Coronavirus-related travel insurance claims are set to cost the UK travel insurance market around £275m, according to initial industry estimates. With such high losses being incurred, there will be departures from the market, allowing the largest players to further consolidate their market positions.

The top three travel insurance underwriters in the UK accounted for 37% of all policies sold in 2019, according to findings from GlobalData’s 2019 UK Insurance Consumer Survey. AXA (13.4%) is the leading player, followed by U K Insurance (12.4%) – in part due to its partnership with Nationwide – and Mapfre (11.2%). With the high cost of claims resulting from coronavirus, we anticipate these three players to see their respective shares of the market increase in the near future as many smaller players are forced to drop out.

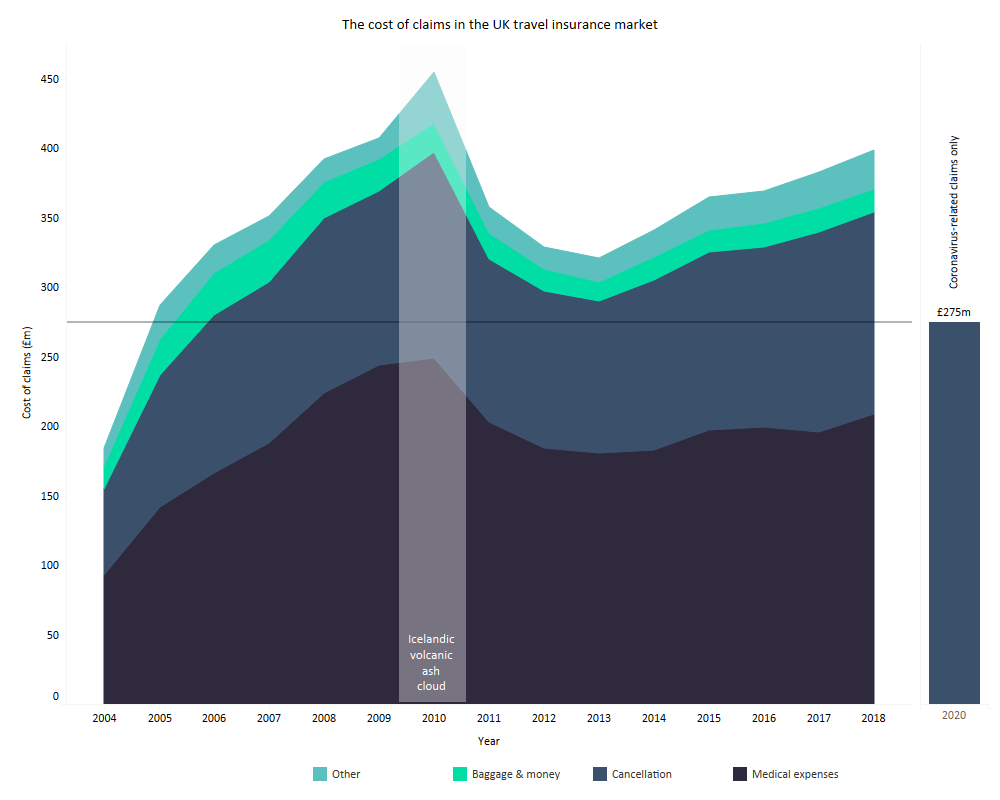

Estimates by the Association of British Insurers (ABI) indicate that the coronavirus pandemic is likely to result in over 400,000 travel insurance claims in the UK for a cost of no less than £275m. The cost of cancellation payouts due to coronavirus is expected to surpass the highest annual figure to date, registered in 2010 when the Icelandic volcanic ash cloud resulted in £148m worth of claims.

The loss ratio in the travel insurance market has been steadily increasing since 2004, according to ABI data. Both John Lewis and Tesco Bank stopped selling new travel insurance policies in 2019, and many players that struggle to cope with the cost of coronavirus-related travel insurance claims will be forced to follow suit.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThis is especially true since a number of insurers, including LV=, Admiral, and Aviva, have suspended the sale of any new travel insurance policies. The combination of this and a huge increase in the number of claims on existing policies will result in travel insurers paying out more in claims than they sell in premiums in the near future.