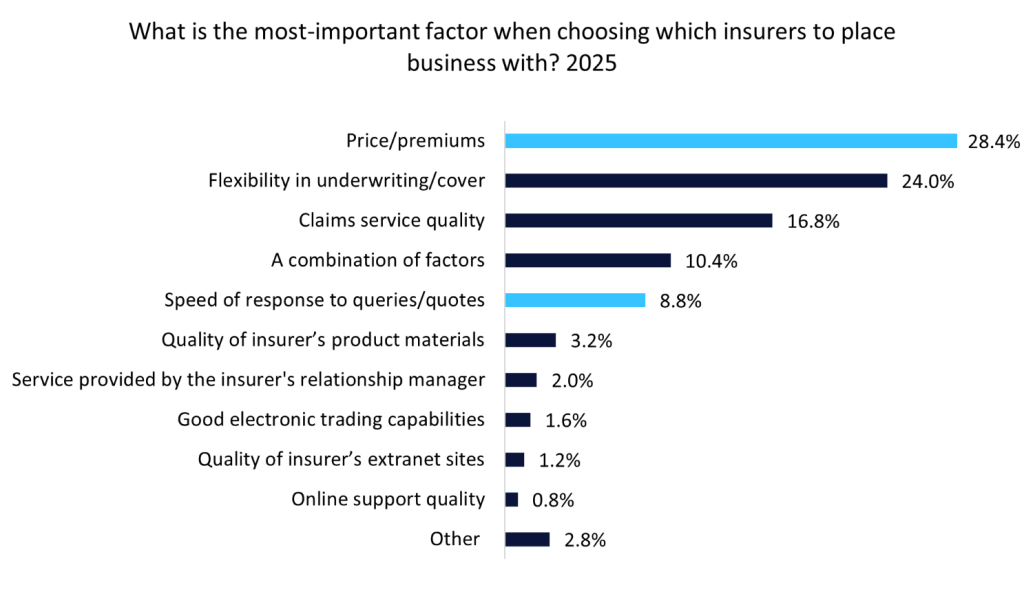

GlobalData surveying has found price or premiums and the speed of response to queries or quotes are key factors when choosing with which insurers to place business. As the insurance landscape evolves, companies that can swiftly modernise customer journeys, streamline back-office operations, and offer competitive pricing will be best positioned to thrive.

According to GlobalData’s 2025 UK Commercial Insurance Broker Survey, 28.4% of respondents selected price or premiums as the most-important factor when choosing which insurer to place business with and 8.8% selected the speed of response to queries or quotes as the most-important factor. This data underscores the dual pressures on insurers to not only provide competitive pricing, but also to enhance operational efficiency and responsiveness.

Aviva’s recent partnership with ICE Insurtech shows how major insurers are embracing digital transformation to remain competitive. By implementing ICE’s policy administration system, Aviva has streamlined its operations and enabled a fully-digital customer journey. Aviva reported a significant reduction in quote turnaround time, halving it from previous benchmarks, which directly correlates with improved customer satisfaction and retention. Additionally, the integration of advanced technology has allowed Aviva to cut IT costs, which in turn has facilitated a reduction in customer premiums. This aligns with the survey findings, indicating that insurers who can effectively leverage technology to reduce operational costs can pass those savings onto consumers; thereby enhancing their competitive edge.

The digital transformation journey is not just about adopting new technologies; it requires a fundamental shift in how insurers approach their business models. Insurers that can effectively modernise their operations, enhance customer journeys, and offer competitive pricing will not only survive, but thrive in the coming years. The case of Aviva serves as a compelling example of how strategic partnerships and technological investments can yield significant benefits. As the landscape continues to evolve, those who embrace change and prioritise customer-centric solutions will emerge as leaders in the insurance market. Companies that can deliver both competitive pricing and rapid response times will be better positioned for success.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData