All articles by GlobalData Financial

GlobalData Financial

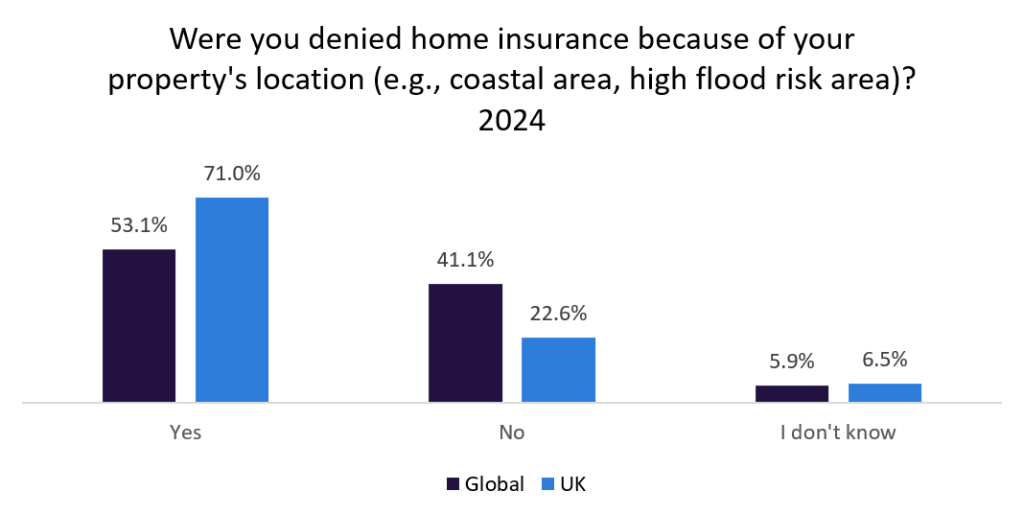

Flood prevention measures will reduce home insurance denials

The concerning figures regarding home insurance denials due to property location are likely to worsen as the impacts of climate change intensify.

Trump presidency could threaten low-income health insurance policyholders

GlobalData’s Local LoB Database shows that the US Medicare health insurance market was worth $761bn in 2023, up 9.4% from $696bn in 2022.

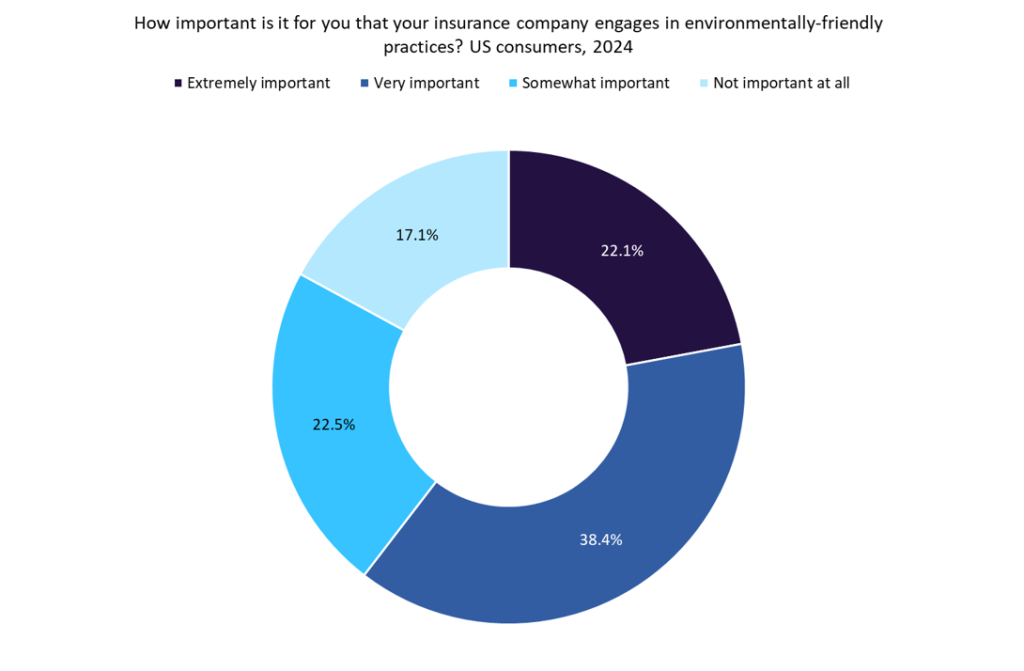

US insurers should still focus on ESG despite potential regulatory rollbacks under Trump

According to a GlobalData consumer survey, 38.4% of US consumers consider it very important for their insurer to engage in environmentally friendly practices.

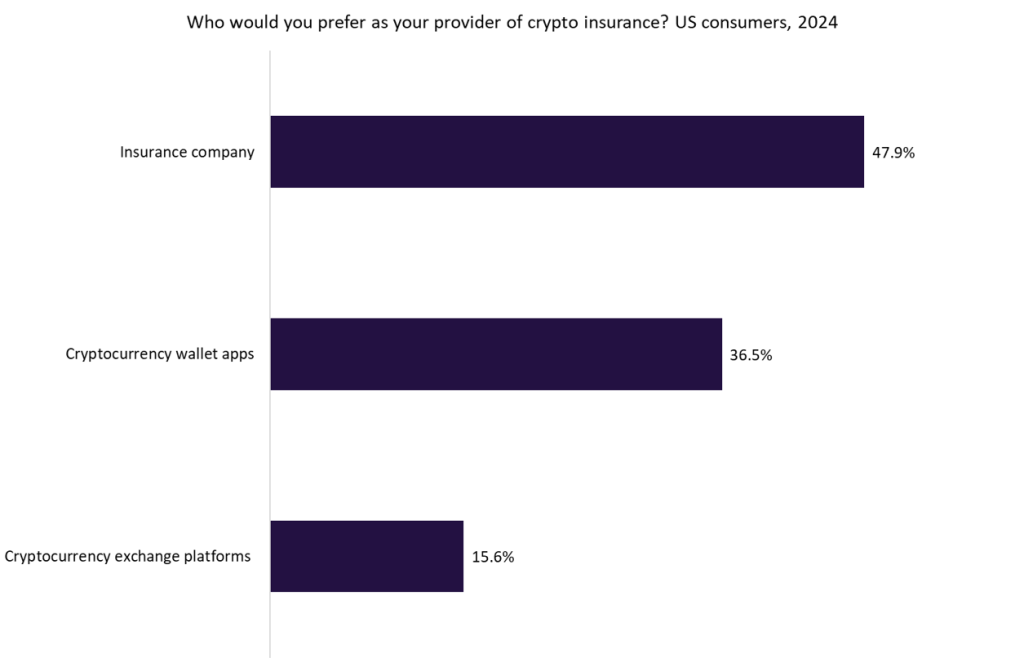

Trump’s election win will create demand for cryptocurrency insurance

At the 2024 Bitcoin Conference in Nashville, Tennessee, Trump pledged to make the US “the crypto capital of the planet” and proposed creating a national Bitcoin reserve.

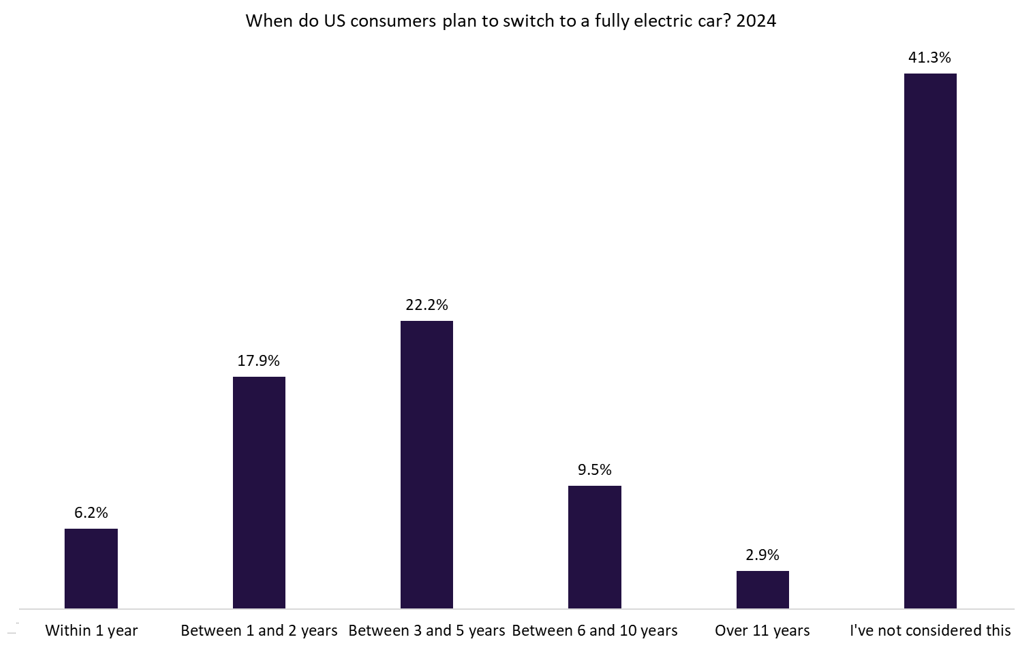

Trump’s election win will slowdown EV insurance growth

President-elect Trump has expressed scepticism toward EVs, criticising government incentives and regulations promoting their adoption.

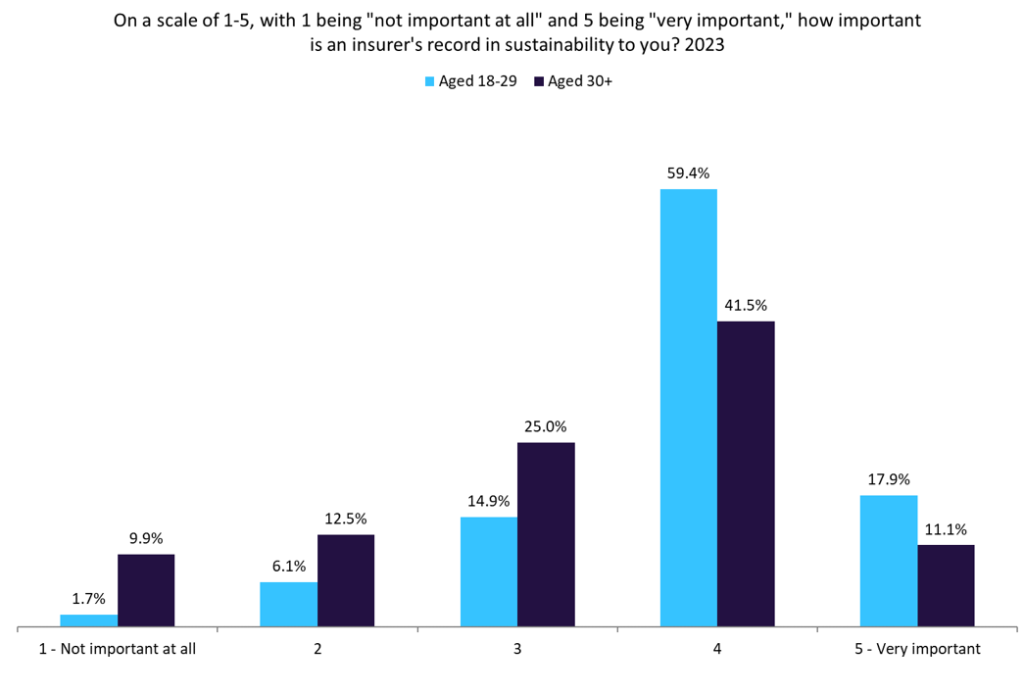

Younger consumers prioritise insurers’ sustainability record more than older generations

According to GlobalData’s 2023 UK Insurance Consumer Survey, consumers aged 18–29 prioritise insurers’ sustainability records more than older age groups.

Ping An reaps rewards of innovating in key insurance industry themes

Ping An has applied for 2,716 patents within AI in insurance over the past 20 years.

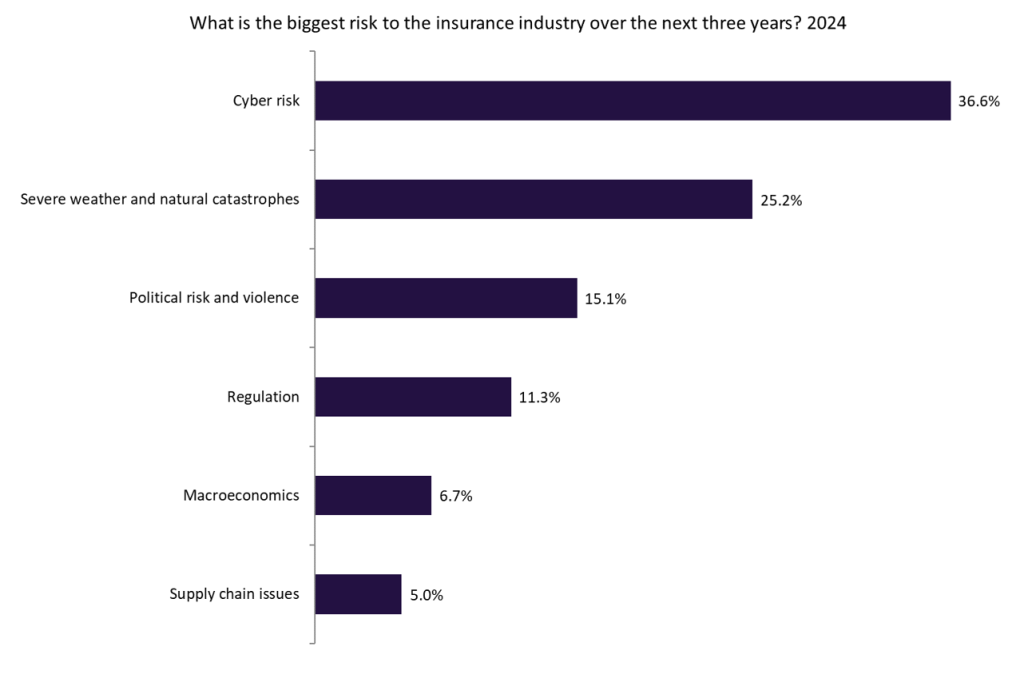

Climate change and natural catastrophes pose significant threats to the insurance industry

