When getting new prices quickly to market, the European life insurance industry plays second fiddle to non-life insurers, many of whom now quote individually prepared prices which are delivered in real-time. But the life market is starting to catch up says Russell Beaumont, a director in Towers Watson’s life insurance advisory practice

Life insurance pricing teams are often highly frustrated individuals. It’s not unusual to need three to six months just to load new prices onto systems due to the IT resources needed. And product overhauls take even longer.

Many can only stop and wonder at the capabilities of their sister non-life companies who have been using advanced pricing techniques for the past 10 years.

These techniques deliver prices based on the characteristics of the individual customer, the sales channel and the nature of the competition, calculated in real time, and which can be updated daily.

If the gains seen in motor business were reproduced in the life markets, then using similar solutions could produce increases of perhaps 25% in new business value that would be available to share between customers, distributors and the providers themselves.

Some life insurers are already taking steps in this direction. The use of predictive modelling techniques to improve risk assessment in areas such as mortality and retention analysis are fairly widespread.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataAt the same time, newer life companies, unburdened by complex legacy systems, are using these more granular risk assessments in their pricing.

Now, faced with a rapidly changing market, there are signs that others are intent on closing the gap. Composite insurers recognise the cross-over possibilities and bancassurance is also a fertile ground for development.

Playing catch-up

Among the main drivers is the evolving change in consumer preferences. A recent Towers Watson survey showed that over half of consumers in the major European markets expect to buy life cover direct from an insurer or through a price comparison website in future.

Consequently, digital distribution capability and technology platforms are recognised as of utmost importance.

A quarter of life insurers said that enhancing their digital footprint is the primary focus of their merger and acquisition (M&A) activity over the next few years in the latest Towers Watson/Mergermarket EMEA M&A Report.

Equally, more sophisticated data use across the industry, the need to manage across multiple distribution channels simultaneously, a regulatory push for greater pricing transparency, and a fear of not being left behind all increase the pressure.

Agile response

The need for greater agility increases the strain on pricing processes and already-stretched IT resources, out of which three common challenges are emerging.

Data expertise: The effective use of internal and external data is highly fashionable, and we have identified six separate drivers which are fuelling this data rush, beginning with readily available structured data.

Using this data effectively not only requires identifying what data are valuable for enhancing understanding of customer behaviours, but having a pricing process that supports the use of that data all the way through to delivery to market.

Take postcode pricing of annuities in the UK for example. Not so many years ago, the use of postcode as a pricing factor was still relatively new. Today, companies have to use it or face their rates quickly falling out of sync with the market.

Pricing processes: Alongside more sophisticated risk and behaviour models, how can companies get prices into the market quickly and monitor the results? Managing more complex processes in a robust and auditable framework is likely to require new tools for quick and effective decision making.

Customer focus: Companies are moving their business towards customer-centric models. So they need to manage and deliver prices consistently across multi-channel access points and legacy systems, integrate customer value-for-money price constraints, and produce enhanced business metrics for performance forecasting.

Tools used by non-life insurers can provide an effective market-facing front end to support all of these requirements for life companies too.

Market impacts

The potential for new pricing approaches to disrupt the status quo in Western European markets is apparent if responses of senior executives at a recent Towers Watson life insurance event are anything to go by:

– Following the financial crisis, Spain has seen a big drop in mortgage lending and the associated life covers. Consumers are now more price sensitive and insurers are competing harder for their business

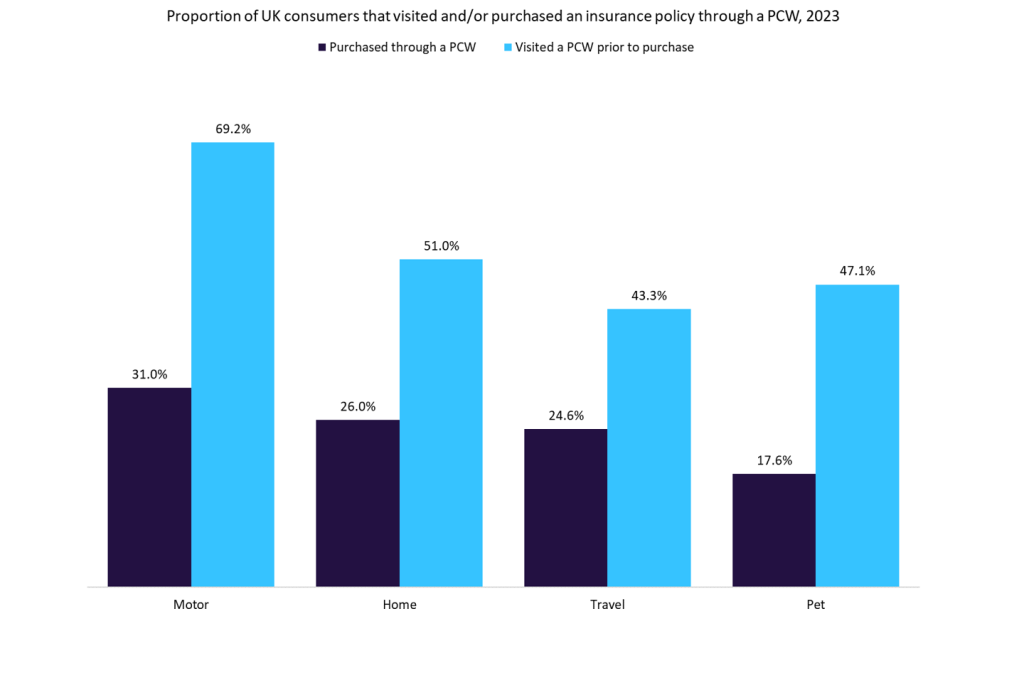

– In Holland and the UK, price comparison websites still represent a relatively small part of the life market, but companies expect them to become more popular and are readying themselves

– In Germany, there is the potential for one company, possibly a new entrant, to substantially shift its pricing approach and it would force ripples through the whole market

– In France, Italy and the Nordic countries, increasing agility to overcome IT constraints and a much more granular understanding of which customers and distributors are producing profits are the key attractions

Changes are coming – ready or not.