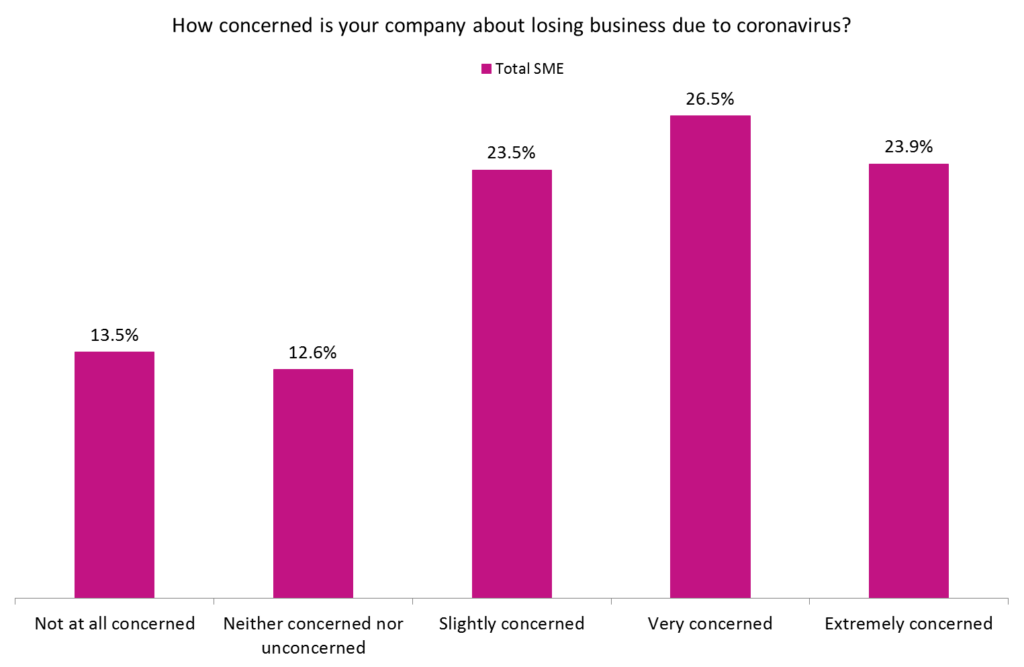

Over half of SMEs surveyed in the UK are very or extremely concerned about losing business due to the coronavirus pandemic, which suggests that commercial insurance is set to stall as businesses struggle, unless it can offer products to reduce those fears.

According to GlobalData’s 2020 UK SME Insurance Survey, 50.3% of SMEs in the UK are very or extremely concerned about the continuing impact of coronavirus, while 73.9% are concerned to some extent. Only 13.5% of SMEs stated they were not concerned at all about losing business due to the pandemic, and the majority of them were sole traders or micro businesses. Similarly, 53% of medium-sized businesses are now concerned about their ability to conduct international business as the pandemic limits travel.

The increased concern surrounding losing business due to coronavirus will only be positive news for insurers looking to offer COVID-19-specific insurance. The rising concerns suggest there is a significant market for such policies, but with the timescale a complete unknown, it is a risky and potentially very expensive product for insurers to offer. This is supported by our consumer survey, as 45.9% of medium-sized businesses are concerned they are underinsured.

There appears to be an opportunity for COVID-19 protection. The economic downturn resulting from the pandemic will lead to continued loss of business among SMEs, which will have a direct knock-on effect on commercial insurers as they will have a reduced insurance budget. Insurers therefore need to balance whether they should risk offering pandemic-inclusive commercial insurance products to make up for a decline in gross written premiums.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData