The major cyberattack on Allianz Life at the end of July 2025 will be damaging to insurance due to the scale of the attack and a section of consumers’ concerns around sharing personal data. Reportedly, the attack impacted the majority of Allianz Life’s US customers and employees. This makes it one of the largest reported cyberattacks in insurance, as Allianz Life has around 1.4 million customers in the US.

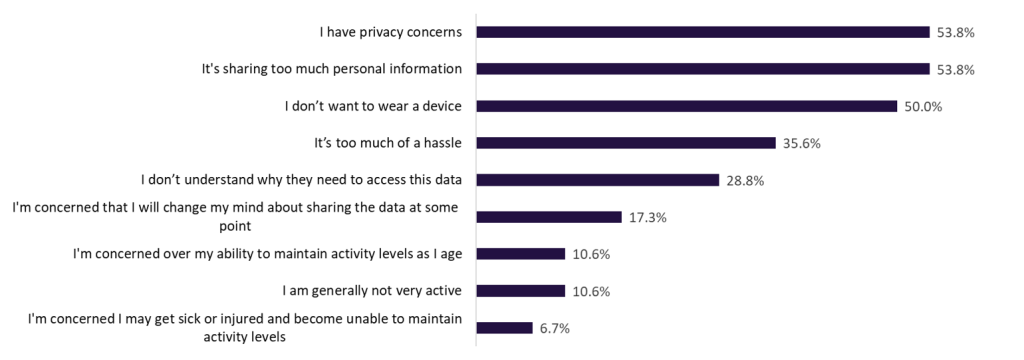

GlobalData’s 2024 Emerging Trends Insurance Consumer Survey found that one of the main issues consumers have with sharing personal data is privacy concerns. Of the US consumers who would not be willing to share fitness and wellness information with their life and health insurer via an Internet of Things device, 53.8% said it was because it involved sharing too much information. Therefore, one of the most damaging aspects of this story to the wider insurance industry may be reduced trust in sharing personal data with insurers. Health and medical data is especially sensitive, which is why this will be especially damaging.

Why would you not be willing to wear an activity (or biotech accessory) and sharing the results with a life or private medical insurance company? (US, 2024)

The scale of this attack has made it a global news story reported not just in the insurance press but by mainstream publications such as the BBC, FT, and others. This will also raise the profile of the risk of cyberattacks for businesses, and especially insurers.

GlobalData’s 2025 UK SME Insurance Survey found that 26.2% of SMEs in the UK bought their cyber insurance policy owing to media reports about other businesses facing cyberattacks, while 19.3% have a policy specifically because a competitor of theirs fell victim to an attack.

Overall, the story is seriously damaging for Allianz Life. It will have to pay large fines and is already facing a class action suit. The scale of the story is also likely to be damaging to the wider insurance industry in terms of consumers’ willingness to share personal data. There will also be reputational damage to Allianz Life specifically, especially in the US where the incident occurred. Personal data is essential to life and health insurers to help tailor policies and improve behaviours to reduce risk. One small positive for the larger insurance industry is that it will raise awareness of the threats that even the largest and best run businesses can face, and this is a good example of why businesses should have a comprehensive cyber insurance policy in place.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData