GlobalData surveying indicates that companies are most likely to establish environment, social, and governance (ESG) performance plans in response to external regulatory and financial pressures. Meanwhile, the FCA has set out new proposals aimed at improving the transparency and reliability of ESG ratings across the market.

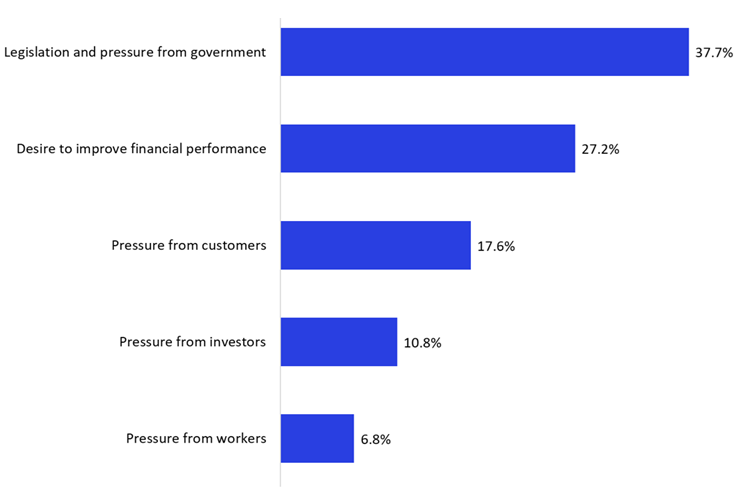

GlobalData’s Thematic Intelligence: ESG Sentiment Polls Q3 2025 shows that legislation and pressure from government is the leading driver for implementing ESG performance plans, selected by 37.7% of respondents. This is followed by a desire to improve financial performance at 27.2%, while pressure from customers accounts for 17.6%. Pressure from investors is cited by 10.8% and pressure from workers by 6.8%. The results highlight that while financial incentives remain relevant, regulatory pressure is by far the most-influential factor shaping ESG adoption.

What is the primary reason why a company should set up an ESG performance plan? Q3 2025

Meanwhile, the Financial Conduct Authority (FCA) has outlined proposals to ensure ESG ratings become more-transparent, reliable, and comparable, following the government’s decision to bring these ratings under the regulator’s remit. Supported by 95% of consultation respondents, the proposals aim to address long-standing concerns about inconsistent methodologies and limited transparency that affect insurers’ ability to assess ESG risks. The FCA’s framework focuses on improving rating transparency, strengthening governance and oversight, managing conflicts of interest, and setting clear expectations around stakeholder engagement and complaints handling. Existing FCA rules will also apply proportionately to new firms entering the regime.

With legislation identified as the top driver for companies setting up ESG performance plans, the introduction of clearer regulatory expectations on ESG ratings reinforces the compliance pressures already shaping corporate behaviour. At the same time, more-transparent and consistent rating methodologies will support companies facing financial, customer, investor, and workforce scrutiny; ensuring ESG performance can be assessed and communicated more credibly across all stakeholder groups.

The combination of regulatory pressure, stakeholder expectations, and the need for credible ESG metrics means insurers and other companies will face rising demands for demonstrable ESG performance. Aligning internal ESG frameworks with the FCA’s strengthened standards will not only support compliance, but also enhance firms’ ability to benchmark progress, identify risks, and communicate responsibly with investors and customers. As ESG expectations continue to evolve, transparent and well-governed performance plans will become increasingly essential across the financial services sector.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData