The insurance industry continues to be a hotbed of patent innovation. Activity is driven by growing demand for digitalization and personalization. With the growing importance of technologies such as telematics, machine learning, big data, deep learning, and data science, insurers are overcoming demographic challenges, low penetration rates, cybercrimes, and fraudulent claims. In the last three years alone, there have been over 9,000 patents filed and granted in the insurance industry, according to GlobalData’s report on Artificial intelligence in Insurance: treatment expense prediction. Buy the report here.

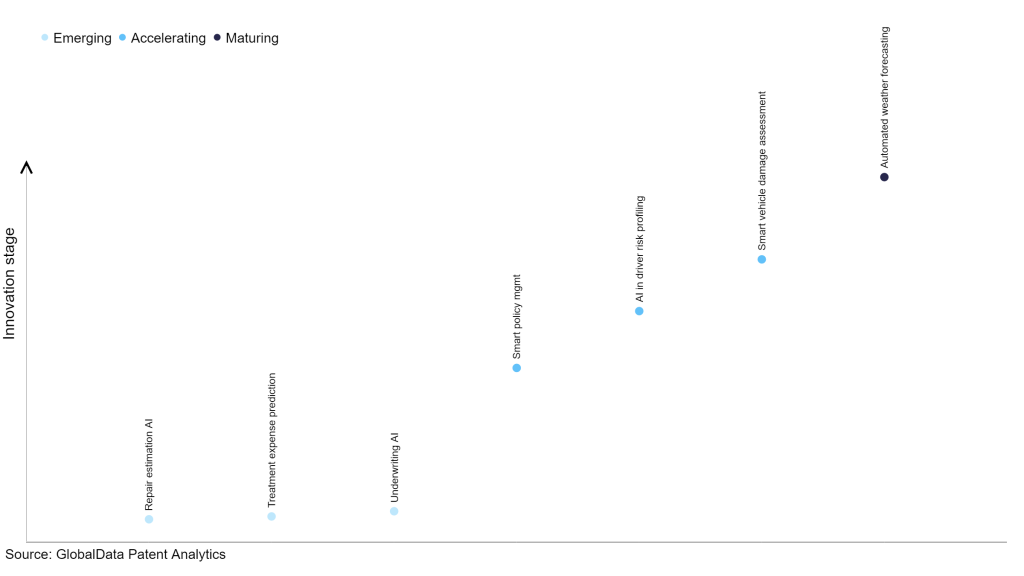

However, not all innovations are equal and nor do they follow a constant upward trend. Instead, their evolution takes the form of an S-shaped curve that reflects their typical lifecycle from early emergence to accelerating adoption, before finally stabilizing and reaching maturity.

Identifying where a particular innovation is on this journey, especially those that are in the emerging and accelerating stages, is essential for understanding their current level of adoption and the likely future trajectory and impact they will have.

25+ innovations will shape the insurance industry

According to GlobalData’s Technology Foresights, which plots the S-curve for the insurance industry using innovation intensity models built on over 75,000 patents, there are 25+ innovation areas that will shape the future of the industry.

Within the emerging innovation stage, repair estimation AI, treatment expense prediction and underwriting AI are disruptive technologies that are in the early stages of application and should be tracked closely. Smart policy management, AI in driver risk profiling and smart vehicle damage assessment are some of the accelerating innovation areas where adoption has been steadily increasing. Among maturing innovation areas is automated weather forecasting, which is now well established in the industry.

Innovation S-curve for artificial intelligence in the insurance industry

Treatment expense prediction is a key innovation area in artificial intelligence

AI-enabled analysis has equipped insurers to accurately estimate the treatment and hospitalization expenses of policyholders and potential customers. AI models make personalized cost predictions by examining multiple elements, including patient history, illness, treatment choices, and medical expenses. Insurers and patients can use this information to determine the insurance coverage needed.

GlobalData’s analysis also uncovers the companies at the forefront of each innovation area and assesses the potential reach and impact of their patenting activity across different applications and geographies. According to GlobalData, there are 95+ companies, spanning technology vendors, established insurance companies, and up-and-coming start-ups engaged in the development and application of treatment expense prediction.

Key players in treatment expense prediction – a disruptive innovation in the insurance industry

‘Application diversity’ measures the number of applications identified for each patent. It broadly splits companies into either ‘niche’ or ‘diversified’ innovators.

‘Geographic reach’ refers to the number of countries each patent is registered in. It reflects the breadth of geographic application intended, ranging from ‘global’ to ‘local’.

Patent volumes related to treatment expense prediction

| Company | Total patents (2010 - 2022) | Premium intelligence on the world's largest companies |

| Cota Inc | 36 | Unlock Company Profile |

| Johnson & Johnson | 34 | Unlock Company Profile |

| Theator Inc. | 34 | Unlock Company Profile |

| UnitedHealth Group Inc | 14 | Unlock Company Profile |

| Koninklijke Philips NV | 13 | Unlock Company Profile |

| Ping An Insurance (Group) Company of China Ltd | 13 | Unlock Company Profile |

| Beta Bionics Inc | 12 | Unlock Company Profile |

| Oracle Corp | 12 | Unlock Company Profile |

| F. Hoffmann-La Roche Ltd | 12 | Unlock Company Profile |

| Advanced Medical Solutions Group Plc | 9 | Unlock Company Profile |

| The Parkland Center for Clinical Innovation | 7 | Unlock Company Profile |

| Quality Healthcare Intermediary, LLC | 6 | Unlock Company Profile |

| Admetsys Corp | 6 | Unlock Company Profile |

| International Business Machines Corp | 6 | Unlock Company Profile |

| CVS Health Corp | 6 | Unlock Company Profile |

| Asahi Kasei Corp | 6 | Unlock Company Profile |

| Amino Inc | 6 | Unlock Company Profile |

| Walmart Inc | 5 | Unlock Company Profile |

| Commonwealth Scientific and Industrial Research Organisation | 5 | Unlock Company Profile |

| Launch Tech Company Ltd | 5 | Unlock Company Profile |

| Salesforce Inc | 5 | Unlock Company Profile |

| Express Scripts Insurance Company | 5 | Unlock Company Profile |

| NovoDynamics Inc | 4 | Unlock Company Profile |

| Embracer Group AB | 4 | Unlock Company Profile |

| Microsoft Corp | 4 | Unlock Company Profile |

| ROM Technologies Inc | 4 | Unlock Company Profile |

| Persivia Inc | 4 | Unlock Company Profile |

| Panasonic Holdings Corp | 3 | Unlock Company Profile |

| Intellectual Ventures Management LLC | 3 | Unlock Company Profile |

| Walgreens Boots Alliance Inc | 3 | Unlock Company Profile |

| The Cigna Group | 3 | Unlock Company Profile |

| 3M Co | 3 | Unlock Company Profile |

| Truveris Inc | 3 | Unlock Company Profile |

| Searete LLC | 3 | Unlock Company Profile |

| Zyter Inc | 3 | Unlock Company Profile |

| Clarify Health Solutions Inc | 2 | Unlock Company Profile |

| PulseData, Inc. | 2 | Unlock Company Profile |

| Millennium Health LLC | 2 | Unlock Company Profile |

| b.well Connected Health Inc | 2 | Unlock Company Profile |

| Clover Health Investments Corp | 2 | Unlock Company Profile |

| P3 Health Partners | 2 | Unlock Company Profile |

| Ping An International Smart City Technology Co Ltd | 2 | Unlock Company Profile |

| Kaid Health Inc | 2 | Unlock Company Profile |

| Pirche AG | 2 | Unlock Company Profile |

| SiriusPoint Ltd | 2 | Unlock Company Profile |

| Alphabet Inc | 2 | Unlock Company Profile |

| Bank of America Corp | 2 | Unlock Company Profile |

| Fujifilm Holdings Corp | 2 | Unlock Company Profile |

| Canon Inc | 2 | Unlock Company Profile |

| Micron Technology Inc | 1 | Unlock Company Profile |

Source: GlobalData Patent Analytics

Ping An Insurance is one of the leading patent filers in medical insurance expense prediction methods, devices, equipment, and storage medium. The company’s invention relates to the technical area of medical treatment and entails obtaining and analyzing an insured patient's historical treatment records. By using the technique, significant errors brought on by estimating the cost of medical insurance based on growth rates can be reduced, and the precision of medical insurance cost prediction is increased. Some other key patent filers in AI for treatment expense prediction for the insurance industry include Theator, Cota, Johnson & Johnson, and F. Hoffmann-La Roche.

In terms of application diversity, Salesforce leads the pack, with Intellectual Ventures Management and SiriusPoint stood in second and third positions, respectively.

By means of geographic reach, Theator holds the top position, followed by Cota and Beta Bionics.

To further understand the key themes and technologies disrupting the insurance industry, access GlobalData’s latest thematic research report on Artificial Intelligence (AI) In Insurance.

Data Insights

From

The gold standard of business intelligence.

Blending expert knowledge with cutting-edge technology, GlobalData’s unrivalled proprietary data will enable you to decode what’s happening in your market. You can make better informed decisions and gain a future-proof advantage over your competitors.