effective educational strategies to convey the importance of insurance to a workforce that may not fully understand its benefits.

The opportunity for the wider insurance industry remains significant, as there is a clear need for accessible and flexible products tailored to the gig economy workforce. Collaboration with gig-economy platforms presents a promising avenue for increasing insurance uptake. By embedding coverage options at the point of onboarding or job acceptance, these platforms can help mitigate the number of underinsured drivers.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData