GlobalData surveying has found that nearly a quarter of small- to medium-sized enterprises (SMEs) purchased a cyber insurance policy due to an increase in remote working. Meanwhile, Marks & Spencer (M&S) has experienced a major cyberattack that wiped around £700m ($932.5m) off its market value; raising concerns that remote access may have created the entry point cybercriminals needed to breach the retailers’ digital defences.

According to GlobalData’s 2025 SME Insurance Survey, 23.4% of SMEs said they purchased cyber insurance due to increased remote working. The recent cyberattack on M&S reinforces this concern. While the retailer has not officially blamed remote access for the breach, its decision to disable virtual private networks (VPNs) used by home-based staff suggests internal fears that remote access may have been a weak point. This reflects a broader trend that hybrid working models continue to introduce risks through poorly-secured home networks, outdated personal devices, and fragmented oversight—vulnerabilities that cybercriminals are increasingly exploiting.

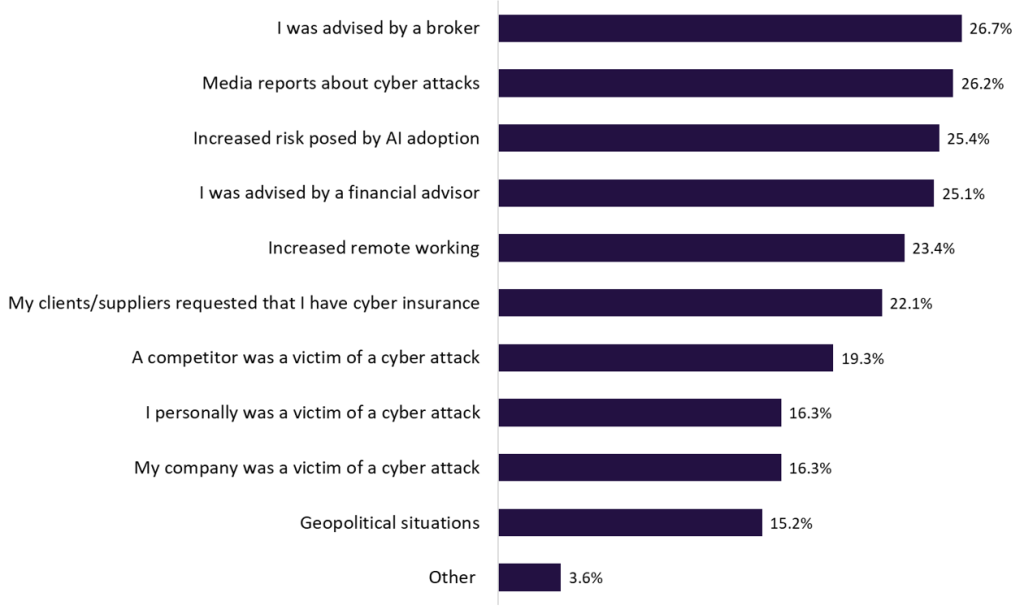

What was the trigger for purchasing cyber insurance? 2025

Meanwhile, 26.2% of SMEs cited media reports on cyberattacks as a reason for purchasing cyber cover and the M&S breach is likely to amplify that influence. As one of the UK’s most-recognised retailers, M&S’s highly publicised loss of nearly £700m in market value is expected to heighten awareness of cyber threats across the SME sector. With widespread news coverage and public scrutiny, this incident may drive more businesses to reassess their exposure and take preventative steps, including taking out or upgrading cyber insurance policies. Overall, the M&S cyberattack highlights the need for stronger cyber resilience in the age of hybrid working. As high-profile breaches raise awareness among SMEs, insurers have an opportunity to respond with tailored cyber products and proactive support that addresses these threats. Brokers may be best placed to drive this change, with GlobalData’s 2025 SME Insurance Survey showing that advice from brokers (26.7%) is the leading factor influencing SME cyber insurance uptake.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData