GlobalData’s survey reveals battery-related protection features are among the most valued aspects of electric vehicle (EV) insurance. The UK motor insurance sector has encountered considerable challenges as it adjusts to the changing landscape of EV adoption. Although there were optimistic expectations that government incentives and environmental policies would hasten the shift to EVs, the actual rate of adoption has not met those forecasts. This slower uptake has heightened concerns among insurers, who are already dealing with the unique risks and expenses associated with EV ownership.

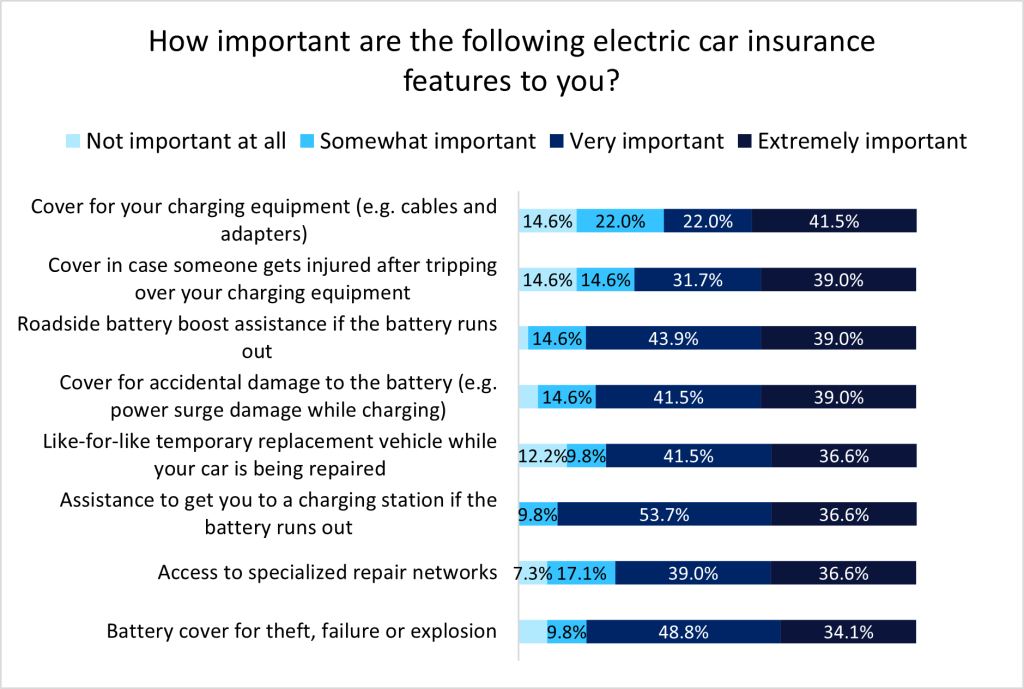

Results from GlobalData’s 2024 Emerging Trends Insurance Consumer Survey reveals that 34.1% of drivers rated battery cover for theft, failure, or explosion as “extremely important,” while an additional 48.8% considered it “very important.” Furthermore, assistance to reach a charging station if the battery runs out was deemed as extremely important by 36.6% of respondents, underscoring the demand for support services tailored to address EV reliability concerns.

Insurers are increasingly pressured to modify their products to cater to the specific needs of EV drivers, which differ significantly from those of traditional vehicle owners. Research from industry bodies found escalating battery replacement costs, a lack of repair expertise, and a shortage of specialised parts have all contributed to uncertainty regarding claims and pricing models. Industry experts stress the necessity of aligning insurance coverage with the realities of EV usage and the evolving expectations of consumers.

Interestingly, this consumer focus on coverage aligns closely with earlier industry insights. In a GlobalData poll ran on Verdict Media sites in Q2 2023, when asked about the biggest challenge for insurers in the transition to EVs, 39.6% of respondents identified the cost of repairs as the primary issue. This reinforces the findings from 2024, as the high expenses associated with battery replacement and repair work remain a central challenge for insurers, directly influencing policy design and pricing strategies.

To effectively address these challenges, insurers should consider implementing educational campaigns to inform consumers about the unique aspects of EV insurance, enhancing customer service related to EV coverage, and actively engaging with stakeholders in the EV ecosystem. Insurers may need to focus on innovation and collaboration with EV manufacturers and repair networks. Tailored products, particularly those that address battery risks and roadside support, could become crucial differentiators. Ultimately, the gap between EV adoption forecasts and the current reality highlights both the volatility of the motor insurance market and the importance of building consumer confidence through responsive, specialised coverage.