Rising interest and gilt rates have had wide-ranging and material implications for UK life insurers’ capital and regulatory reporting requirements. Will Machin (director) and Phil Tervit (senior director) from WTW’s Insurance Consulting and Technology business, write

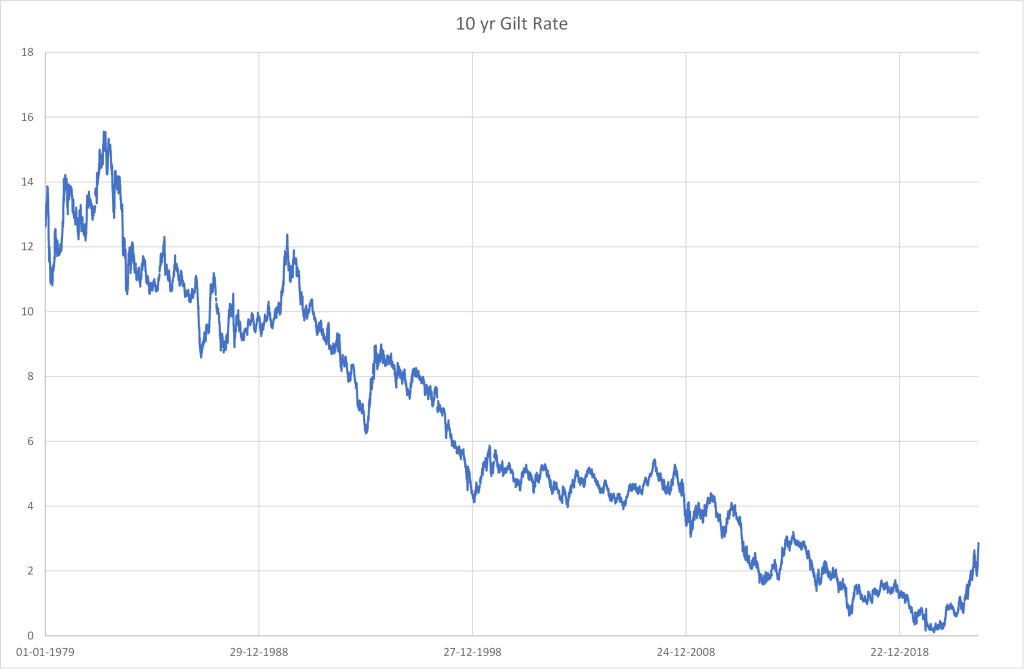

A key trend in 2022 was the rapid escalation in UK gilt rates, with 10-year spot rates reaching more than 4% in October last year. The circa +3% increase in gilt rates was larger than a 1-in-200 interest rate stress for the internal model companies taking part in WTW’s 2021 Risk Calibration Survey. It is also much larger than the Standard Formula 1-in-200 stress of circa +1%.

So, how will UK life insurers address the challenges these rate movements bring for risk, capital and regulatory reporting?

Immediate impacts

The most immediate impact for many insurers has been the improvement in coverage ratios. Liabilities have reduced because of the increase in discount rates, but so have asset valuations. The overall effect has been determined by hedging strategy; most insurers have hedged the coverage ratio against interest rate falls and have suffered IFRS losses with rate increases.

Insurers have also faced a lack of liquidity in the gilts market. Some companies have interest rate hedges, and the increase in interest rates gives rise to collateral demands at short notice. The lack of liquidity was most acute for defined benefit pension funds using a liability driven investment (LDI) strategy, in which derivatives match assets to liabilities.

This led to pro-cyclic behaviour, in which firms sought to liquidate assets such as gilts and corporate bonds to post collateral. This depressed their market value and further increased interest rates, leading to yet more collateral demands. The Bank of England then intervened as buyer of last resort to improve liquidity and created a ‘repo’ facility.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe short-term spikes and lack of liquidity will have tested many insurers’ liquidity frameworks. Some have fared better than others, depending on the assets permissible under the collateral agreements and their exposure to LDI funds. However, most insurers’ balance sheets have been remarkably resilient, possibly in part due to the PRA requirements of SS5.19 which firms will have considered when defining their liquidity frameworks.

Nevertheless, in its list of priorities for 2023, the PRA has highlighted that gaps did exist in some insurers’ liquidity frameworks. We anticipate life insurers are likely to have to adjust their liquidity risk framework at a minimum, or if not then make adjustments to their investment strategy (for example, asset allocation) in light of these events.

Capital management through volatile periods

Understanding the capital impacts of the volatile markets has been a priority for firms. Finalising Q3 2022 results and reporting to the market in particular was challenging for most and added further strain on finance functions.

For insurers focused on the annuity market, the Solvency II risk margin will have undergone a significant decrease with a further 65% reduction from the anticipated Solvency II reforms as confirmed by HMRT’s November 2022 consultation response. We are expecting the first PRA consultation this summer.

The reduction in rates has made it cheaper to hold longevity risk on the balance sheet. Insurers are holding high levels of longevity reinsurance and it is unclear whether this will continue.

Continuing to manage the overall capital position against the capital risk appetite remains key. Market volatility leads to impacts in the Solvency II balance sheet including Solvency Capital Requirement, and for most may also impact the level of capital buffers (or as a minimum the justification thereof). Some insurers are making revisions to the capital management policy to ensure it remains fit for purpose, largely driven by a review of the measurement of interest rate risk.

Implications for internal model calibrations

A fundamental issue for many insurers is that their models are not calibrated to what has turned out to be (at least) a 1-in-200 year event (see Figure 1), at least as interpreted by Solvency II calibrations.

Figure 1: 10-year-gilt rate movements (Source: Bank of England)

Interest rates rose dramatically, although the interest rate curve is now downward sloping, which could be interpreted as a market expectation that rates will come back down. However, factors such as the Ukraine conflict, the energy price spike and post-pandemic recovery – exacerbated by the previously artificially low rates brought about by quantitative easing – continue to bite.

Some may argue that none of these factors are “extreme” – perhaps because of precedents in living memory (such as the 1970s oil shock) or a belief that they’ve been “priced in” to market conditions.

But for insurers that have an internal model, the simple fact is that most model calibrations are much lower than the movements seen last year. We saw most insurers during 2022 adopt a wait-and-see approach; however, we expect that insurers will revisit their risk calibrations this year, in line with the PRA’s expectations that firms should be able to respond to market conditions different from recent experience.

Reporting adjustments

For now, regulatory reporting will need to continue on existing capital models (whether internal models or Standard Formula), a focus on explaining the results and comparing movements to prior period sensitivities to assess accuracy will be key.

In its 2023 priorities letter, the PRA stated that it will focus on how well capital models are operating in the new economic environment. Internal model companies should be able to include the movements of interest rates in 2022 in the calibration of the model going forward, although the beneficial impact of higher interest rates on coverage ratios may relieve some of the immediate pressure to reconsider the stress approach. Inclusion of the additional experience with interest rates should strengthen this exercise; however, the key consideration will be the expert judgement on plausible future paths for interest rates – will they revert to their pre-2022 levels, and if so how quickly?

Likewise, Standard Formula companies could expect to strengthen calibrations with additional ‘severe’ data points from 2022.

There is clearly much for UK life insurers to consider around capital management and reporting as a result of rising rates. Some insurers have started to revisit their calibrations, for example by extending backwards in time the data set used in order to include the 1970s oil shock. At the very least, companies should be documenting that the Board has considered the issue and what approach has been taken.