Life insurance is often described as a product that is sold and not bought, with advisers playing a crucial role in the distribution of policies. GlobalData’s 2018 UK Insurance Consumer Survey found that more needs to be done to ensure the lowest-income households are not left behind.

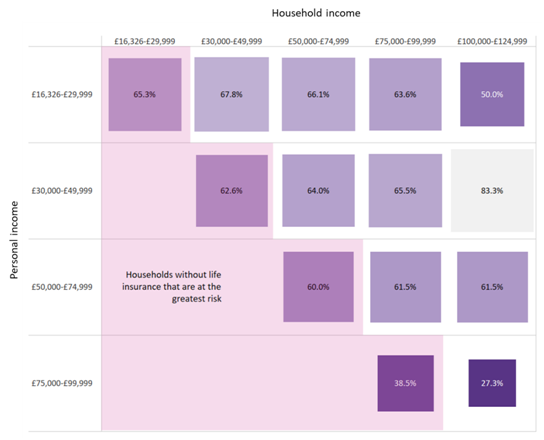

The survey indicates that amongst houses that are being paid for on a mortgage, the majority of individuals who are the main earners do not have life insurance. The chart below highlights that a considerable group of individuals (those in the shaded area) who are the main breadwinners in the home earn under £75,000 and have no life insurance in place.

Should their financial and residential status remain the same, when these individuals die those left in the home will undoubtedly face challenges meeting financial commitments such as mortgage repayments.

The above chart highlights that there is clearly a need for the life insurance market to target individuals who are the main earners in their home. This is particularly true of those earning under £75,000, as in all categories 60% or more have no life insurance. There is a clear increase in the uptake of life insurance once an individual is earning £75,000 and over, as only 38.5% of these individuals who are purchasing their home on a mortgage have no life insurance in place.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataWith such a difference in the levels of uptake between income brackets, policies that can be tailored to a greater extent and are suitable to an individual’s existing financial commitments need to be developed.