A GlobalData survey indicates that industry experts believe embedded insurance holds the most significant growth potential for disrupting personal lines insurance over the next five years. Meanwhile, IAG Loyalty (a subsidiary of International Airlines Group [IAG]) has officially launched its operations in the UK insurance market, aiming to enhance its European presence and expand its offerings with the introduction of Wanda by Avios travel insurance, in collaboration with embedded insurance provider Open.

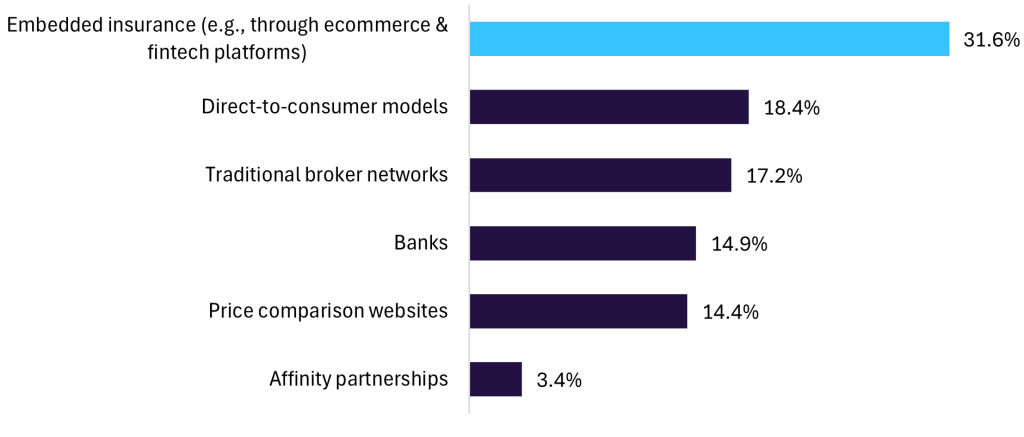

In a poll conducted by GlobalData on Verdict Media sites in Q1 2025, 31.6% of participants identified embedded insurance as the distribution channel anticipated to experience the most growth in personal lines within the next five years. This finding is attributed to its ability to seamlessly integrate coverage into everyday purchases, making protection more accessible, relevant, and convenient for consumers.

Which distribution channel will see the most growth in personal lines insurance over the next five years? Q1 2025

IAG’s entry into the travel insurance sector will build on its existing customer base and distribution channels to offer tailored personal lines products. By integrating insurance directly within its travel services, the group is positioning itself to increase uptake at the point of sale. This approach reflects IAG’s broader strategy, as travel providers are well placed to incorporate insurance seamlessly into their service offerings.

This expansion reflects a wider industry trend whereby embedded insurance is increasingly recognised as a significant growth driver in personal lines. Both traditional insurers and new market entrants are actively seeking partnerships and technological solutions to take advantage of this distribution channel. As customer expectations shift toward convenience and integration, embedded distribution is poised to transform the purchasing and selling of personal lines products.

IAG’s entry into the UK market highlights the competitive potential and strategic

significance of embedded insurance. As demand rises, insurers will need to adapt by providing customisable, flexible solutions and collaborating with distribution partners to optimise growth opportunities.