All articles by GlobalData Financial

GlobalData Financial

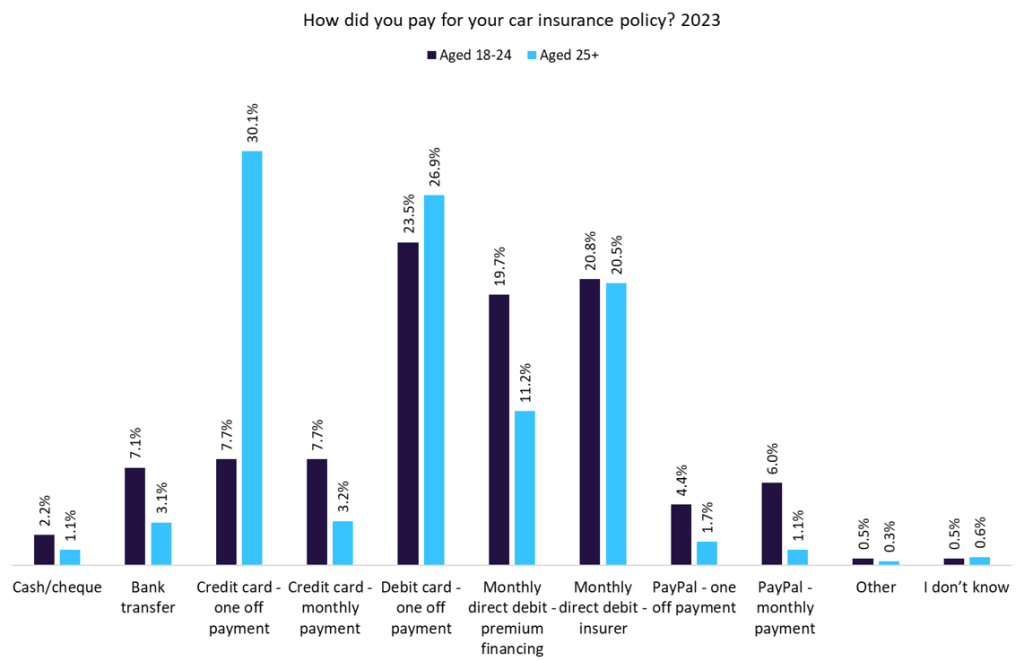

Younger consumers are more likely to pay their motor insurance in monthly payments

Younger consumers are more likely to opt for monthly payments for their motor insurance for various reasons.

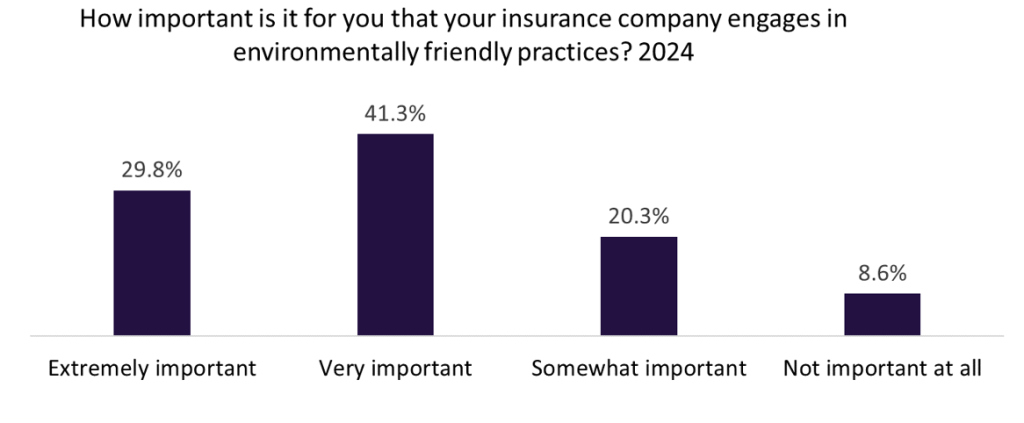

Global consumers want to see action from insurers in the fight against climate change

GlobalData’s 2024 Emerging Trends Insurance Consumer Survey found that a total of 77% of respondents were either very or somewhat concerned about global warming and climate change.

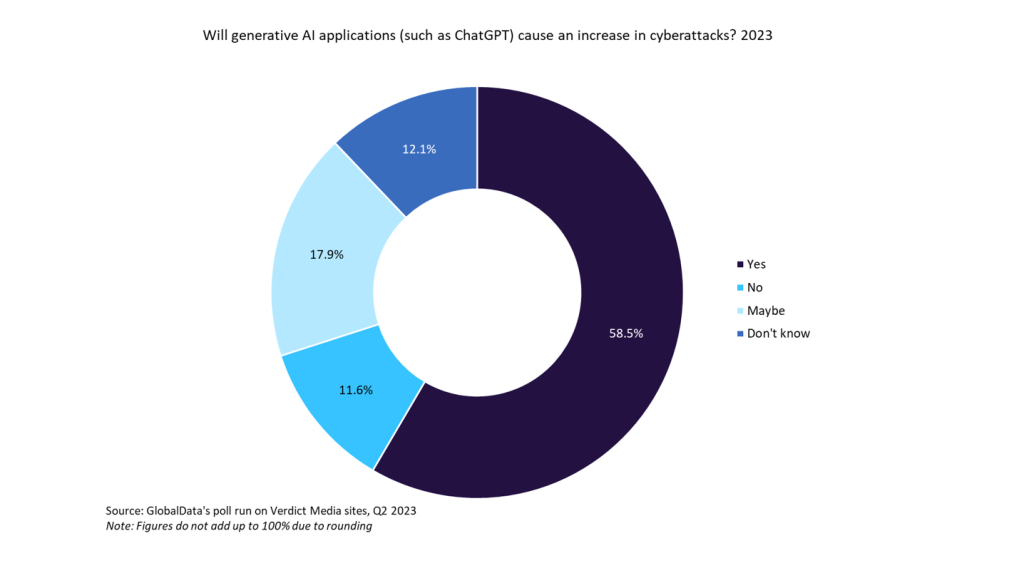

Star Health’s data breach highlights growing cyber risks in insurance industry

In August 2024, the company experienced a major breach in which hackers exploited Telegram chatbots to leak sensitive information from over 31 million customers.

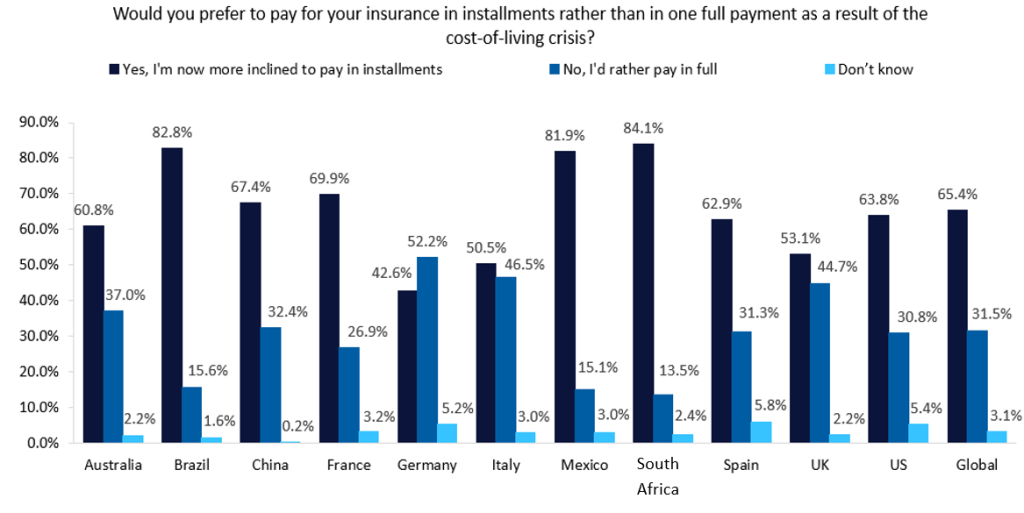

Most global consumers prefer to pay insurance in instalments as cost-of-living crisis bites

