Insurers targeting younger generations face longstanding industry issues of a lack of understanding and a lack of consumer trust, a GlobalData poll has found. While quicker fixes such as social media strategies and more flexible products may help somewhat, they would only appeal to a small proportion so the more long-term issues need to be addressed to reach these generations.

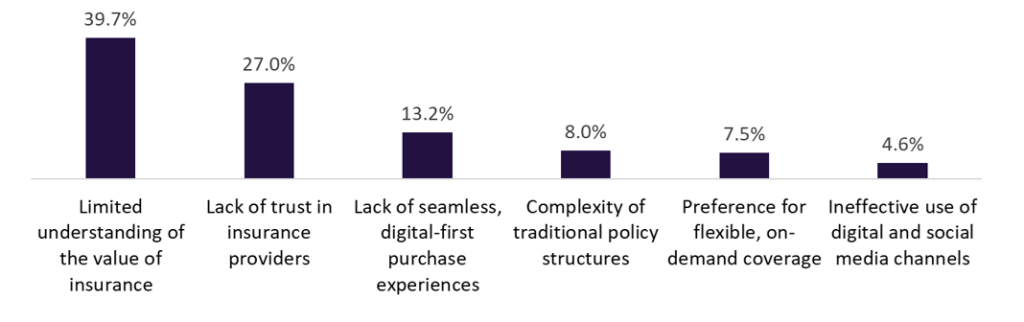

A GlobalData poll conducted on Life Insurance International in Q1 2025 (with 174 respondents) found that over 50% of respondents believed either a lack of understanding of insurance or a lack of trust in insurance providers were the key challenges in selling insurance to Gen Z and millennials. While these consumer segments are typically digitally savvy, addressing their concerns will require more than upgrading digital platforms and social media strategies.

What is the biggest challenge in selling insurance to younger generations (Gen Z and millennials) among the following factors? 2025

Indeed, a lack of consumer trust is a recurring issue for the industry. Rising premiums across some personal lines is not helping the situation; increasing the value and engagement insurers offer will be essential in turning this around.

Communicating the value of policies will also be a challenge—especially as many young people are introduced to insurance through the ‘grudge purchase’ of mandatory car insurance. However, the modern features of some insurance products can provide added value and engage customers. Features such as nutrition and fitness plans and smartwatch discounts within health insurance, or smart home devices helping make homes safer, are ways that can increase interaction and value between insurers and customers.

A lack of consumer understanding may be easier to fix, and limited understanding of the value of insurance and complexity of product structures are both seen as challenges. Insurers are often known for having long and complicated terms and conditions. Yet some providers—most notably US startup Lemonade—have prioritised simplicity of language and making policy terms as easy to understand as possible.

These poll findings should be concerning to insurers, suggesting that improving younger generations’ perception of the insurance industry must be a key priority going forward. Longer-term issues such as consumer understanding and trust cannot be fixed simply by improving PR and social media strategies. Instead, providers must aim to increase engagement with customers, make policies easier to understand, and add value and incentives where profit margins allow.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData