A GlobalData poll has found that embedded insurance is emerging as the leading distribution channel for personal lines over the next five years. Automakers and other consumer brands that integrate cover at the point of sale or into ownership journeys will be best positioned to capture new customers, increase conversion, and boost retention.

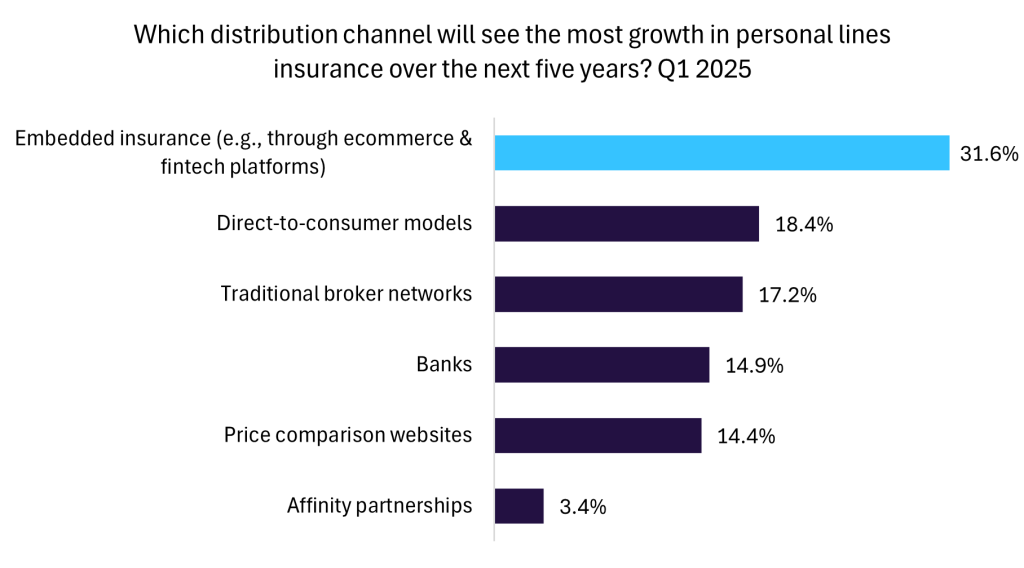

The poll, conducted in Q1 2025 among industry professionals, found that 31.6% expect embedded insurance to see the most growth in personal lines, outpacing direct to consumer models (18.4%), traditional broker networks (17.2%), banks (14.9%), price comparison websites (14.4%), and affinity partnerships (3.4%). That margin indicates a meaningful shift in distribution channels and consumer expectations toward seamless, contextual purchasing.

Suzuki’s recent multi-year partnership with UK embedded insurance platform Wrisk provides a clear example of how a car manufacturer can operationalise this approach. Wrisk will deliver the core digital platform and intermediary services to enable a monthly rolling motor insurance subscription for UK Suzuki customers, embedding insurance into purchase and ownership touchpoints such as at sale, alongside financing, or through post sale portals and apps. By offering continuous cover with simplified onboarding, flexible billing, and easier renewals or cancellations, Suzuki aims to deliver a friction-reduced, brand-aligned customer experience that reduces leakage to third-party providers and supports higher lifetime value through subscription revenues and cross sell opportunities.

The advantages of embedded insurance help explain why motor lines are seen as the most likely to be disrupted by embedded insurance, as found by a 2023 GlobalData poll. Embedding cover reduces friction at the point of sale, simplifies policy selection and servicing, and leverages existing brand trust. It also enables richer data flows, from vehicle telematics to usage and purchasing behavior, which can improve pricing and product personalization.

Firms that move early to integrate insurance into the customer journey, while ensuring operational robustness and regulatory compliance, will be best placed to capitalise on this shift. Insurers should pursue partnerships with car manufacturers and invest in APIs, modular product design, and real-time underwriting to enable compelling embedded offers.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData