Around half of UK consumers said they would like to see more women and ethnic minorities on the boards of leading insurers, according to GlobalData surveying. This follows news that Lloyd’s of London’s Head of Culture, Mark Lomas, said that the industry had made progress but had a long way to go. While all industries receive criticism for not being inclusive enough, insurance has been particularly slow at promoted diversity among positions of power within the industry.

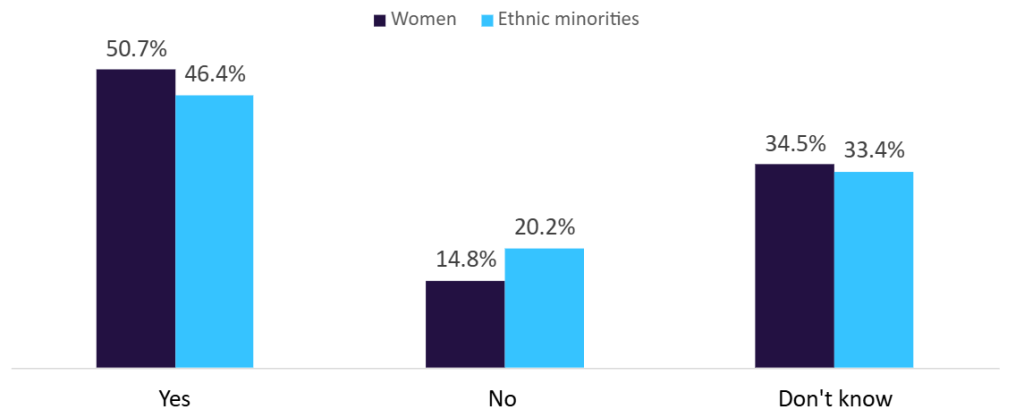

According to GlobalData’s 2024 UK Insurance Consumer Survey, 50.7% of UK consumers would like to see more women on boards, while 46.4% would like to see more ethnic minorities. Around a third said they were not sure for both categories which means a relatively-small proportion said they would be against this.

Would you like to see more of the following in board rooms of insurance companies? 2024

The ABI (The Association of British Insurers) in 2024 found that the percentage of women in senior manager and director roles within the industry was 32% and ethnic minorities was at 11% in 2022. Both of these figures show progress, but the feeling is that more can be done. Pressure from consumers will only ramp up across the board on environmental, social, and governance (ESG) issues. The social side of ESG, which diversity falls under, has so far been secondary to environmental issues, especially with regards to consumer pressure.

However, this is something that could increase, especially as insurers have to release statistics in this area. Therefore, providing opportunities and pathways for women and ethnic minorities of all experience levels should be a priority for most insurers going forward.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData