Environmental, social, and governance (ESG) ratings can lead to better underwriting performance, with GlobalData findings suggesting that improving financial performance is one of the key reasons companies believe an ESG performance plan should be implemented.

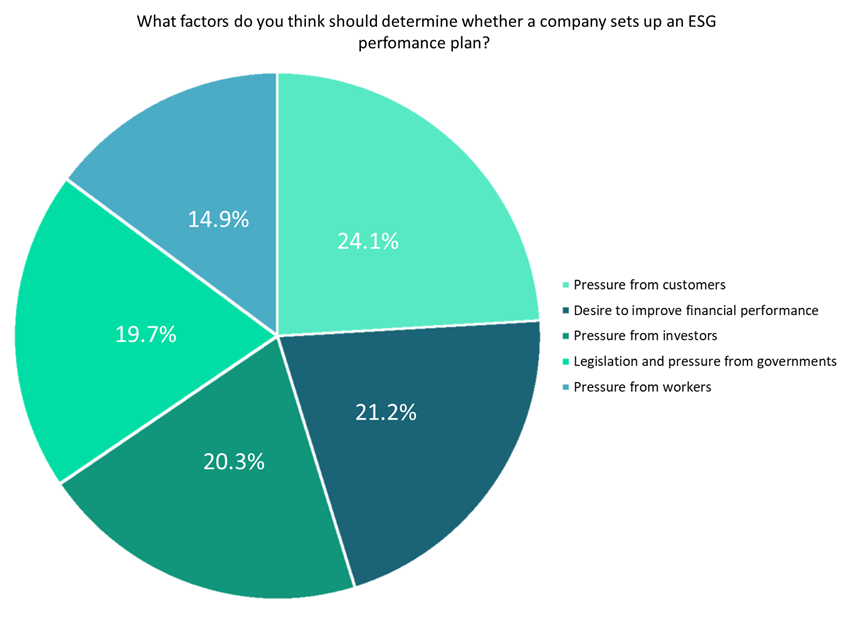

According to GlobalData’s Emerging Technology: Sentiment Analysis Q3 2022 Survey, a desire to improve financial performance is a key reason why a company should set up ESG plans, with 21.2% of respondents citing this factor. Additionally, a recent study by international insurance broker Howden and specialty insurer Fidelis found that better underwriting performance is correlated with higher ESG ratings.

Increasingly, investors are applying ESG factors as important determinants for whether or not to invest in specific companies. There is an increasing recognition among investors that ESG issues can have an impact on company value and that the management of these risks can increase economic value for companies and their shareholders. As per GlobalData’s Poll/Macro Themes: ESG Survey Q1–Q3 2022, 54.5% of respondents said they do consider ESG issues before investing in a company and 42.7% said they would divest from companies not sufficiently addressing ESG issues.

Overall, insurers should think about accelerating their ESG commitments as the benefits both financially and reputationally can be huge. The added bonus that strong ESG targets also improve brand image and revenue makes it a win-win for insurers.