Aviva has signalled its commitment to cyber insurance by releasing a new SME product. This is a positive move given that SMEs are increasingly interested in cyber insurance as a result of the pandemic.

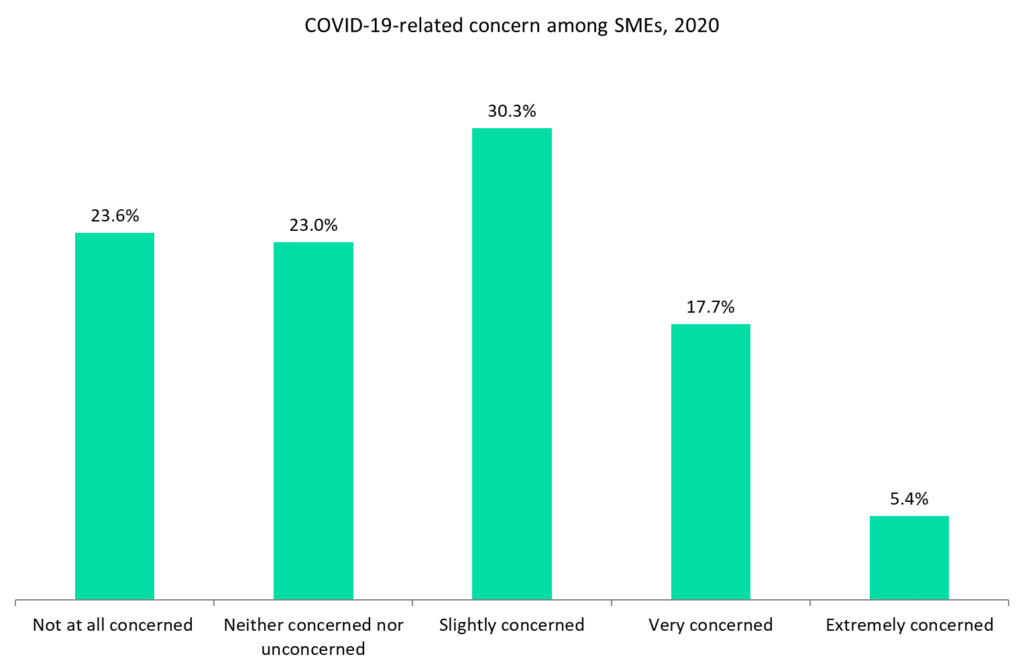

This is one of the conclusions from GlobalData’s 2020 UK SME Insurance Survey. A total of 53.4% of respondents were concerned to some extent about cyber-crime as a result of the pandemic, which shows it is now an issue for a significant proportion of SMEs.

This suggests that now is a very good time to launch a new cyber product for SMEs. Concern is at a high level but the penetration rate for the product remains low, which indicates it is an area ripe for growth. Our survey found that just 33.7% of SMEs in the UK held a cyber insurance policy in 2020.

The potential size of the market has undoubtedly grown as a result of COVID-19. Scammers have been preying on people’s fears around COVID-19 with a rise in phishing emails about the pandemic. Our survey found that 9.5% of SMEs said their likelihood of purchasing a cyber insurance policy has increased as a result of the pandemic, while only 3.9% said it had decreased.

The Aviva cyber insurance policy will be sold through brokers who will be able to provide quotes in minutes. Offering a new product (as opposed to an add-on) highlights Aviva’s intentions in the area. This is likely to be a key topic in the next few years and we expect to see activity from other leading insurers in this line.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData