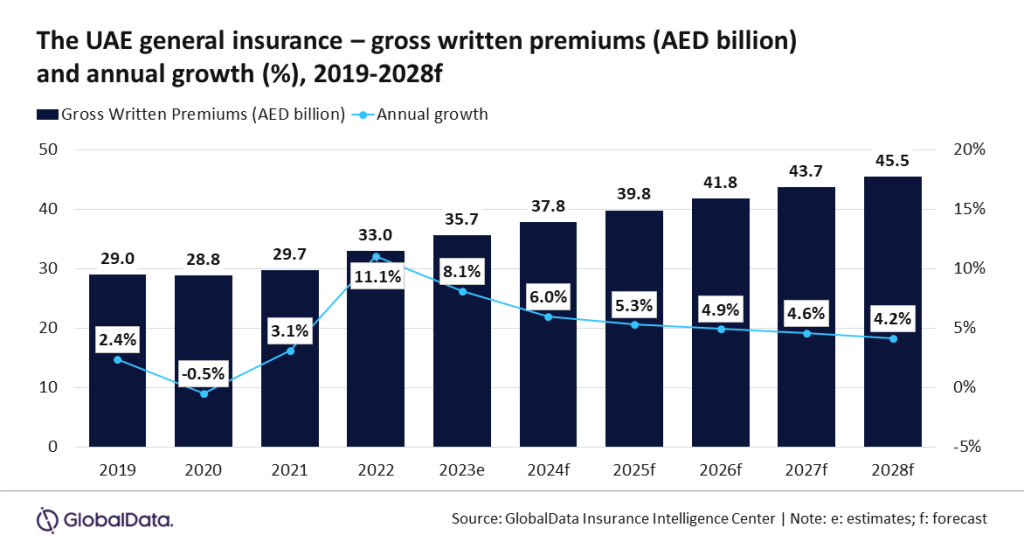

The general insurance industry in the UAE is set to grow at a CAGR of 4.7% from AED37.8bn ($10.3bn) in 2024 to AED45.5bn ($12.4bn) in 2028, in terms of GWP.

Furthermore, the general insurance sector in UAE is expected to grow by 6% in 2024, according to GlobalData. This is predicted to be supported by PA&H, motor, and property insurance lines that are supposed to account for over 85% of general insurance premiums in 2024.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Prasanth Katam, insurance analyst at GlobalData, said: “The UAE witnessed a slower economic growth of 3% in 2023 as compared to 7.9% growth in 2022, due to cuts in oil production and the deceleration of non-oil sectors. As a result, the general insurance industry is expected to witness slower growth of 8.1% in 2023 as compared to 11.1% growth in 2022. The trend is expected to continue in 2024 and 2025 due to the global economic slowdown and increased geopolitical uncertainties.”

PA&H insurance is the leading line of business that is expected to account for an estimated 59.1% share of the general insurance GWP in 2024. It is expected to grow by 4.7% in 2024, supported by increasing demand for health insurance policies due to rising health awareness after the COVID-19 pandemic.

In addition, with increasing cases of chronic diseases, an aging population, and advancements in medical technology, the cost of treatment and medication has been increasing significantly in the UAE.

As a result, the premium prices of health insurance policies have been increasing over the last couple of years. The health insurance premiums are expected to rise further in 2024, which will support the growth of PA&H insurance.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataKatam added: “Positive regulatory developments will also support the growth of PA&H insurance. In January 2024, the UAE government mandated individuals applying for or renewing their residence visas in Dubai and Abu Dhabi to have a valid health insurance policy.”