A GlobalData poll conducted in Q2 2024 showed that 25.2% of industry insiders consider severe weather and natural catastrophes one of the biggest threats to the insurance industry.

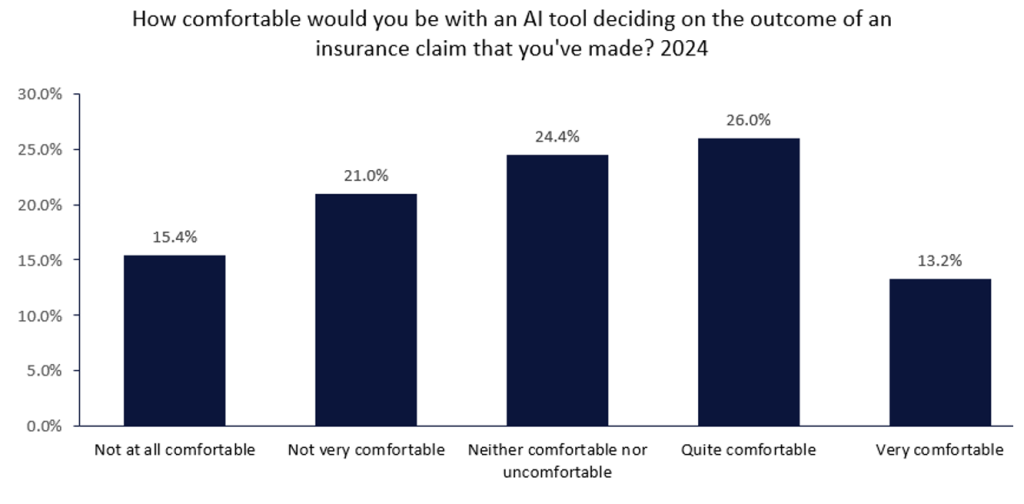

Consumers would generally be happy for an AI solution to decide the outcome of their insurance claim

Insurers must ensure the seamless integration of AI in claims management from the outset, or risk discouraging consumers from embracing automated tools.

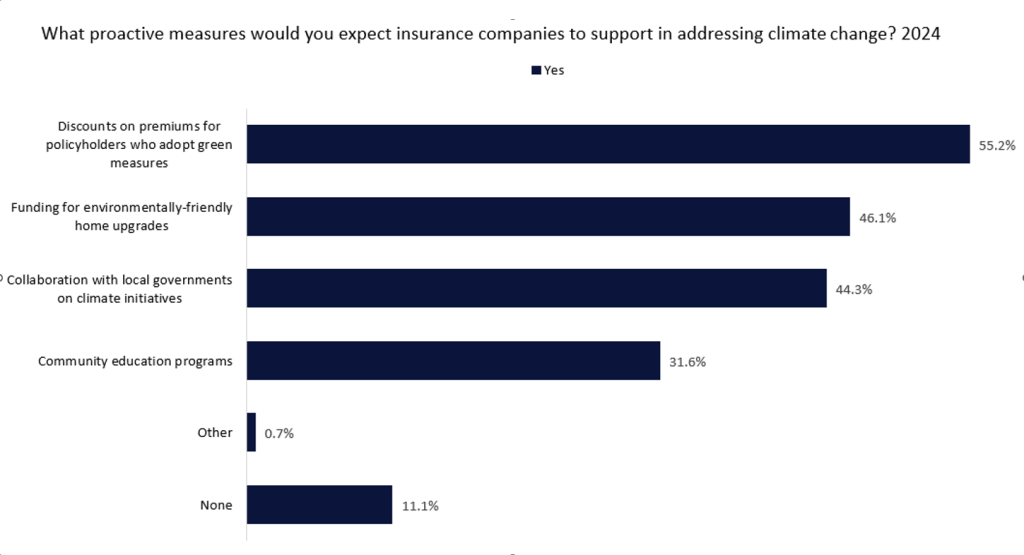

Over half of global consumers believe insurers should engage in the fight against climate change

GlobalData’s 2024 Emerging Trends Insurance Consumer Survey found that 77% of consumers around the world are either concerned or very concerned about global warming.