GlobalData’s 2024 Emerging Trends Insurance Consumer Survey found that 65.4% of global consumers prefer paying for their insurance in instalments because of the cost-of-living crisis

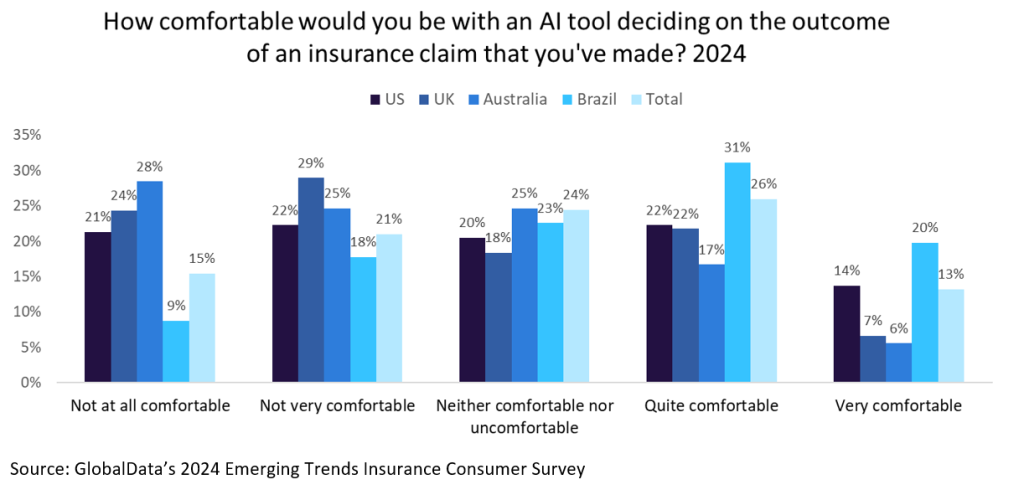

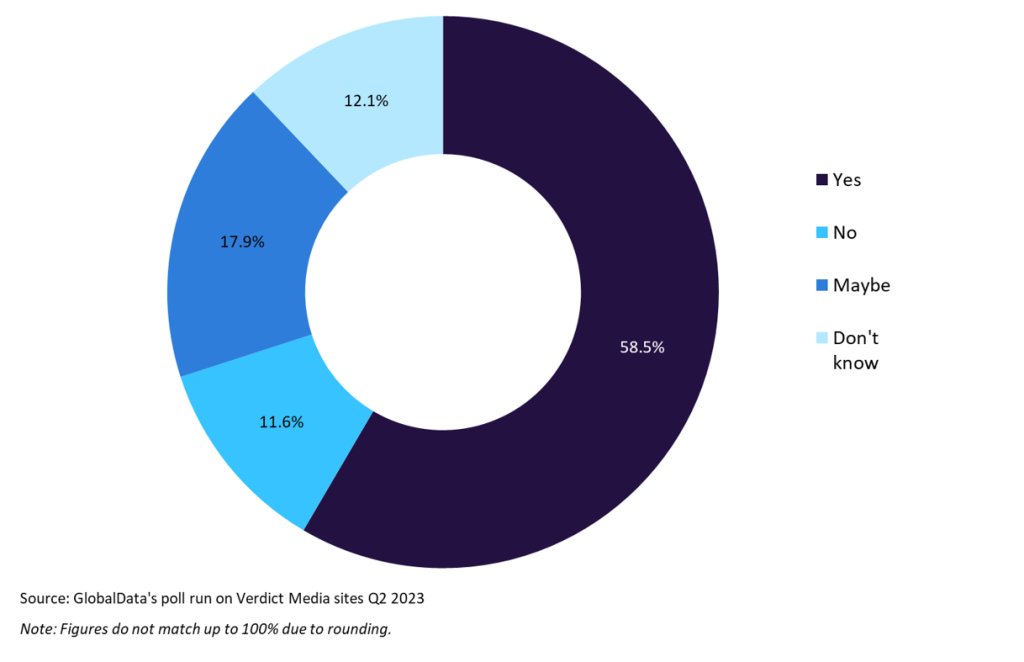

Insurance customers around the world are ready to interact with AI tools

A GlobalData survey found that 39% of all respondents would be quite or very comfortable having an AI tool decide the outcome of an insurance claim.

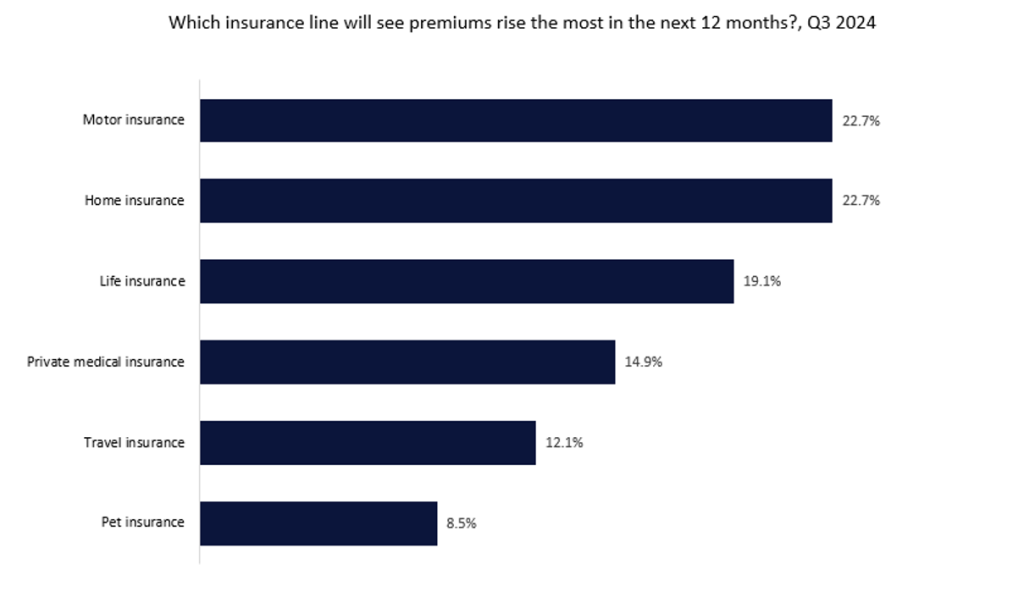

Insurance insiders are divided on whether home or motor insurance premiums will rise the most

While the cost-of-living crisis has pushed prices up, rising costs linked to home and motor insurance lines have split opinions on which premiums will fare worst.

