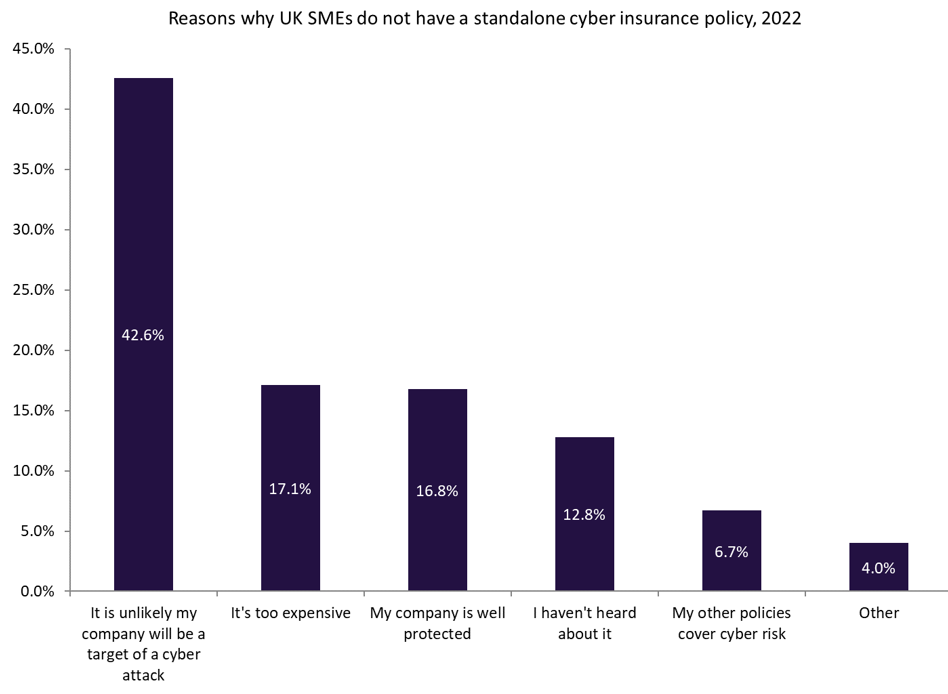

GlobalData findings suggest the main reason UK SMEs do not have a standalone cyber insurance policy is because they think it is unlikely their company will be a victim of a cyberattack. However, a report by cybersecurity consultant JUMPSEC found that the UK is the most targeted country outside the US for ransomware attacks.

GlobalData 2022 UK SME Insurance Survey

In GlobalData’s 2022 UK SME Insurance Survey, 42.6% of respondents stated that the main reason they do not have a standalone cyber insurance policy is because they think it is unlikely their company will be a victim of a cyberattack. This shows that helping SMEs understand their cyber risk remains a key challenge for insurers in growing new business in this line.

In addition, 17.1% of respondents stated that cyber policies are too expensive, while 16.8% claim their company is well protected. As an illustration of the cyber risk faced by UK SMEs, a report from JUMPSEC found that the UK is the most frequently targeted country outside the US for ransomware attacks.

In Europe, 20% of such attacks occur in the UK. Additionally, JUMPSEC found that ransomware attacks increased by 87% in the UK in the first half of 2023 (compared to 37% globally). It expects 2023 to be the most prolific year for ransomware, surpassing the previous highs in 2021.

While many SMEs believe it is unlikely they will fall victim to a cyberattack, they are gradually becoming more concerned about this risk. GlobalData’s 2022 UK SME Insurance Survey found that 50.7% of SMEs are concerned about the risk of a cyberattack – a 1.2 percentage point increase compared to 2021. The hesitance towards purchasing a cyber insurance policy among SMEs is somewhat understandable, with many of them looking to cut costs wherever possible amid the cost-of-living crisis. Yet the financial and reputational cost of being a victim of a cyberattack can be fatal, especially in such uncertain macroeconomic conditions.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataOverall, the cost of falling victim to a cyberattack far outweighs the cost of a cyber insurance policy. Insurers need to communicate the importance of these policies and convince SMEs that they need to boost their protection as cyberattacks become a growing concern.

Charlie Hutcherson is an associate analyst at GlobalData