Freelance and gig economy workers will be among those hardest hit by coronavirus with many unable to work, while some will feel forced to continue as they have no financial safety net. Freelancers and gig workers do not receive as many workers’ benefits, such as sick pay, and have as of yet received no support from the UK government following the emergency March 2020 Budget.

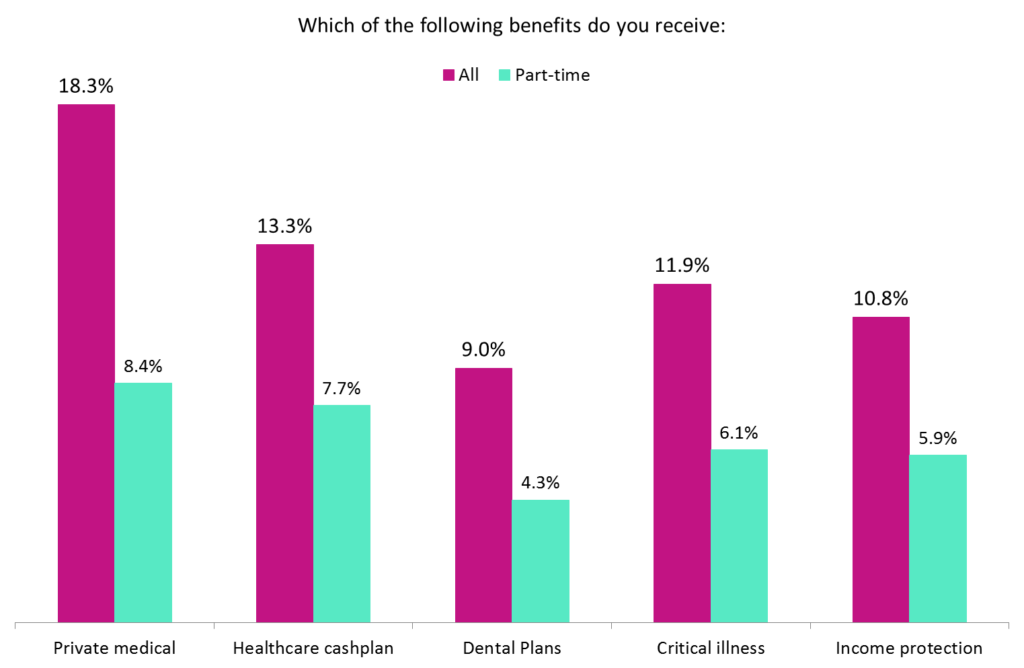

Freelancers and gig workers receive fewer benefits than the average UK employee, according to GlobalData’s 2019 UK Insurance Consumer Survey. This is not a surprise, as full-time employees legally have to be offered a base level of workers’ rights and benefits. However, there is a significant coverage gap – just under 10 percentage points’ difference for private medical insurance – highlighting the market opportunity for insurers. Worryingly, only 5.9% of part-time workers had income protection insurance through their employees in 2019. This means if they can’t work for any reason, they will not receive any income, as they are normally on zero-hour contracts.

Part-time employees have less access to company-funded benefits

The lack of a financial safety net means that many taxi drivers, food delivery partners, and other gig economy workers might continue to work even if they have coronavirus symptoms. Very few are covered by insurance, so it is essential that the government extends sick pay to gig workers and freelancers.

This is likely to lead to a significant uptick in gig workers taking out cheap and flexible on-demand insurance policies, covering them against events or illnesses that could cause them to miss work in the future. However, some providers may adopt exclusions now that coronavirus has become a global pandemic.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData