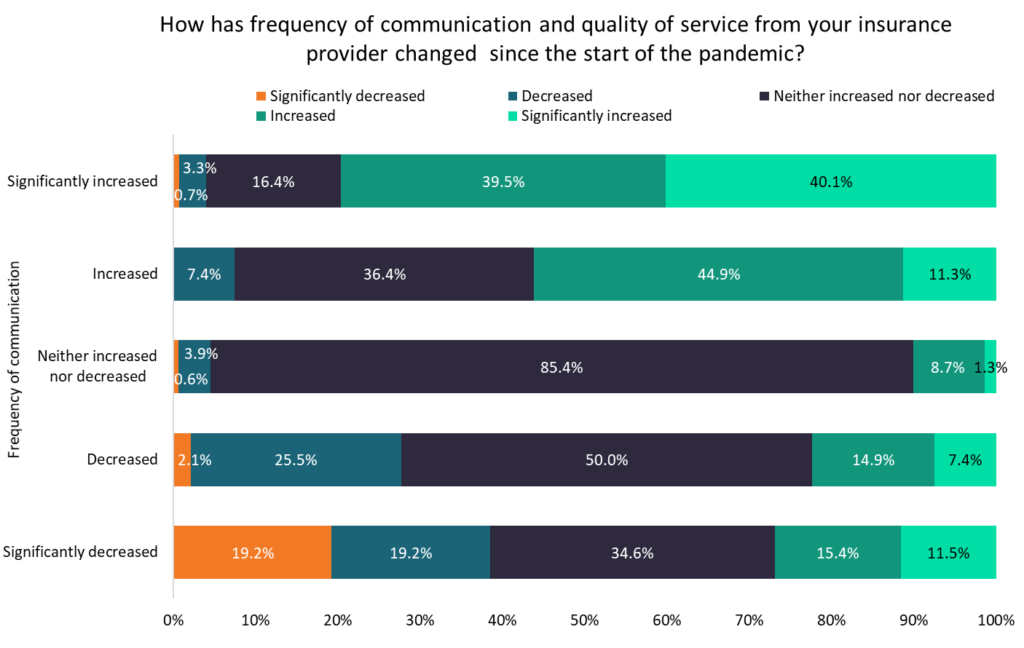

GlobalData findings suggest that there is a strong link between customer satisfaction and the level of communication offered by insurance providers. Nearly four in five SMEs that said the frequency of communication with their insurance provider had significantly increased since the start of the COVID-19 pandemic also reported an increase in the quality of service they have received.

According to GlobalData’s 2021 UK SME Insurance Survey, 79.6% of SMEs that said the frequency of communication with their insurance provider had significantly increased compared to before the pandemic reported a better quality of service over the period. This compares to just 26.9% of SMEs that had significantly less communication from their provider than pre-COVID-19 reporting an increase in the quality of service they received.

Meanwhile, among SMEs that reported an increase in communications, 56.2% said the quality of service from their provider has increased.

The COVID-19 pandemic has highlighted the complexity of commercial insurance, with many policyholders suddenly questioning the level of cover their policy provides. On top of this, the business interruption test case led to many companies unsure if they were eligible for payouts – or the value of the claim to which they were entitled. Insurers that have communicated to their policyholders with openness and clarity have seen notable improvements in perceptions of their quality of service over the course of the pandemic. Naturally, insurers that provide a higher-quality service are more likely to see renewals and recommendations, reducing churn rate and building brand loyalty going forward.

For insurers, this data should show the importance of strong communication with policyholders. Given that just 27.1% of SMEs reported any kind of increase in communication from their provider – coupled with the clear value this has added to the majority of those policyholders – insurers should continue looking to build more open and engaging relationships with their clients in the future.

The increasing prevalence of data and technology within insurance can aid providers in understanding the requirements of each individual customer. This will help them to better provide feedback, assistance, and transparency when it comes to renewal. Effective communication can therefore be a simple but highly effective tool in insurers’ armouries as they continue to focus on customer-centric ideologies.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData