With the majority of brick and mortar retail shops closed, online sales have become the new norm. Accelerated growth in online sales will provide more opportunities for insurers as businesses adapt to changing consumer behaviours.

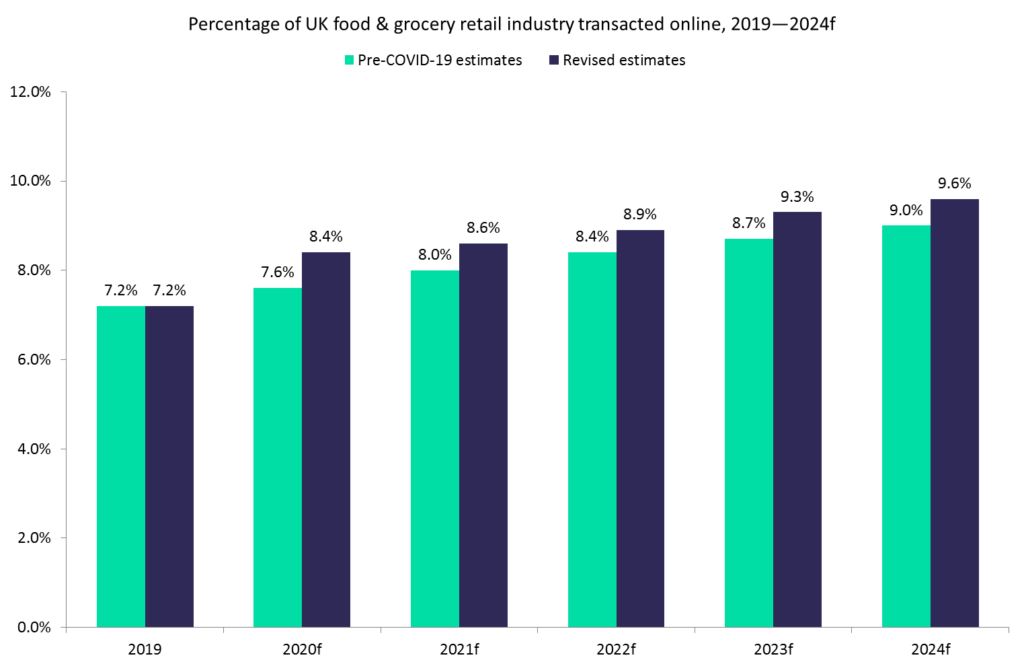

Food and groceries sales are thriving during government-imposed lockdowns. In the UK, a number of grocers, including Ocado, Sainsbury’s, and Waitrose, have had to expand their delivery services in order to cope with growing online sales. According to GlobalData Retail, the online grocery sector is forecast to account for 8.4% of grocery sales in 2020 and generate an additional £1.8bn more than what was previously expected. Across the entire retail industry, online sales are expected to grow at a faster rate than offline sales over the next four years.

As online sales become increasingly popular, businesses will face greater cyber risks. Retailers will hold more digital records of sensitive personal information, including payment details, than ever. According to a report from Shape Security, hackers account for more than 90% of login traffic on e-commerce websites.

Companies will also have to scale their delivery capabilities to meet demand by expanding fleets. Regulations have been temporarily relaxed to allow drivers to work for longer continuous periods during the lockdown, but companies will need to expand their fleets once changes to regulations are reinstated.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataBusinesses will have to increase their motor and cyber insurance policy cover as a result of increased risk in these two areas, generating more premiums for insurers. While this may not translate into new policies for large retailers that are more likely to already have cyber and fleet insurance products in place, some SMEs have explored the online channel in order to generate some sales during the lockdown. With online sales increasing in popularity, it is likely that some of these SMEs will make online sales a lasting feature, opening the door for new insurance policies to be sold.