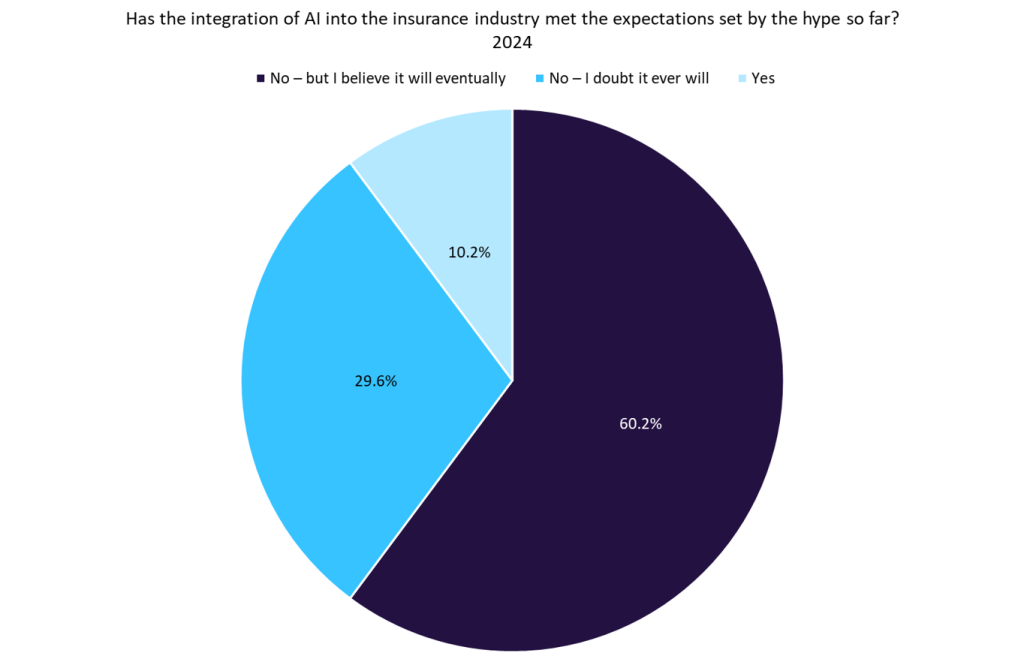

Insurance insiders say AI has not met expectations yet but still holds future potential

The optimism held by the majority of insurance insiders reflects the belief that AI’s development is still in the early stages.

Crypto crashes will increase insurance interest

According to a 2024 GlobalData poll, 44% of respondents said they would be interested in an insurance product for cryptocurrency wallets.

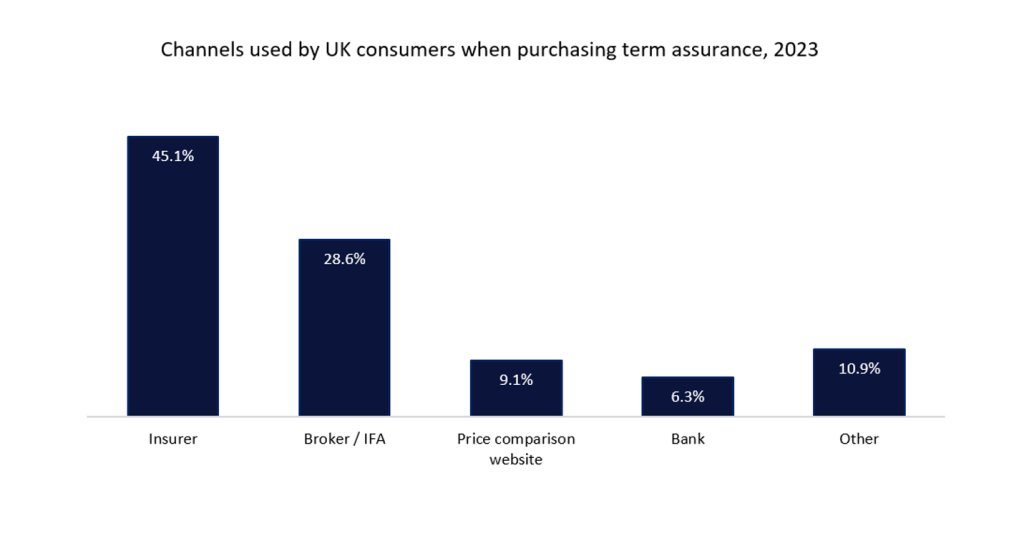

More UK consumers perceive that brokers provide better life insurance deals

Life insurance policies tend to be more complex in nature than other more commoditised non-life policies, driving demand for advised sales.

Businesses must strengthen their defences against AI-driven cyber threats

As AI adoption grows, the need for robust cybersecurity measures and comprehensive insurance coverage becomes even more critical.