Insurtech Urban Jungle is launching household insurtech targeted at younger homeowners. GlobalData statistics show this is a market ripe for disruption.

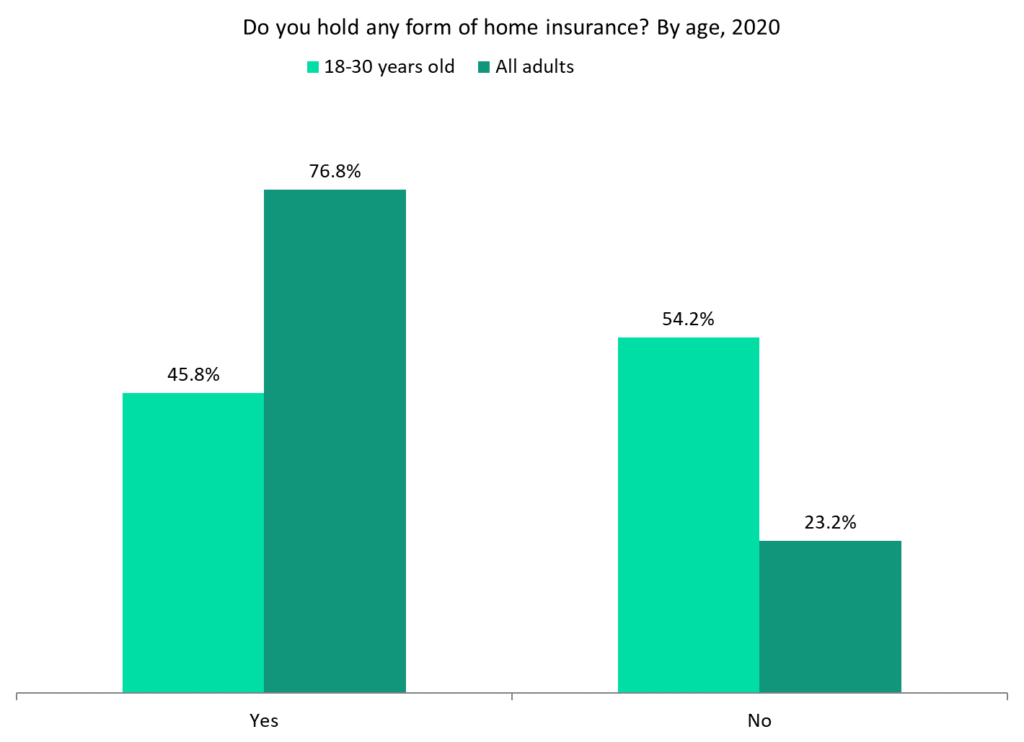

GlobalData’s 2020 UK Insurance Consumer Survey found that 45.8% of respondents 30 years old and younger have no form of home insurance. This represents a significant difference compared to overall market uptake, which stands at 76.8%. The same survey also found that adults aged 18–30 are particularly likely to purchase home insurance through a price comparison site (PCW). The proportion of adults aged 30 and under purchasing through PCWs is 35.4%, compared to 24.8% across all respondents. This indicates they are driven heavily by value and look to find as cheap a policy as possible.

Urban Jungle’s new policy, launched with digital insurer Wakam, prioritises value but also offers other benefits such as being able to pay monthly and stop coverage at any time. This should suit the 18–30 age group perfectly. Paying premiums monthly gives consumers a much more manageable fee to pay and leaves them less committed to the product, as they can switch or cancel anytime. This is also likely to benefit renters whose living situation can change more quickly, as Urban Jungle allows consumers to switch seamlessly from its renters’ policy to this new product aimed at young homeowners.

Insurers are always searching for successful ways to bring younger generations into the insurance market. The growth of Generation Rent has made this harder in recent years. Our data highlighting that over half of individuals aged 18 to 30 do not have home insurance shows insurers have a way to go, but also suggests the market is ripe for disruption and growth. Household insurtech could be the key.

Young homeowners often have stretched budgets, meaning manageable monthly payments should prove popular. The key will be to offer cheap, flexible, and digital policies, which is what Urban Jungle appears to be doing with this new product.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData