Tower, a New Zealand insurer, has entered a partnership with climate and natural catastrophe risk insurtech company CelsiusPro.

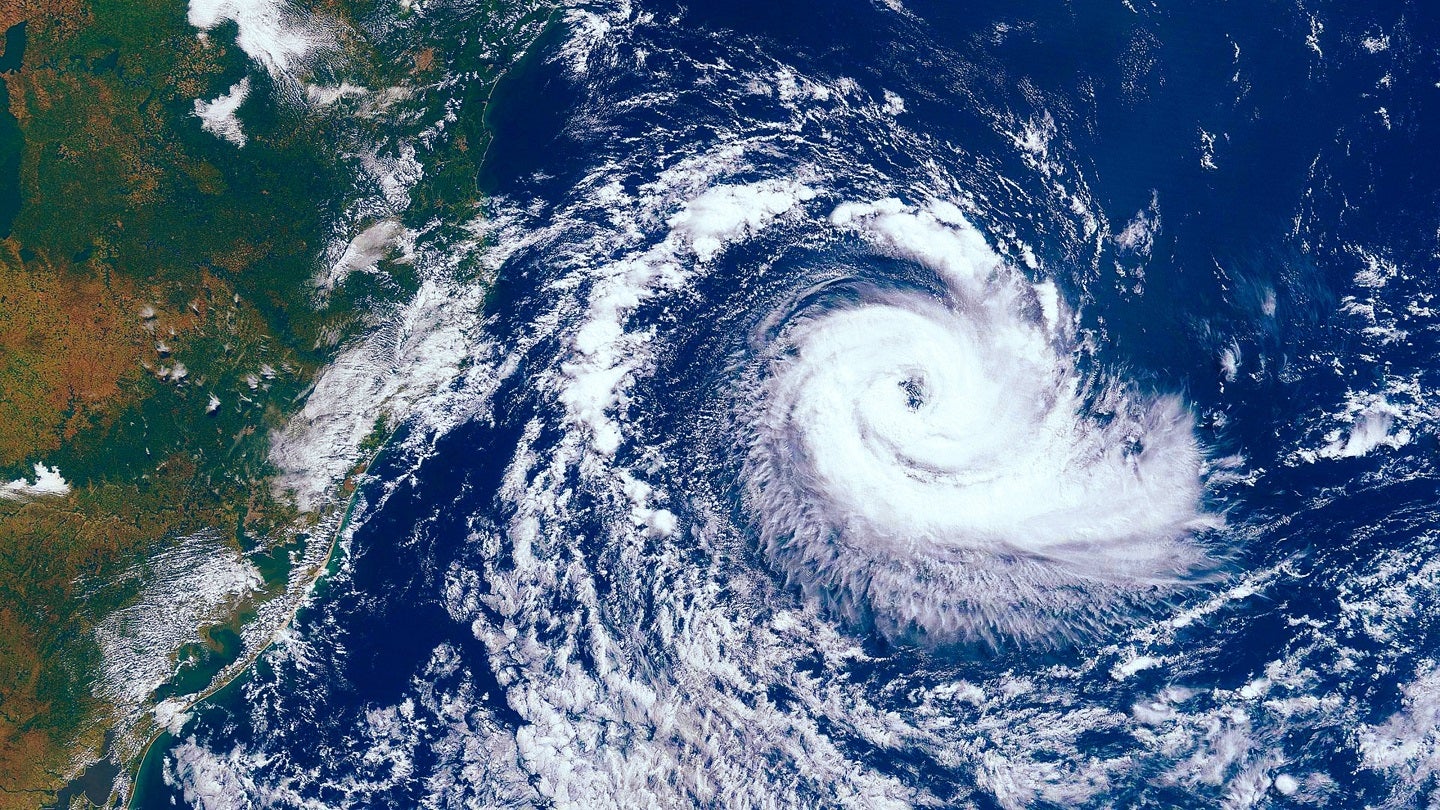

The collaboration has resulted in the launch of an IT platform designed to streamline the distribution of parametric insurance, starting with Tower’s cyclone response cover in Fiji and Tonga.

Parametric insurance offers policyholders prompt cash payouts when their property is affected by a high-wind tropical cyclone, irrespective of the actual damage.

The distribution and administration of this insurance are facilitated by CelsiusPro’s White Label Platform technology.

The product relies on data from the Joint Typhoon Warning Centre to ensure reliable coverage, with payouts being triggered when a cyclone reaches a predetermined intensity.

Tower customers can now access advanced features including self-registration with multi-factor authentication, an online premium calculator, automated policy generation, real-time monitoring and expedited settlement processes.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAccording to CelsiusPro, the inclusion of mobile payment capabilities, secured through partnerships with local telecommunications and banking companies, offers a significant advantage, especially for customers in remote areas.

The cyclone response cover is designed to provide financial protection to a diverse range of clients including micro and small enterprises, independent farmers, mariners, rural communities and retail customers.

Tower and CelsiusPro are set to expand their White Label Platform partnership to Samoa within the next few weeks, with a target completion date of the end of September 2024.

Furthermore, Tower is preparing to introduce a parametric rainfall product for customers in Fiji.

CelsiusPro CEO Mark Rueegg said: “We are pleased to partner with Tower and support their commitment to helping clients recover faster from climate events. Our proprietary technology enables Tower to provide an intuitive and seamless user experience, making it easier for clients to purchase parametric insurance.”

Tower chief underwriting officer Ron Mudaliar said: “Tower’s purpose is to protect and enhance the future for the good of our customers and communities. Parametric insurance is one tool we are using to help increase insurance awareness and uptake in the Pacific.

“We are committed to helping the economic and personal resilience of Pacific communities using parametric insurance, and are thrilled to partner with CelsiusPro on this journey.”

This development follows a partnership in July between Global Parametrics, part of the CelsiusPro Group, and One Acre Fund, an organisation dedicated to supporting smallholder farmers.

Their collaboration is aimed at protecting farmers in Zambia and Malawi from the financial impact of crop losses due to drought.