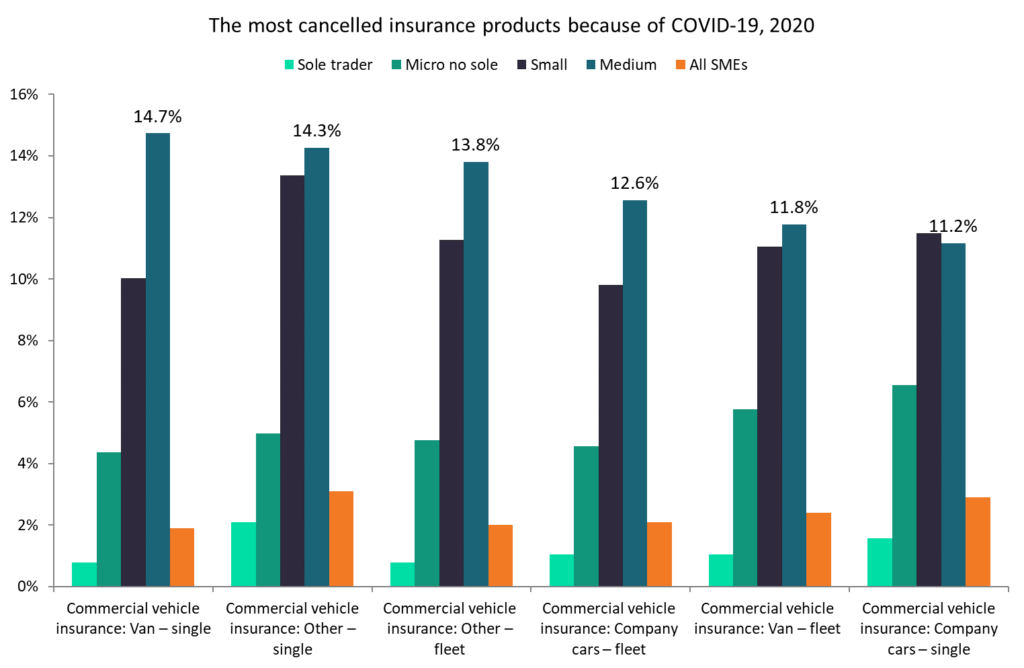

Out of all commercial lines, six motor-based SME insurance products have seen the highest level of cancellations among UK medium-sized businesses specifically because of the pandemic in 2020.

GlobalData’s 2020 UK SME Insurance Survey shows that out of the 20 products we asked medium-sized business about, the six most cancelled types of policy this year because of COVID-19 were all vehicle-based ones. The highest proportion was for single van insurance, which saw 14.7% of policies cancelled for this reason. These six products were also the only ones in double-figure percentages for COVID-19 cancellations among medium-sized businesses.

While other commercial lines saw more cancellations for this reason for SMEs overall, the medium-size category is particularly relevant as it is where the biggest contracts are. Therefore, providers of these products would have seen significant losses in 2020. The positive may be that a lot of these would have been temporary cancellations while businesses were unable to travel, and delivery fleets were more difficult during a year of lockdowns and restrictions. Of course, online shopping has surged, and many delivery-type businesses are significantly up, so these insurers who have lost this high level of business may also have picked up new customers or upsold contracts.

While other commercial lines saw more cancellations for this reason for SMEs overall, the medium-size category is particularly relevant as it is where the biggest contracts are. Therefore, providers of these products would have seen significant losses in 2020. The positive may be that a lot of these would have been temporary cancellations while businesses were unable to travel, and delivery fleets were more difficult during a year of lockdowns and restrictions. Of course, online shopping has surged, and many delivery-type businesses are significantly up, so these insurers who have lost this high level of business may also have picked up new customers or upsold contracts.

It also means commercial motor insurers will need to be proactive in winning back customers next year as normality slowly returns. It also presents an opportunity to insurers to win business, as there will be a significant proportion of the market looking for new insurers. With SMEs’ budgets squeezed, the key is likely to be in the value proposition of policies, but much can be said for offering flexibility as well, as uncertainty over future lockdowns and restrictions continues.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData